News

All You Need to Know

Blockchain has been a revolutionary response for industries facing the growing pressure of centralized operations’ limitations. By building an ecosystem which runs on zero trust, the technology introduced the world with processes that were incredibly neutral, change-proof, and 100% transparent when compared to their predecessors – traditional computing environment.

Having reached a stage where blockchain has established its credibility across industries, the technology now faces an oracle problem – reliance on an Internet connection. Since blockchains don’t have built-in communication capabilities with external APIs or other blockchains, it not only prohibits them from interacting with the traditional systems but also hinders interoperability with other blockchains.

With the growing traction of a multi-blockchain world, interoperability protocols are fast becoming a critical infrastructure for exchanging tokens and data between blockchains.

Through this article, we will deep dive into the concept and necessity of blockchain interoperability for businesses, giving you an understanding of how the process works and the changes to expect from its implementation.

The Origin of Blockchain Interoperability Solutions

The importance of blockchain interoperability can be understood best by keeping it on the same spectrum as globalization. The technique gives blockchain systems the ability to open up asset flow which is locked in individual chains.

Like nations, blockchains can also specialize and function better than others in specific areas. While some blockchains could be ideal for minting new NFT, others might offer extremely low transaction charges. Moreover, for some dApps, the place where the chain sits would be a deciding factor for providing scalability and security in a decentralized environment.

Opening the connection between these specialized blockchains does a lot more than simply creating opportunities for existing applications to scale. It builds opportunities for new apps and use cases to emerge – examples of which exist across the economic history, from the new domains of businesses due to globalization, to the rise of new e-businesses, which increased interoperability on the web.

While this is happening on a macro level, on the ground level, the lack of interoperability was causing a number of persistent issues leading to companies asking for solutions focused on blockchain interoperability for businesses.

- Absence of a direct interoperability between Ethereum and Bitcoin limits bitcoin users from using their crypto funds within Ethereum.

- Users cannot directly transact BTC for ETH without the presence of a centralized cryptocurrency exchange.

- Although Ethereum and Binance Smart Chain both support USDT, one cannot send USDT from Ethereum to Binance Smart Chain or any other blockchain.

- Blockchain evangelists want to implement Blockchain in the traditional financial system. But if two banks use different blockchains, conducting transactions between them will be complex, leading to blockchain creating a segregated system rather than a unified one.

Also Read: How Much Does it Cost to Develop a Cryptocurrency Exchange App like Coinbase?

The more we dive into blockchain interoperability, the more one thing becomes clear – the situation is of critical importance for decentralized platform owners who are looking for better scalability and the perks that come with it. Let us look into some of the obvious benefits of achieving blockchain interoperability.

Business Benefits of Blockchain Interoperability

As the blockchain space expands, interoperability is becoming increasingly critical for determining a project’s success. While blockchain interoperability’s global valuation is poised to reach $3 billion by 2034, in 2025 itself, we’ll see more interchain collaborations and developments happening as companies continue to push for greater blockchain efficiency, scalability, and privacy.

