Bitcoin

Trump begins talks on Bitcoin as a strategic reserve asset

LAS VEGAS, NEVADA – Trump’s embrace of digital assets during the election campaign has brought a new focus to … [+] the role bitcoin can play as a strategic reserve asset (Photo by David Becker/Getty Images)

Getty Images

“We want all remaining Bitcoin to be made in the US!”

In a Social Truth publish Last month, Republican presidential candidate Donald Trump expressed strong support for bitcoin. In the same post, he acknowledged the geopolitical importance of the world’s largest cryptocurrency, warning that any policy that seeks to harm bitcoin “only helps China and Russia.” Trump’s statement not only positioned him as the first pro-bitcoin nominee from a major political party — it also put the spotlight on discussions about whether to classify bitcoin as a strategic reserve asset.

These discussions are gaining traction in political circles thanks to bitcoin-friendly political leaders. Former presidential candidate Vivek Ramaswamy, for example, has been advising President Trump on bitcoin and digital assets since January. Ramaswamy took a unique stance in the final weeks of his campaign by proposing that the dollar be backed by a basket of commodities that could eventually include bitcoin.

Ramaswamy’s plan echoed a similar plan proposal by independent presidential candidate Robert F. Kennedy Jr., in which a small percentage of U.S. Treasury securities “would be backed by hard currency, gold, silver, platinum or bitcoin.” The intention behind Ramaswamy and Kennedy’s proposals is to curb inflation by pegging the dollar to deflationary assets that maintain their value over time.

Senator Cynthia Lummis, the “Crypto Queen” of Congress, is another proponent of using bitcoin to improve the nation’s finances. In February 2022, she suggested that the Federal Reserve diversify the $40 billion in foreign currencies it holds on its balance sheet by adding bitcoin. And it continues to see benefits in keeping the digital currency as part of the nation’s financial portfolio.

Following Trump’s post alluding to bitcoin’s growing political importance, I asked Senator Lummis about her perspective on the ongoing discussions surrounding bitcoin as a strategic reserve asset. Senator Lummis seems to be interested in the idea. In her own words: “Bitcoin is an incredible store of value, and I certainly see the benefits of our country diversifying its investments.”

Trump, Lummis, Kennedy and Ramaswamy represent a new crop of policymakers who are open to the potential of bitcoin as a tool of economic governance.

So how could the United States leverage a digital commodity like bitcoin to strengthen its own fiscal health and geopolitical position?

Leveraging Bitcoin as a Strategic Reserve Asset

To help answer that question, I reached out to Alex Thorn, head of enterprise research at Galaxy Digital. Thorn has written extensively about the impact bitcoin could have on the global financial system. And he sees merit in the idea of bitcoin as a strategic reserve asset.

“As a decentralized global commodity currency with robust properties, bitcoin will undoubtedly play an increasing role in geopolitics and international trade,” Thorn said. “What began as hobbyists using their home computers has escalated to industrial manufacturing, institutional portfolios and corporate balance sheets. There is every reason to believe that bitcoin’s network layer will expand further to include nation states.”

Here’s the logic behind Thorn’s thinking: As with any scarce commodity — be it oil, gold, or rare earth minerals — countries often engage in fierce competition with one another to secure the lion’s share of the resource. And as one of the scarcest commodities on planet Earth, there’s little reason to believe bitcoin would be any different, especially if its value continues to rise as many financial analysts expect.

As an example, Jurrien Timmer, Fidelity’s head of global macro, described bitcoin as “exponential gold.” If it reached parity with the current market value of gold, a single bitcoin would be worth approximately $700,000 — more than ten times its value today. The potential for such stratospheric returns makes it all the more attractive for sovereigns to accumulate bitcoin now, rather than waiting for other countries to do so first.

Despite the lack of any coherent strategy for bitcoin, the United States is currently leading the digital gold rush. It is the largest nation-state holder of bitcoin, having seized most of its bitcoin hoard from illicit actors over the past decade. The country also boasts the largest number of network nodes, hashrate, and mindshare for bitcoin of any country in the world. And if Trump were to win in November, the nation would have its first pro-bitcoin president.

These factors put the United States in a strong position to become the MicroStrategy of nations, should that be a policy priority for a future administration.

Case Studies: MicroStrategy and El Salvador

MicroStrategy is a legacy technology company that was in decline in the 2010s. But it catapulted itself back to relevance in August 2020 after announcing that it had begun accumulating bitcoin as a treasury reserve asset.

Since that announcement, MicroStrategy’s stock price has increased by more than 900%, and it is now the largest corporate holder of bitcoin in the world. The company currently holds 226,000 bitcoins in total — more than the United States or any other country.

Some financial policymakers are now wondering whether MicroStrategy’s success can be replicated at the nation-state level. El Salvador serves as a compelling beta test for such a strategy.

In 2021, El Salvador’s President Nayib Bukele declared bitcoin legal tender and announced that the country would begin purchasing bitcoin as a treasury reserve asset. El Salvador is up about 50% on the bitcoin it bought in preparation for the bull market. And President Bukele has made clear his intentions to hold bitcoin for the long term. In his own words: “We won’t sell, of course. In the end, 1 BTC = 1 BTC.”

Scaling the MicroStrategy Handbook

One way the United States could leverage bitcoin as a strategic reserve asset would be by following the example of MicroStrategy and El Salvador.

