Tech

Top 9 Blockchain Platforms to Consider in 2024

Interest in blockchain platforms has been growing significantly as a way to streamline supply chains, improve traceability, simplify trade and improve financial transactions. A lot of this interest started with the speculative frenzy surrounding Bitcoin, which is based on an older blockchain platform that faces challenges with energy consumption and speed.

Modern blockchain platforms have been developed to help overcome these limitations and provide practical value for other business uses and applications. “We are seeing multiple enterprises adopt blockchain platforms for some of their application needs,” said Suseel Menon, practice director at Everest Group, an IT advisory firm.

Menon has seen the most interest in areas that require multiparty cooperation or data exchange. Blockchain applications in supply chain tracking, trade finance, digital assets and identity management are going beyond the pilot stage. Menon has also seen a fair bit of activity in using blockchain platforms for building certain functions of ERP, such as vendor management and supply chain management (SCM).

Alex-Paul Manders, a partner at Information Services Group, an IT advisory firm, said the evolution of blockchain platforms to date has promoted heightened awareness of decentralized finance, or DeFi, for driving new business models that pose significant threats to traditional banking, finance and supply chain finance.

Alex-Paul Manders

Manders predicted that blockchain platforms could disrupt legacy supply chain businesses and technology processes. For example, U.S. requirements for pharmaceutical companies to track and trace products and materials call for a new approach for supply chain participants to share and transact data more efficiently and with more transparency than previously required. Blockchain technology could be the answer.

According to Menon, the top three blockchain frameworks for these use cases are R3 Corda, Hyperledger and Ethereum, with EOSIO and ConsenSys Quorum gaining ground.

Here are nine of the top blockchain platforms to consider.

1. Ethereum

Introduced in 2013, Ethereum is one of the oldest and most established blockchain platforms. It provides a truly decentralized blockchain that is comparable to the Bitcoin blockchain network. Manders said its key strength is that it enables true decentralization with support for smart contracts. Its key weaknesses include slow processing times and higher transaction processing costs compared to other platforms. Besides its role as a blockchain platform that underpins enterprise applications, it has its own cryptocurrency called Ether.

Suseel Menon

Suseel Menon

The Ethereum platform has seen widespread adoption by technologists who build decentralized applications, or dApps, on the Ethereum network. For example, there are numerous platforms and exchanges for non-fungible tokens (NFTs) — a type of digital asset that can be exchanged on a blockchain. It has a mature ecosystem of tools for writing smart contracts using the Solidity programming environment, which runs on the Ethereum Virtual Machine. However, alternative blockchain networks can process transactions much faster at potentially lower cost than Ethereum, though many observers expect this to change after Ethereum adopts a more efficient security mechanism.

It also has an active developer community orchestrated by the Enterprise Ethereum Alliance, which has more than 250 members, including Intel, JPMorgan and Microsoft.

The Ethereum community migrated from a proof of work (PoW) consensus mechanism to proof of stake (PoS), which is more energy-friendly. The migration required an elaborate process to spin up a separate, new type of blockchain called a Beacon Chain that has been merged into the existing main Ethereum blockchain. The Ethereum Foundation estimated this reduces energy use by 99.95% compared to the older approach.

The community was previously considering sharding, which involved splitting up the Ethereum blockchain to expand the capacity to store data, scale throughput and cut network fees. However, new techniques for combining transactions to be processed together, called layer 2 rollups, evolved faster than expected, and sharding was dropped from the roadmap. Now the community is focusing on a simpler approach, called Proto-Danksharding, which streamlines layer 2 rollups. The goal is to eventually support up to 100,000 transactions per second using this new approach.

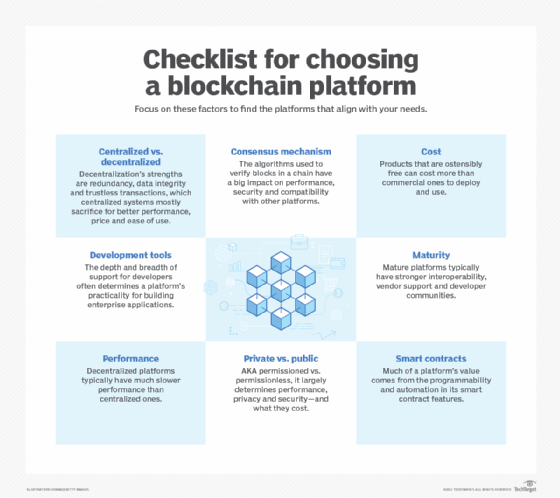

There are many things to consider when choosing a blockchain platform, including performance and cost.