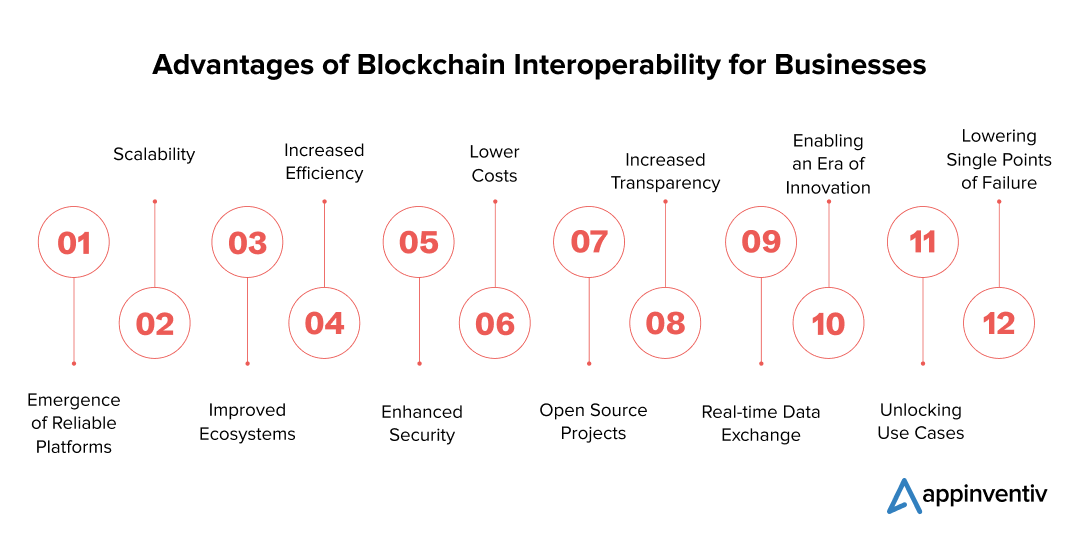

Emergence of Reliable Platforms: One of the significant benefits of blockchain interoperability for businesses is that it enables different blockchains to connect, allowing users to easily transact across multiple platforms. Through this, companies would be able to build more secure and reliable platforms, which would depend on multiple blockchain networks that are known for completing transactions safely and effectively.

Scalability: One of the most evident challenges blockchain struggles with is scalability. Companies will be able to overcome this hindrance by using various interoperable blockchain solutions. As a result, developers would also be able to create more sophisticated applications and services without any obvious or unforeseen performance issues or paying significant transaction charges.

Improved Ecosystems: The role of blockchain interoperability in businesses enables improved communication between blockchains, building a better ecosystem for both businesses and users. We can expect to see increased interchain collaboration as brands work towards providing their customers with innovative services and products.

Increased Efficiency: Cross-chain communication can create a space for introducing greater efficiency in the blockchain space. By using data from different blockchains, companies can lower the cost and time associated with multi-platform transactions, allowing faster transaction settlement and better experiences.

Enhanced Security: Interoperability can create a system for enhanced safety on the blockchain by creating robust consensus mechanisms, which ultimately make it difficult for malicious actors to take network control. In the future, we are likely to see projects taking advantage of this to build more secure systems for the users.

Lower Costs: Another evident importance of blockchain interoperability can be seen in reduced business costs. Companies can use data from multiple blockchain networks to create efficient processes, which helps lower operational costs and build upon overall profitability.

Open Source Projects: Blockchain interoperability can power the creation of open-source projects, which range across multiple blockchains. These projects, in turn, will allow developers to create innovative apps and services without thinking of compliance or compatibility issues.

Increased Transparency: Another one of the critical business benefits of blockchain interoperability lies in companies being able to provide greater visibility into their operations through multiple blockchain connectivities. This increased transparency guarantees customers direct access to up-to-date information on transactions on the network, which ultimately helps build trust between the company and them.

Real-time Data Exchange: Blockchain interoperability allows a real-time data exchange among multiple networks. It can help companies scale faster as they are able to quickly identify new growth opportunities and respond to customer requests more efficiently.

Enabling an Era of Innovation: Interoperability could also enable a new generation of innovation. By creating an open, interconnected ecosystem, developers can create powerful applications and services that leverage the best features from multiple blockchains. As a result, they could lead to new categories of products and services that benefit businesses and consumers alike.

Unlocking Use Cases: Importance of blockchain interoperability can also be seen in the technology unlocking new business use cases. By obtaining data from different blockchains, businesses can create more personalized solutions that are better suited to their customers’ requirements – along the way, they can tap into applications that are yet to come on the surface.

Lowering Single Points of Failure: Interoperability lowers dependance on a single blockchain network, eliminating the probability of disruptions while guaranteeing operations’ continuity. In the event of network failure, transactions can get routed through alternative pathways, augmenting reliability and resilience. This distributed architecture directly lowers the chance of systemic failures and improves the blockchain ecosystem’s robustness.

This list of benefits highlighting the importance of blockchain interoperability for businesses, while expansive, is still only scratching the surface. The true potential will emerge only after businesses have incorporated interoperability in their decentralized offerings.

Let us look at the ‘how’ in the next section.

The Common Blockchain Interoperability Solutions

The best starting point when talking about blockchain interoperability solutions would be to look into the most popular cross-chain interactions.

- Token swaps – Involve trading a token on source chain and then receiving a separate token on the destination chain. These cross-chain token swaps are usually done through atomic swap protocols and/or cross-chain automated market makers (AMMs), which place different liquidity pools on every blockchain to power the swap.

- Token bridges – Comprise locking or burning the tokens through a smart contract on a source chain and then minting or unlocking tokens through a separate smart contract active on the destination chain. Token bridges enable assets to move across blockchain networks, increasing the token utility as a result.

