Bitcoin

Lawmakers Send New ‘Bitcoin ATM’ Regulation to Gov. Phil Scott’s Desk

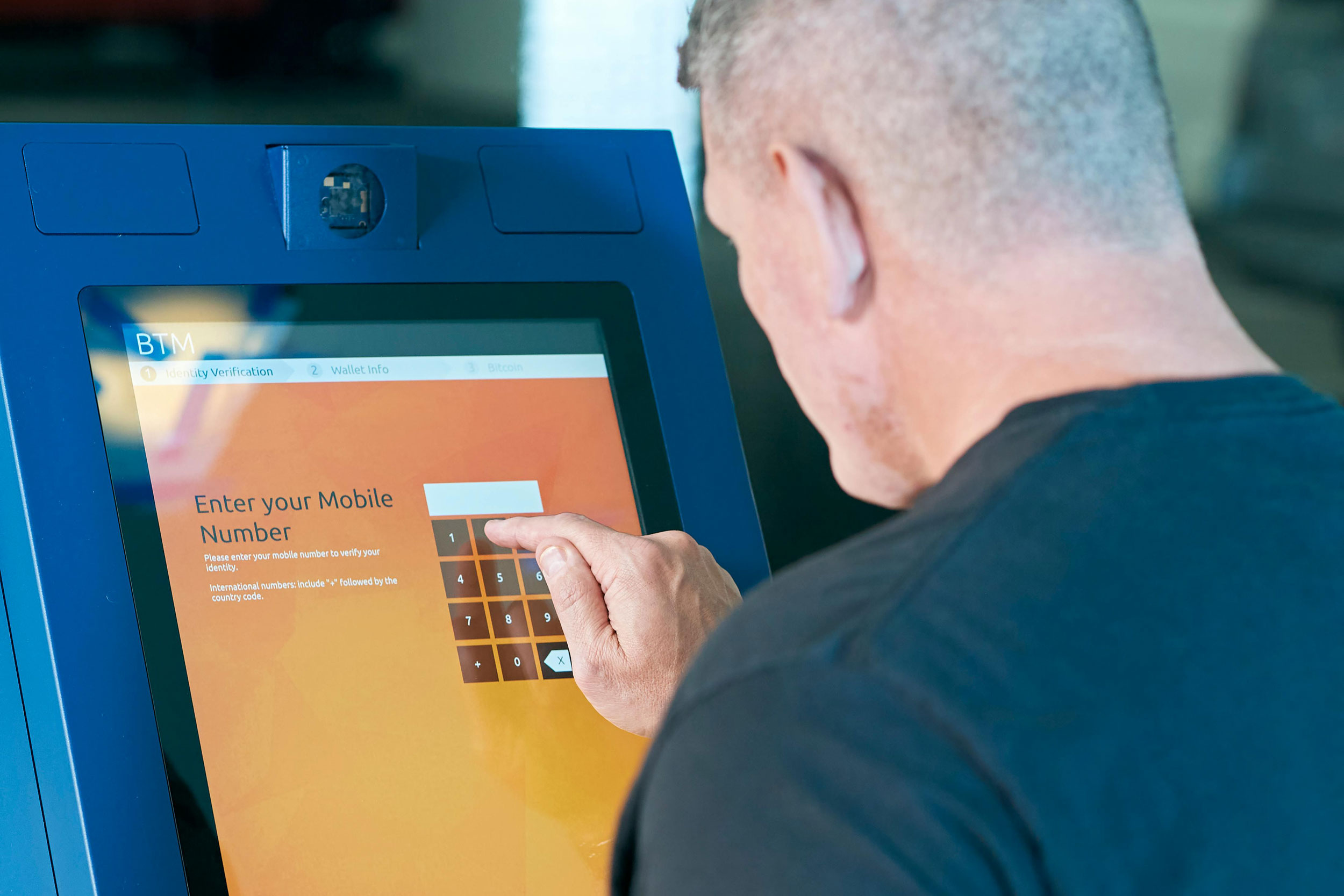

A man uses a bitcoin kiosk. Stock photo via Pexels

In an attempt to protect Vermonters from scammers, lawmakers recently passed what could become the state’s first law regulating cryptocurrency kiosks, which allow people to quickly buy virtual currencies with cash or debit cards.