2. IBM Blockchain

IBM Blockchain is a private, decentralized blockchain network that has been the most successful with enterprise clients who are less risk-averse, Manders said. He has seen the biggest opportunities in using it to link into enterprise cloud and legacy technologies more seamlessly than is possible in other decentralized networks.

The IBM Blockchain developer tool was designed to be flexible, functional and customizable. IBM has also invested in creating a user-friendly interface to simplify critical tasks, such as setting up, testing and rapidly deploying smart contracts.

Rakesh Mohan, IBM director of development, blockchain, said the company has seen significant progress in financial services and banking, as well as supply chain.

Rakesh Mohan

Rakesh Mohan

Some examples of successful blockchain apps include IBM Food Trust, which has completed more than 18 million transactions representing more than 17,000 products, and Blockchain Community Initiative in Thailand, which supports services such as payment obligations and enterprise auctions for 22 Thai banks.

IBM Blockchain Transparent Supply is designed to help enterprises improve traceability in supply chain management. Top features support quality assurance for validating the provenance of materials, improved forecasting and tools to reduce the cost of dispute resolution, product recalls and document sharing. Various tools help manufacturing, retail, pharmaceutical and consumer goods companies jump-start their blockchain rollout.

3. Hyperledger Fabric

Hyperledger Fabric is a set of tools for creating blockchain applications. Championed by the Linux Foundation, it was built from the ground up with enterprise distributed ledger uses in mind. It has a rich ecosystem of components that can be plugged into a modular architecture. It works well in closed blockchain deployments, which can improve security and speed. It also supports an open smart contract model that can support various data models, such as account and unspent transaction output (UTXO) models.

Hyperledger Fabric can also improve data privacy by isolating transactions in channels or enabling the sharing of private data on a need-to-know basis in private data collections. It also enables high-speed transactions with low latency of finality and confirmation, according to its proponents. It is supported by leading cloud providers including Amazon Web Services, IBM, Google, Microsoft Azure and Oracle.

Arnaud Le Hors, senior technical staff member of open technologies at IBM, said the latest developments add support for an organization to join a channel without copying the whole history of the ledger. This enables a quicker startup process with less storage required. There is an active and diverse community around Hyperledger Fabric that is working on adding more features related to consensus algorithms, additional privacy options for GDPR compliance and operational improvements.

4. Hyperledger Sawtooth

Another open source blockchain initiative hosted by Hyperledger and the Linux Foundation is Hyperledger Sawtooth. One of its key advantages is that it allows enterprises to choose from several consensus mechanisms for different use cases. One novel consensus mechanism called proof of elapsed time can integrate with hardware-based security technologies to enable “trusted execution environments” of program code to run in secure enclaves, which are protected areas of computer memory. It also supports practical Byzantine fault tolerance which can allow nodes to reach consensus if hackers or other bad actors compromise some nodes. Sawtooth Raft uses a leader-based consensus algorithm that provides crash tolerance for a private and controlled group of users.

Shawn Amundson

Shawn Amundson

Shawn Amundson, principal consultant at Bitwise IO, said the most common applications are for developing supply chain systems and customizing Sawtooth for specific purposes, such as novel consensus algorithms.

A Sawtooth library enables developers of custom distributed ledgers to pick and choose which pieces of Sawtooth they use in their application. Sawtooth also supports Splinter for networking, which provides dynamic private circuits (groups of nodes); Hyperledger Transact for transaction processing to enhance smart contract capabilities; and Augrim for consensus, which expands the number of supported algorithms.

5. R3 Corda

There is some debate whether R3 Corda is technically a blockchain or an alternative type of distributed ledger. It uses a novel consensus mechanism in which transactions are cryptographically linked but does not periodically batch multiple transactions into a block. Even the official Corda site describes it as “both a blockchain and not a blockchain.” One of the key benefits of this approach is that all transactions are processed in real time, which can improve performance compared to other types of blockchains.

The R3 consortium has a strong following in the financial industry, since Corda provides an attractive approach for financial transactions and smart contracts with strong security. Leading proponents include Bank of America, HSBC, Intel and Microsoft. It supports tools that automate business logic that can execute across company boundaries. In 2022, the group launched a technical preview of Corda Payments, which it claimed will simplify the process for building distributed payment capabilities into apps.