- Native payments – Involve an app present on the source chain triggering the payment on the destination chain in the native asset. The cross-chain payments can also be done on the source chain in its native asset on the basis of the data from a separate blockchain network.

- Contract calls – Here a smart contract present on a source chain calls upon a smart contract function deployed on the destination chain, potentially on the basis of data that originates on the source chain. Several contract calls can be merged to shape a complex cross-chain app, which might involve token bridging and swaps.

To power these cross-chain interactions, four interoperability solutions are used. These solutions validate the state of a source blockchain and relays the ensuing transactions to the destination blockchain. Both these functions – state verification and relay – play a key role in completing cross-chain interactions.

Web2 Validation

Web2 validation happens when someone uses a Web2 service for executing a cross-chain transaction. A common example of this can be seen in users leveraging centralized exchanges for swapping or bridging their tokens. The user simply has to deposit their assets in a source chain address that’s under the exchange’s control and then withdraw the same or different tokens (via a swap) to a destination chain address controlled by them.

External Validation

External validation is when the validator nodes set from all the blockchain of the cross-chain interaction are used for validating the state of the source blockchain and triggering the subsequent transaction on the destination chain after a specific criteria is met. While there are a number of approaches to address committee-based consensus – decentralized oracle networks, multi-party computation, threshold multi-signature contracts – all of them involve validator nodes for trust-minimized off-chain computation which gets authenticated on-chain.

Local Validation

Local validation is when the cross-chain interaction counterparties verifies the state of each other. If both consider the other valid, a cross-chain transaction gets executed, resulting in successful peer-to-peer cross-chain transactions. These cross-chain swaps which are based on local validation are often called atomic swaps. These atomic swaps come with a high level of trust-minimization with reasonable blockchain assumptions, as swap either happens successfully or both the transactions fail.

Native Validation

Native validation happens when a destination blockchain active on a cross-chain interaction verifies the source blockchain state to confirm transactions and then executes a subsequent transaction on their own chain. This is typically performed by running a light client of the source chain in the destination chain virtual machine or by running both side-by-side.

While these solutions are being incorporated by leading blockchain firms like Chainlink, Cosmos, and Polkadot, etc. to create better connectivity between the networks, the success is highly dependent on how well/strategic the interoperable systems are.

At Appinventiv, when we work on blockchain software development, we believe that the project to be truly scalable, future-oriented, and effective, its interoperability mechanism should be strategically built. On that note, here are the requirements that we share with our clients to make their blockchain interoperability ready.