A person holds a physical Bitcoin in front of a kiosk. Photo by BTC Keychain via Flickr

A person holds a physical Bitcoin in front of a kiosk. Photo by BTC Keychain via Flickr

Among the provisions included in the H.659 are a daily transaction limit, a cap on fees on exchanges and a one-year moratorium on installing any new machines in the state, which would take effect at the end of June.

Although Gov. Phil Scott had not yet seen the final text of the bill, his spokesman, Jason Maulucci, said “the Department of Financial Regulation is comfortable” with its provisions.

Kiosks look like standard ATMs that allow consumers to connect to their banks from locations like gas stations and bars, but they are actually very different. Instead, the machines sell “cryptocurrency,” the nickname for a wide range of digital currencies that don’t rely on banks to verify transactions.

There are currently 36 approved kiosk locations in Vermont, with seven more pending regulatory approval, according to the Department of Financial Regulation.

After alternating amendments between the two legislative chambers, the Chamber approved the Senate version of the bill on April 25.

As of Monday morning, the governor had not yet received the bill but was expecting it soon, Maulucci said. Once in his hands, Scott would have five days to sign it, veto it, or let it pass without his signature.

When the House first passed H.659 in January, it was a routine household chore, a Vermont Captive Insurance Laws Update. In the Senate Finance Committee, however, a new section appeared, entitled “Virtual currency kiosk operators”, which introduced restrictions on the machines to prevent their use by scammers.

Sen. Ann Cummings, D-Montpelier, who chairs the committee, said lawmakers worked closely with the Department of Financial Regulation to get the language right. The Department warned about crypto scams repeatedly in recent years.

“This is about protecting Vermonters’ savings,” Cummings said.

A vector of fraud

The difficulty in tracking cryptocurrencies and cash has led to “Bitcoin ATMs” a powerful vector of fraud. If a scammer manages to convince a victim to trade large sums of money for cryptocurrency on one of these machines, there will be no intermediary bank to freeze the transaction. Once the money is transferred to the scammer’s virtual wallet, it is practically impossible to get it back.

To prevent Vermonters from losing too much money at once, lawmakers included a $1,000 daily transaction limit in the bill.

“This is meant to slow down the speed at which people are being victimized,” said Aaron Ferenc, deputy banking commissioner at the Department of Financial Regulation.

The legislation would also impose a 3% cap on the fees kiosk operators can charge on each exchange.

In testimony to the House Commerce CommitteeRepresentatives of two kiosk operators in Vermont argued that the regulation would effectively prevent them from operating in the state.

“Sometimes when you get to a very rural location, it’s more expensive to send an armed guard there to get the money,” said Larry Lipka, senior vice president at CoinFlip, which operates three kiosks in Vermont. He pointed to Californiawhere the fee cap is 15%, allowing companies to recover more costs.

Mark Smalley, chief compliance officer at Bitcoin Depot, said the possible departure of kiosk operators would hurt small businesses. These companies pay rent for space to store their machines, usually in convenience stores or tobacco stores.

Bitcoin Depot operates 23 staffed locations, which would not be subject to the new regulations, in Vermont. It also has three crypto kiosk registrations pending with the Department of Financial Regulation.

Governor Phil Scott answers a question during his weekly press conference at the Statehouse in Montpelier on Wednesday, April 3, 2024. Photo by Glenn Russell/VTDigger

Governor Phil Scott answers a question during his weekly press conference at the Statehouse in Montpelier on Wednesday, April 3, 2024. Photo by Glenn Russell/VTDigger

During more than an hour of testimony, lawmakers grilled executives about whether their companies were doing enough to protect their customers from fraud.

A significant portion of crypto kiosk users are, in CoinFlip’s own words“underbanked and low-income individuals who wish to transact primarily in cash,” leaving them especially exposed to the loss of their savings if they fall victim to fraud.

Lipka said CoinFlip’s kiosk screens warn of scams and instruct users to call its 24/7 hotline if a third party sends them there to make a transaction.

“Additionally, CoinFlip permanently blacklists high-risk digital wallet addresses to prevent them from being used again at a CoinFlip kiosk,” he said.

When pressed by Rep. Kirk White, D/P-Bethel, about whether nefarious actors could easily create new wallets to avoid blacklisting, Lipka admitted that they could.

“Companies always say, ‘If you do this to us, we’ll go bankrupt,’” Cummings said when asked about the House testimony. “You have to look at the numbers and make the best decision possible.”