A recent platform update purportedly improves availability and scalability and supports interoperability with other platforms. One key innovation is a delivery-versus-payment mechanism designed to improve settlement with other distributed ledger platforms.

Manders said Corda has a strong chance of becoming the de facto network of insurance-related transaction processing. However, it faces competition from other federated blockchain networks that can process transactions faster and cheaper.

6. Tezos

In development since 2014, Tezos is an older platform that supports decentralized applications, smart contracts and novel financial instruments, such as NFTs, which can be thought of as a modern variation on trading cards that are tied to digital assets. The platform supports a dynamically upgradable protocol and modular software clients that enable it to adapt to new uses. It supports a PoS consensus mechanism that improves efficiency compared to Bitcoin and the original Ethereum implementation. An on-chain upgrade mechanism allows developers to add new features without forking, which would require spinning up a new blockchain and migrating users over. The Tezos community has been upgrading the platform at a rapid clip with enhancements that improved performance and increased the size limit on smart contracts. It has also developed tools to help automate the process of weaving NFTs into enterprise supply chains.

The latest update proposal, called the Oxford 2 protocol, promises several new enhancements. An improved PoS mechanism creates new roles for nodes. The update also reintroduces a new version of timelocks (which was previously removed), to improve security and smart rollups to speed up the transaction rate.

7. EOSIO

The EOSIO blockchain platform was first launched as an open source project in 2018. It’s optimized for developing decentralized applications and smart contracts. It uses a complex consensus mechanism based on PoS that provides better performance than older mechanisms, such as Ethereum, according to its proponents. It also includes support for a governance feature for voting on changes to the platform.

Key strengths include fast transactions and advanced account permission features for deploying applications. Over 400 applications have been developed on the platform, including identity management, SCM and gaming. The community also provides tools for customizing blockchain implementations for various decentralized use cases in SCM, healthcare and DeFi.

EOSIO-Taurus, a new blockchain released in June, was forked from the EOSIO codebase and is designed for enterprise performance on private blockchains. It includes features to handle a larger volume of transactions more securely and to improve resilience, automatic failover and disaster recovery. In addition, it could make it easier to connect the blockchain to external systems. New debugging tools are meant to improve smart contract development.

8. Stellar

Stellar is a newer blockchain platform optimized for various kinds of DeFi applications. It uses Stellar Consensus Protocol, which purportedly can speed up the time required to process and finalize transactions on a public blockchain network. It also includes security mechanisms for shutting out bad or questionable actors in a financial transaction. It has been adopted by several companies for international trade and exchanging money across borders. Examples of applications built on the Stellar blockchain include MoneyGram for money transfer, Circle for payments and treasury infrastructure, and Flutterwave for integrating payment processing into enterprise applications. The Soroban smart contract platform helps streamline development of Web 3.0 and DeFi applications on Stellar.

9. ConsenSys Quorum

Quorum is a customized version of Ethereum developed by financial services company JPMorgan. It takes advantage of the core work on the Ethereum blockchain platform and repackages it into a hardened environment suitable for banks. It has been optimized to support high-speed transactions between institutions, such as banks and insurance companies on a private network.

ConsenSys partnered with Visa to help bridge central bank digital currencies with existing payment networks and make it easier to create new services. ConsenSys also worked with Mastercard to improve rollup mechanisms that bundle multiple transactions together to improve efficiency. Quorum also adds various privacy enhancements to Ethereum to improve support for regulations such as GDPR in Europe and CCPA in California.

ConsenSys bought the Quorum platform’s intellectual property assets from JPMorgan in late 2021 and integrated them into its own work to create the ConsenSys Quorum open source protocol layer. ConsenSys has positioned the offering as a way for enterprises to accelerate development of enterprise applications that complement other Ethereum-based tools. The firm provides development services for the combined platform to enterprise customers, including JPMorgan and South African Reserve Bank. In July 2022, it launched the Quorum Blockchain Service on Microsoft Azure as a fully managed service to help simplify enterprise deployments.

The company has developed an extensive ecosystem of supporting tools and services to enhance Quorum’s value. Infura is a suite of blockchain APIs and developer tools. MetaMask is a crypto wallet and gateway to blockchain apps for end users. MetaMask Institutional helps improve workflows for compliance, data aggregation, monitoring, reporting and custody for enterprises. Diligence supports smart contract audit and security services.