Blockchain Interoperability in Business Best Practices

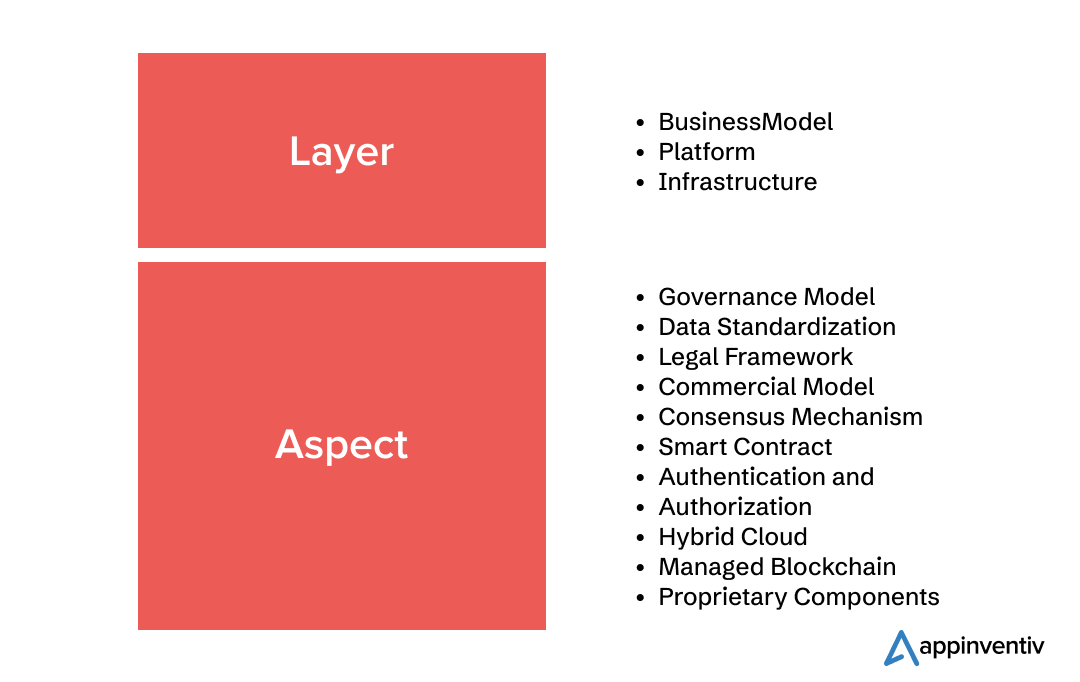

The impact of the role of blockchain interoperability in businesses is highly dependent on how well it is implemented in the solution. The interoperability model usually works around three layers that address all the cross-chain challenges.

Business Model Layer

When two blockchain ecosystems transmit data, the governance models that are working behind these ecosystems must be easily comparable with each other, alongwith a well-defined legal framework and commercial arrangements. Believing that technical feasibility can enable interoperability is very short-sighted and thus be avoided.

Here are the questions that businesses should answer in this layer –

- To which industries and data standards do these participants adhere?

- Are any of these participants currently part of an existing blockchain ecosystem? If so, what data standards are utilized?

- What methods should participants use to discover, exchange, and apply relevant distributed data across different ecosystems?

- Does the intended use case require features provided by related ecosystems, such as payments or trade finance in supply chain scenarios?

- How can we prevent or mitigate interoperability risks like exposing information to untrusted third parties and losing access to information on secondary chains?

Platform Layer

When two ecosystems exchange data points, blockchain interoperability calls for a careful consideration into assuring that the platform layers are technically compatible with the consensus mechanism, authentication, and smart contract.

Here are the questions that businesses should answer in this layer –

- Are any participants already engaged in an existing blockchain ecosystem? If so, what blockchain platform do they use, and which consensus mechanism is it based on?

- Do the blockchain platforms support similar multi-signature transactions for authentication and authorization? For instance, does one platform authenticate at the user level while another does so at the node level?

- Can we develop a cross-authentication mechanism?

- Considering a notary scheme-based interoperability solution, is it practical to trust a third party to operate a notary scheme for cross-chain interoperability, or does it conflict with the decentralization goal?

- If using a relay-based interoperability solution, why were the two ecosystems initially built on different blockchain technologies? How can participants in the application layers of two distinct blockchains establish trust, given their differing consensus mechanisms and governance models?

- Can an API gateway be established?

Infrastructure Layer

The infrastructure layer works with a set of components that enables blockchain platform’s services. These usually include, but are not restricted to, computation, storage, networking, and virtualization.

Here are the questions that businesses should answer in this layer –

- Will the use case subject the solution owner to regional legal constraints regarding data storage locations or something else?

- Does the use case enable the solution owner to deploy it on a virtual private cloud?

- Can the use case utilize Blockchain-as-a-Service (BaaS) offerings?

- Is the IT organization sufficiently mature to manage hosting nodes, wallets, secure keys, or tokens?

Here were the blockchain interoperability in business best practices that we typically suggest our clients to follow when they are on the journey to scale up, irrespective of the use cases they are exploring.

As we conclude the article, let us look into what the future holds for blockchain interoperability for businesses.

The Future of Blockchain Interoperability in Business

There is a pivotal need for siloed blockchain networks to communicate with each other effortlessly. In the absence of a blockchain abstraction layer, dApps depend on separate, in-house integrations for every cross-chain interaction they want to use – a process known for being incredibly resource-intensive, time-consuming, and complex.

With the industry-wide focus shifting on finding and expanding the scope of blockchain interoperability for businesses, we will see a number of interoperability platforms coming into existence. Along with this, new partnerships will form in the tech space as businesses explore new use cases.

While this is on the business end, customers or the end users are definitely in for a treat with them becoming more confident in using blockchain applications and being on a center stage as interoperability opens innumerable use cases.

FAQs

Q. What is blockchain interoperability?

A. It refers to the ability of different blockchain networks to communicate and interact with one another seamlessly. This functionality enables the transfer and exchange of data, assets, and information across various blockchain platforms without requiring intermediaries. It aims to create a more connected and efficient blockchain ecosystem, enhancing the overall utility and versatility of blockchain technology.