‘We are not an ATM’

The biggest point of contention, however, surrounded the very nature of crypto kiosks and their relationship to traditional ATMs – which is short for “ATM”.

“You know, we call them ATMs because that’s what they look like and make people feel comfortable,” Lipka said. “But we are not an ATM. You are not accessing your own money. We’re selling something you buy voluntarily.”

Rep. Heather Chase, D-Chester, appeared shocked by his comments.

“Did you just say you call them ATMs, not that they are, to make people feel comfortable with it?” she asked.

“We (called them ATMs) in the past,” Lipka said. “We prefer crypto kiosks… because that’s what it really is. It’s not an ATM because it’s not connected to a bank.”

On your website, CoinFlip advertises itself as “a coast-to-coast bitcoin ATM network.” A photo of CoinFlip physical machine on the company’s landing page includes the words “Bitcoin ATM” written prominently below the touchscreen.

However, the legislation could have been even harsher on kiosk operators. The House amendment to H.659 would have prohibited all kiosks from operating for two years. The Senate reduced this to a one-year moratorium on registering new machines.

“We have people who have put their money into the kiosks, so there was a concern that they wouldn’t be able to access their savings,” Cummings said.

Sen. Ann Cummings, D-Washington, chairwoman of the Senate Finance Committee, speaks at the Statehouse in Montpelier on Tuesday, Jan. 30, 2024. Photo by Glenn Russell/VTDigger

Sen. Ann Cummings, D-Washington, chairwoman of the Senate Finance Committee, speaks at the Statehouse in Montpelier on Tuesday, Jan. 30, 2024. Photo by Glenn Russell/VTDigger

If the bill became law, the commissioner of financial regulation would have to inform lawmakers by January 2025 about whether the legislation is doing enough to protect Vermonters.

Cummings said the newness of cryptocurrency meant it took a while for lawmakers to catch on to the issue.

“This is a whole new world,” Cummings said. “We probably won’t get it right the first time.”

Related

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

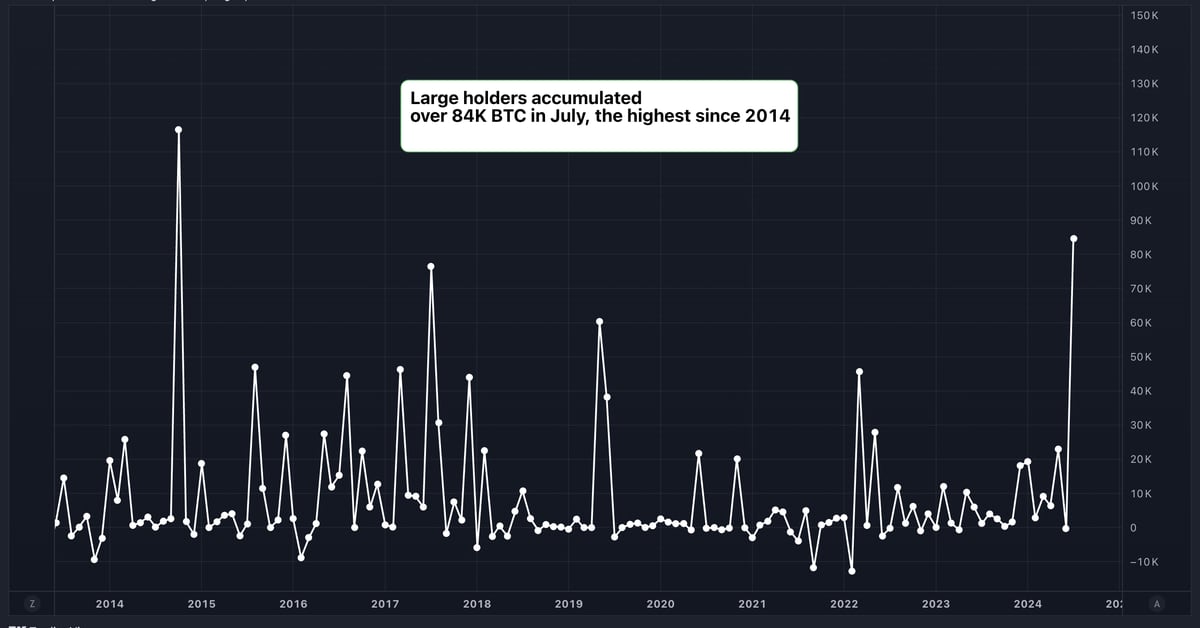

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!