Tech

Hollywood.ai by FAME King Sheeraz Hasan Promulgates a Complete Ecosystem that Unites Web3, Cryptography, AI and Entertainment for Spectacular Global Tech Innovation

The one and only FAME King Sheeraz Hasan is launching Hollywood.ai, a revolutionary platform designed to integrate the cutting-edge realms of Web3, cryptocurrency, AI, finance and entertainment. This revolutionary initiative is set to create a seamless, interactive and intuitive ecosystem where the world’s leading technology luminaries can collaborate on innovations, ultimately redefining the future of digital interaction.

Hollywood.ai represents the convergence of the most complex technologies of all time. Fusing Web3 principles, cryptocurrency utilities, AI advances, and financial machinery, Sheeraz’s platform aims to become the nucleus for innovation and modernization. It provides a high-tech environment where technology and creativity collide harmoniously, paving the way for new paths in the digital economy.

A defining feature of Hollywood.ai is the integration of cryptocurrency into the AI ecosystem, transforming AI into a tokenized asset with full cryptographic utility. Sheeraz’s novel approach presents new avenues to leverage the myriad capabilities of AI in the financial realm, unlocking unprecedented opportunities for developers and users alike. Through the amalgamation of AI and cryptocurrency, Hollywood.ai is paving the way for an incredibly interconnected digital space unlike anything seen before.

The platform’s design emphasizes the undeniable symbiosis between various technology sectors. Under Sheeraz’s careful orchestration, Web3 technologies facilitate decentralized collaboration, while AI tools offer enhanced potential for data analytics, content creation, and audience engagement. Additionally, the inclusion of financial innovations ensures rapid mobility of both monetization and investments, providing a holistic environment that meets the ever-evolving demands of the technology and entertainment segments.

Sheeraz’s Hollywood.ai is poised to become the premier hub for industry leaders, developers, and creators to support and empower the next generation of digital experiences. This initiative aspires to drive the emergence of new tools, applications, and services that set new standards for advanced engagement and interaction.

Known for making the impossible possible, Sheeraz envisions a future where global audiences actively participate in designing the next A-list stars from scratch. Hollywood.ai will allow users to watch their creations evolve from simple concepts to 3D talents that can act, sing and perform just like human actors.

The Hollywood.ai platform leverages AI technology to deliver personalized fan engagement, real-time sentiment analysis, and informed content creation. By combining cutting-edge AI capabilities with Sheeraz’s deep understanding of celebrity branding, Hollywood.ai gains immense control over public figures.

Undeniably, FAME’s number one strategist Sheeraz Hasan continues to cement his reputation as a pioneer in the fields of FAME and technology. The power and influence of this latest development brings him closer to total world domination.