Q. How does blockchain interoperability work?

A. Blockchain interoperability for businesses works by using standardized protocols, bridges, and cross-chain communication mechanisms that allow different blockchains to exchange information and assets. These technologies enable blockchains to understand and validate data from other networks, facilitating seamless interaction.

Smart contracts, atomic swaps, and interoperability platforms like Polkadot and Cosmos are some of the tools that help achieve this connectivity, ensuring that transactions and data transfers are secure and efficient across multiple blockchain networks.

Q. How can blockchain interoperability improve business efficiency?

A. The approach can significantly enhance business efficiency by enabling seamless data sharing and transactions across different blockchain platforms. This eliminates the need for intermediaries, reduces operational costs, and speeds up processes. Businesses can leverage interoperable blockchains to streamline supply chains, enhance transparency, and improve collaboration with partners using different blockchain technologies. This interconnected approach allows for more efficient and secure business operations, fostering innovation and scalability in various industries.

![]()

THE AUTHOR

chirag

Blockchain Evangelist

Fuente

News

Terra Can’t Catch a Break as Blockchain Gets $6 Million Exploited

The attack, which exploited a vulnerability disclosed in April, drained around 60 million ASTRO tokens, sending the price plummeting.

The Terra blockchain has been exploited for over $6 million, forcing developers to take a momentary break the chain.

Beosin Cyber Security Company reported that the protocol lost 60 million ASTRO tokens, 3.5 million USDC, 500,000 USDT, and 2.7 BTC or $180,000.

Terra developers paused the chain on Wednesday morning to apply an emergency patch that would address the attack. Moments later, a 67% majority of validators upgraded their nodes and resumed block production.

The ASTRO token has plunged as much as 75%. It is now trading at $0.03, a 25% decline on the day. Traders who took advantage of the drop are now on 195%.

The vulnerability that took down the Cosmos-based blockchain was disclosed in April and involved the deployment of a malicious CosmWasm contract. It opened the door to attacks via what is called an “ibc-hooks callback timeout reentrancy vulnerability,” which is used to invoke contracts and enable cross-chain swaps.

Terra 2.0 also suffered a massive drop in total value locked (TVL) in April, shortly after the vulnerability was discovered. It plunged 80% to $6 million from $30 million in TVL and has since lost nearly half of that value, currently sitting at $3.9 million.

The current Earth chain emerged from the rubble as a hard fork after the original blockchain, now called Terra Classic, collapsed in 2022. Terra collapsed after its algorithmic stablecoin (UST) lost its peg, causing a run on deposits. More than $50 billion of UST’s market cap was wiped out in a matter of days.

Terraform Labs, the company behind the blockchain, has been slowly unravelling its legal woes since its mid-2022 crash. Founder Do Kwon awaits sentencing in Montenegro after he and his company were found liable for $40 billion in customer funds in early April.

On June 12, Terraform Labs settled with the SEC for $4.4 billion, for which the company will pay about $3.59 billion plus interest and a $420 million penalty. Meanwhile, Kwon will pay $204.3 million, including $110 million in restitution, interest and an $80 million penalty, a court filing showed.

News

Google and Coinbase Veterans Raise $5M to Build Icebreaker, Blockchain’s Answer to LinkedIn

Icebreaker: Think LinkedIn but on a Blockchain—announced Wednesday that it has secured $5 million in seed funding. CoinFund led the round, with participation from Accomplice, Anagram, and Legion Capital, among others.

The company, which is valued at $21 million, aims to become the world’s first open-source network for professional connections. Its co-founders, Dan Stone and Jack Dillé, come from Google AND Monetary base; Stone was a product manager at the cryptocurrency giant and also the co-creator of Google’s largest multi-identity measurement and marketing platform, while Dillé was a design manager for Google Working area.

The pair founded Icebreaker on the shared belief that the imprint of one’s digital identity (and reputation) should not be owned by a single entity, but rather publicly owned and accessible to all. Frustrated that platforms like LinkedIn To limit how we leverage our connections, Dillé told Fortune he hopes to remove paywalls and credits, which “force us to pay just to browse our network.” Using blockchain technology, Icebreaker lets users transfer their existing professional profile and network into a single, verified channel.

“Imagine clicking the login button and then seeing your entire network on LinkedIn, ChirpingFarcaster and email? Imagine how many introductions could be routed more effectively if you could see the full picture of how you’re connected to someone,” Stone told Fortune.