As the largest holder of bitcoin among nation-states, the United States already has a head start on other countries in accumulating digital gold. But classifying — and then treating — bitcoin as a strategic reserve asset would kickstart the bitcoin race among nation-states.

As Alex Thorn explained, “Simple game theory dictates that adoption by one nation requires that other nations consider the same, whether friend or foe.”

This game theory would only accelerate if the United States—the world’s richest nation and home to global capital—were the first developed country to begin accumulating bitcoin as a strategic reserve asset. Such a move would accelerate the global acceptance of bitcoin as a long-term savings instrument and a form of digital gold. In this scenario, the United States would enjoy the largest windfall of profits among OECD countries as a result of maintaining its first-mover advantage.

Weighing the pros and cons

Of course, as with any bold strategy, there are always tradeoffs. To get a broader sense of the pros and cons of adopting bitcoin as a strategic reserve asset, I reached out to Matthew Pines, a national security fellow at the Bitcoin Policy Institute.

Among the pros, Pines said that such a move “could position the United States well against authoritarian challengers (who may be considering their own asset diversification and hedging strategies), while also signaling that it intends to lead emerging open digital financial networks.”

But among the cons: “This strategy would face substantial challenges, including regulatory hurdles, introducing additional uncertainty into the U.S. Treasury market (even though it can serve as a gold-like substitute for tangible assets on the national balance sheet), and political opposition that could undermine its sustainability.”

Pairing Bitcoin and Stablecoins

However, policymakers could mitigate uncertainty in the US Treasury bond market by combining a bitcoin adoption strategy with robust promotion of dollar-based stablecoins.

Stablecoin providers are now the 18th largest holder of US debt, containment approximately $120 billion in U.S. Treasury notes. To put that number into perspective, stablecoin providers currently hold more U.S. Treasuries than some of the United States’ largest trading partners, including Germany and South Korea. Furthermore, brokerage firm Bernstein predict that the stablecoin market will grow exponentially over the next decade, reaching a total market value of $3 trillion by 2028.

As former Speaker of the House Paul Ryan he wrote In The Wall Street Journal last month, USD stablecoins could create unprecedented demand for US Treasurys and even avert a debt crisis. According to Ryan, it’s up to US policymakers to see stablecoins for what they are: a generational opportunity to expand dollarization and strengthen the Treasury market.

A holistic digital asset strategy is essential to achieving this goal. Such a strategy would seek to increase demand for U.S. debt through stablecoins, while strengthening the nation’s overall balance sheet through bitcoin.

A robust balance sheet driven by bitcoin in the early stages of nation-state adoption would only increase the resilience of the American economy. And a stronger economy would only increase confidence in Treasury notes backed by the “full faith and credit” of the U.S. government. With this strategy, policymakers could therefore lay the foundation for an unexpected future—one in which bitcoin and the dollar grow together.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

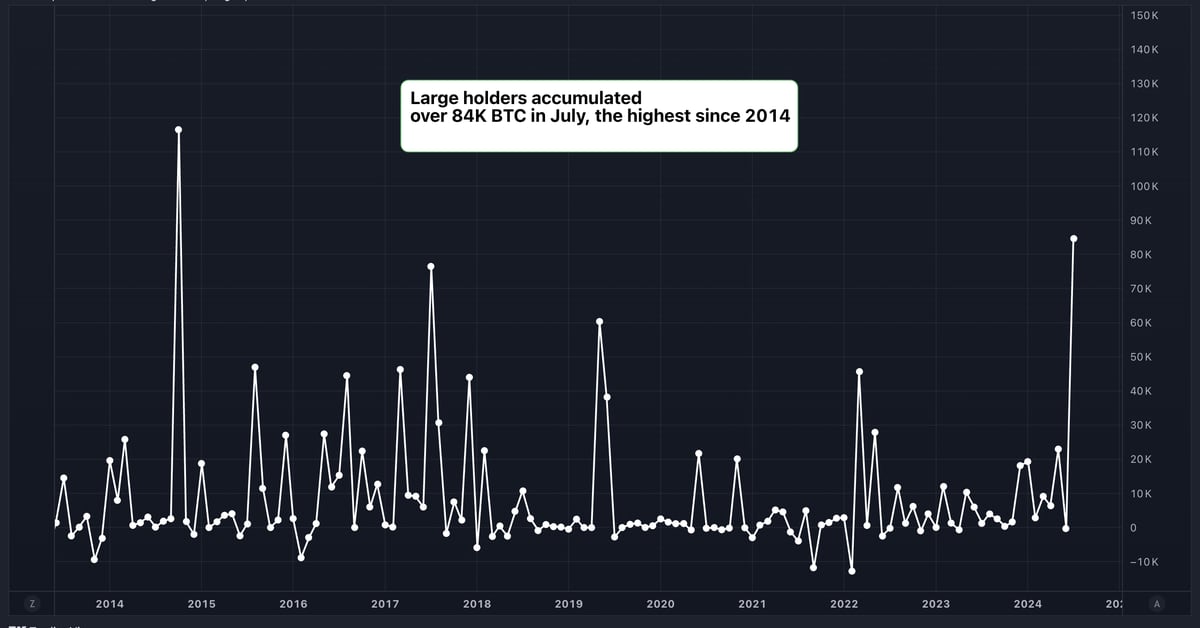

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos9 months ago

Videos9 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum9 months ago

Ethereum9 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos9 months ago

Videos9 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!