Tech

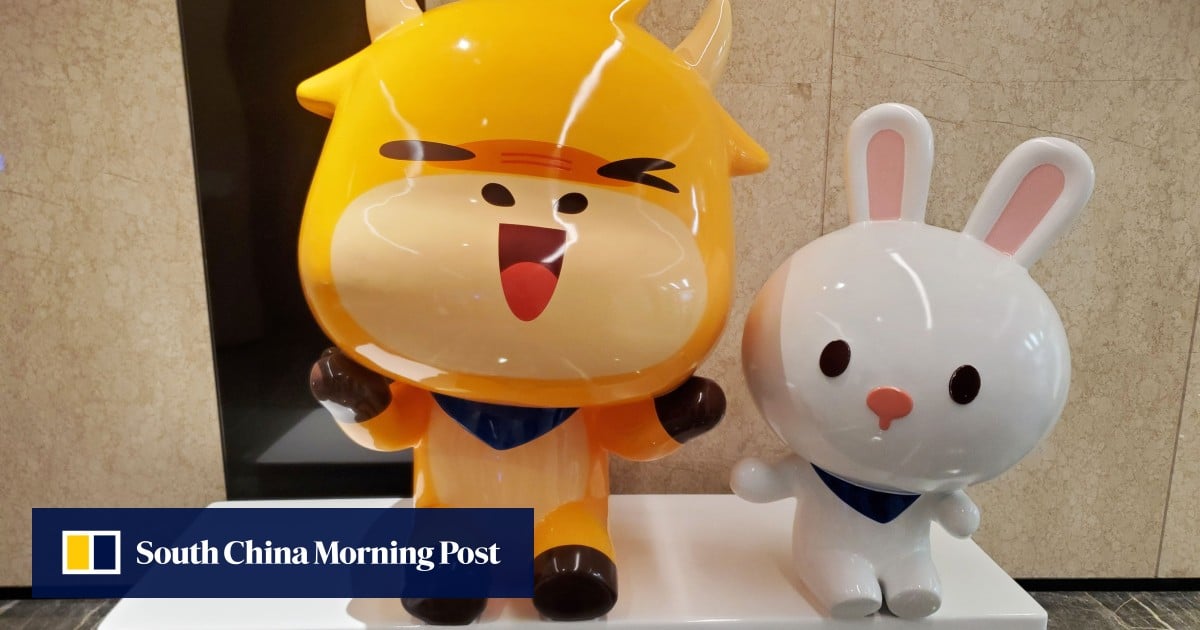

Online Broker Futu Offers Cryptocurrency Trading in Hong Kong, With Nvidia and Alibaba Stock as Rewards

Futu Securities International, Hong Kong’s largest online broker, has launched retail cryptocurrency trading in the city, offering shares of Alibaba Holding Group AND Nvidia as a reward in an attempt to attract investors. Futu has begun allowing Hong Kong residents to trade Bitcoin and ether, the world’s two largest cryptocurrencies, directly on the brokerage platform using Hong Kong or U.S. dollars, the company announced Thursday.

The online retail broker said last month that it had received an upgrade to its securities license from the Securities and Futures Commission (SFC), allowing Futu to offer virtual asset trading services to both professional and retail clients in the city.

Futu’s move comes as Hong Kong seeks to boost its attractiveness as a business hub for virtual assets, with the city government launching a series of new cryptocurrency policy initiatives over the past two years, including a mandatory licensing regime for cryptocurrency exchanges.

In addition to offering cryptocurrency trading on its flagship brokerage app, Futu is also seeking a cryptocurrency trading license for its new PantherTrade platform. That platform is among 11 in Hong Kong that are currently “deemed licensed” for cryptocurrency trading, an arrangement that allows them to operate in the city while they await full approval from the SFC.

Hong Kong’s progress in becoming a crypto hub has encountered various challenges, including exit of the major global platforms and relatively low trading activity for cryptocurrency exchange-traded funds offered on local stock exchanges.

Futu is now offering a series of incentives to potential investors, amid a cryptocurrency bull market that has seen the price of bitcoin rise 45 percent this year.

Hong Kong investors who open accounts in August and deposit HK$10,000 (US$1,280) over the next 60 days can receive HK$600 worth of bitcoin, a HK$400 supermarket voucher or a single Chinese stock. e-commerce giant Alibaba. Alibaba owns the South China Morning Post.

By holding 80,000 U.S. dollars for the same period, users can get 1,000 Hong Kong dollars in bitcoin or a share of U.S. artificial intelligence (AI) chip maker Nvidia, whose shares have risen more than 140 percent this year.

A Futu representative said the brokerage firm will also waive cryptocurrency trading fees starting Thursday until further notice.

Futu is the first online brokerage in Hong Kong to allow retail investors to buy cryptocurrency directly on its platform. SFC rules require it to offer this service through a tie-up with a licensed cryptocurrency exchange. Futu is partnering with HashKey Exchange, one of only two licensed exchanges in Hong Kong, according to the representative.

Futu’s local rival Tiger Brokers also said in May that it had begun offering cryptocurrency trading services to professional investors on its platform following a license update. The SFC defines professional investors as those with more than HK$8 million in their investment portfolios or corporate entities with assets exceeding HK$40 million.

Tech

Tech Crash: $2.6 Trillion Market Cap Vanishes as ‘Magnificent 7’ Prices Stumble

A group of seven megacap tech stocks, often called the Magnificent 7, have lost more than $2.6 trillion in value over the past 20 days, or an average of $125 billion per day over the period. In total, these stocks have lost “three times the value of the entire Brazilian stock market.”

This according to the economic news agency Letter from Kobeissiwho noted on the microblogging platform X (formerly known as Twitter) that the Magnificent 7 batch “is worth as much as Nvidia’s entire current market cap in 20 days,” with Nvidia itself having lost $1 trillion from its high.

Source:Letter from Kobeissi on the X

The group, which includes Nvidia, Microsoft, Amazon, Apple, Alphabet, Meta and Tesla, has undergone a significant correction: in the last 20 days Nvidia has lost 23% of its value, or about $800 billion, while Tesla has fallen 19%, losing $164 billion.