Users can instantly prove their credentials and provide verifiable endorsements for people in their network. The idea is to create an “open graph of reputation and identity,” according to the founders. They hope to challenge LinkedIn’s closed network that “secures data,” freeing users to search for candidates and opportunities wherever they are online. By building on-chain, the founders note, they will create a public ledger of shared context and trust.

Verified channels are now launched for

Chirping

Online Guide

Wallet

Discord

Telephone

TeleporterYou can find them in Account -> Linked Accounts Italian: https://t.co/mRDyuWW8O2

— Icebreaker (@icebreaker_xyz) April 3, 2024

“Digital networking is increasingly saturated with noise and AI-driven fake personas,” the founders said in a statement. For example: Dillé’s LinkedIn headline reads “CEO of Google,” a small piece of digital performance art to draw attention to unverifiable information on Web2 social networks that can leave both candidates and recruiters vulnerable to false claims.

“Icebreaker was created to enable professionals to seamlessly tap into their existing profiles and networks to surface exceptional people and opportunities, using recent advances in cryptographically verifiable identity,” the company said, adding that the new funding will go towards expanding its team and developing products.

“One of the next significant use cases for cryptocurrency is the development of fundamental social graphs for applications to leverage… We are proud to support Dan, Jack and their team in their mission to bring true professional identity ownership to everyone online,” said CoinFund CIO Alex Felix in a statement.

Learn more about all things cryptocurrency with short, easy-to-read flashcards. Click here to Fortune’s Crash Course in Cryptocurrency.

Fuente

News

Luxembourg proposes updates to blockchain laws | Insights and resources

On July 24, 2024, the Ministry of Finance proposed Blockchain Bill IVwhich will provide greater flexibility and legal certainty for issuers using Distributed Ledger Technology (DLT). The bill will update three of Luxembourg’s financial laws, the Law of 6 April 2013 on dematerialised securitiesTHE Law of 5 April 1993 on the financial sector and the Law of 23 December 1998 establishing a financial sector supervisory commissionThis bill includes the additional option of a supervisory agent role and the inclusion of equity securities in dematerialized form.

DLT and Luxembourg

DLT is increasingly used in the financial and fund management sector in Luxembourg, offering numerous benefits and transforming various aspects of the industry.

Here are some examples:

- Digital Bonds: Luxembourg has seen multiple digital bond issuances via DLT. For example, the European Investment Bank has issued bonds that are registered, transferred and stored via DLT processes. These bonds are governed by Luxembourg law and registered on proprietary DLT platforms.

- Fund Administration: DLT can streamline fund administration processes, offering new opportunities and efficiencies for intermediaries, and can do the following:

- Automate capital calls and distributions using smart contracts,

- Simplify audits and ensure reporting accuracy through transparent and immutable transaction records.

- Warranty Management: Luxembourg-based DLT platforms allow clients to swap ownership of baskets of securities between different collateral pools at precise times.

- Tokenization: DLT is used to tokenize various assets, including real estate and luxury goods, by representing them in a tokenized and fractionalized format on the blockchain. This process can improve the liquidity and accessibility of traditionally illiquid assets.

- Tokenization of investment funds: DLT is being explored for the tokenization of investment funds, which can streamline the supply chain, reduce costs, and enable faster transactions. DLT can automate various elements of the supply chain, reducing the need for reconciliations between entities such as custodians, administrators, and investment managers.

- Issuance, settlement and payment platforms:Market participants are developing trusted networks using DLT technology to serve as a single source of shared truth among participants in financial instrument investment ecosystems.

- Legal framework: Luxembourg has adapted its legal framework to accommodate DLT, recognising the validity and enforceability of DLT-based financial instruments. This includes the following:

- Allow the use of DLT for the issuance of dematerialized securities,

- Recognize DLT for the circulation of securities,

- Enabling financial collateral arrangements on DLT financial instruments.

- Regulatory compliance: DLT can improve transparency in fund share ownership and regulatory compliance, providing fund managers with new opportunities for liquidity management and operational efficiency.

- Financial inclusion: By leveraging DLT, Luxembourg aims to promote greater financial inclusion and participation, potentially creating a more diverse and resilient financial system.

- Governance and ethics:The implementation of DLT can promote higher standards of governance and ethics, contributing to a more sustainable and responsible financial sector.