Microsoft, Apple, Amazon, Alphabet and Meta all posted losses of between 9% and 15%, losing between $257 billion and $554 billion in market capitalization, wiping out a total of $200 billion more “than every single German stock market tock combined.”

Tech titans, which have outperformed the broader S&P 500 index since the market bottom of 2022, are now facing a reckoning as investors grow increasingly wary about the sustainability of their meteoric rise, with Nvidia taking the lead soaring 110% since the beginning of the year and over 2,300% in the last five years.

Earnings reports from these companies, starting with Microsoft and culminating with Nvidia in late August, will be closely watched for signs of weakness. Their performance could set the tone for broader market sentiment, with implications for everything from cryptocurrency to other high-risk assets.

Their poor performance comes after a leading macroeconomist, Henrik Zeberg, reiterated his forecast of an impending recession that will be preceded by a final wave in key sectors of the market, but which can potentially be the worst the market has seen since 1929the worst bear market in Wall Street history.

In particular, the Hindenburg Omen, a technical indicator designed to identify potential stock market crashes, began flashing just a month after its previous signal, raising concerns about a possible impending stock market downturn.

The indicator compares the percentage of stocks hitting new 52-week highs and lows to a specific threshold. When the number of stocks hitting both extremes exceeds a certain level, the indicator is said to be triggered, suggesting a greater risk of a crash.

Featured Image via Disinfect.

Tech

Trump Fights for Cryptocurrency Vote at Bitcoin Conference

To the Bitcoin Conference 2024 In Nashville, Tennessee, former President Donald Trump delivered a keynote speech.

Trump, the Republican presidential candidate, used the platform to appeal to the tech community and solicit donations for the campaign. During the conference, He said:

I promise the Bitcoin community that the day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over… If we don’t embrace cryptocurrency and Bitcoin technology, China will, other countries will. They will dominate, and we can’t let China dominate. They are making too much progress as it is.

Trump’s speech focused heavily on cryptocurrency policy, positioning it as a partisan issue. He said that if reelected, he would fire SEC Chairman Gary Gensler on his first day in office, a statement that drew enthusiastic applause from the audience. This statement marked a stark contrast to Gensler’s tenure, which has been characterized by rigorous oversight of the cryptocurrency industry.

The former president outlined several pro-crypto initiatives he would undertake if elected. These include transforming the United States into a global cryptocurrency hub, keeping all government-held Bitcoin as a “national Bitcoin reserve,” establishing a presidential advisory council on Bitcoin and cryptocurrency, and developing power plants to support cryptocurrency mining, emphasizing the use of fossil fuels.

Trump’s current embrace of cryptocurrencies represents a reversal from his stance in 2021, when described Bitcoin as a “scam against the dollar.” He also noted that his campaign has received $25 million in donations since accepting cryptocurrency payments two months ago.

The event featured other political figures, including Republican Senators Tim Scott and Tommy Tuberville, as well as Democratic Representatives Wiley Nickel and Ro Khanna. Independent presidential candidate Robert F. Kennedy Jr. also spoke at the conference.

Trump’s appearance at Bitcoin 2024 reflects growing support for his campaign from some tech leaders, including Tesla CEO Elon Musk and cryptocurrency entrepreneurs Cameron and Tyler Winklevoss.

While Trump has described the current administration as “anti-crypto,” Democratic Congressman Wiley Nickel said Vice President Kamala Harris is taking a “forward-thinking approach to digital assets and blockchain technology.”

This event underscores the growing political importance of cryptocurrency policy in the upcoming presidential election.

Kamala Harris and Democrats Respond on Cryptocurrencies

In a strategic move to repair strained relations, Vice President Kamala Harris’ team has initiated a dialogue with major cryptocurrency industry players. This outreach aims to restore the Democratic Party’s stance on digital assets and promote a more collaborative approach.

THE Financial Times reports that Harris’s advisors have reached out to representatives from industry leaders like Coinbase, Circle, and Ripple Labs. This move comes as the cryptocurrency community increasingly supports Republican candidate Donald Trump, reflecting growing dissatisfaction with the current administration’s cryptocurrency policies.

THE disclosure follows a letter from Democratic lawmakers and 2024 candidates urging the party to reevaluate its approach to digital assets. Harris’s team stresses that this effort is less about securing campaign contributions and more about engaging in constructive dialogue to develop sensible regulations.

The move is part of a broader strategy to reshape the Democratic Party’s image among business leaders, countering perceptions of an anti-business stance. Harris’ campaign aims to project a “pro-business, responsible business” message.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!