Luxembourg’s approach to DLT in finance and fund management is characterised by a principle of technology neutrality, recognising that innovative processes and technologies can contribute to improving financial services. This is exemplified by its commitment to creating a compatible legal and regulatory framework.

Short story

Luxembourg has already enacted three major blockchain-related laws, often referred to as Blockchain I, II and III.

Blockchain Law I (2019): This law, passed on March 1, 2019, was one of the first in the EU to recognize blockchain as equivalent to traditional transactions. It allowed the use of DLT for account registration, transfer, and materialization of securities.

Blockchain Law II (2021): Enacted on 22 January 2021, this law strengthened the Luxembourg legal framework on dematerialised securities. It recognised the possibility of using secure electronic registration mechanisms to issue such securities and expanded access for all credit institutions and investment firms.

Blockchain Act III (2023): Also known as Bill 8055, this is the most recent law in the blockchain field and was passed on March 14, 2023. This law has integrated the Luxembourg DLT framework in the following way:

- Update of the Act of 5 August 2005 on provisions relating to financial collateral to enable the use of electronic DLT as collateral on financial instruments registered in securities accounts,

- Implementation of EU Regulation 2022/858 on a pilot scheme for DLT-based market infrastructures (DLT Pilot Regulation),

- Redefining the notion of financial instruments in Law of 5 April 1993 on the financial sector and the Law of 30 May 2018 on financial instruments markets to align with the corresponding European regulations, including MiFID.

The Blockchain III Act strengthened the collateral rules for digital assets and aimed to increase legal certainty by allowing securities accounts on DLT to be pledged, while maintaining the efficient system of the 2005 Act on Financial Collateral Arrangements.

With the Blockchain IV bill, Luxembourg will build on the foundations laid by previous Blockchain laws and aims to consolidate Luxembourg’s position as a leading hub for financial innovation in Europe.

Blockchain Bill IV

The key provisions of the Blockchain IV bill include the following:

- Expanded scope: The bill expands the Luxembourg DLT legal framework to include equity securities in addition to debt securities. This expansion will allow the fund industry and transfer agents to use DLT to manage registers of shares and units, as well as to process fund shares.

- New role of the control agent: The bill introduces the role of a control agent as an alternative to the central account custodian for the issuance of dematerialised securities via DLT. This control agent can be an EU investment firm or a credit institution chosen by the issuer. This new role does not replace the current central account custodian, but, like all other roles, it must be notified to the Commission de Surveillance du Secteur Financier (CSSF), which is designated as the competent supervisory authority. The notification must be submitted two months after the control agent starts its activities.

- Responsibilities of the control agent: The control agent will manage the securities issuance account, verify the consistency between the securities issued and those registered on the DLT network, and supervise the chain of custody of the securities at the account holder and investor level.

- Simplified payment processesThe bill allows issuers to meet payment obligations under securities (such as interest, dividends or repayments) as soon as they have paid the relevant amounts to the paying agent, settlement agent or central account custodian.

- Simplified issuance and reconciliationThe bill simplifies the process of issuing, holding and reconciling dematerialized securities through DLT, eliminating the need for a central custodian to have a second level of custody and allowing securities to be credited directly to the accounts of investors or their delegates.

- Smart Contract Integration:The new processes can be executed using smart contracts with the assistance of the control agent, potentially increasing efficiency and reducing intermediation.

These changes are expected to bring several benefits to the Luxembourg financial sector, including:

- Fund Operations: Greater efficiency and reduced costs by leveraging DLT for the issuance and transfer of fund shares.

- Financial transactions: Greater transparency and security.

- Transparency of the regulatory environment: Increased attractiveness and competitiveness of the Luxembourg financial centre through greater legal clarity and flexibility for issuers and investors using DLT.

- Smart Contracts: Potential for automation of contractual terms, reduction of intermediaries and improvement of transaction traceability through smart contracts.

Blockchain Bill IV is part of Luxembourg’s ongoing strategy to develop a strong digital ecosystem as part of its economy and maintain its status as a leading hub for financial innovation. Luxembourg is positioning itself at the forefront of Europe’s growing digital financial landscape by constantly updating its regulatory framework.

Local regulations, such as Luxembourg law, complement European regulations by providing a more specific legal framework, adapted to local specificities. These local laws, together with European initiatives, aim to improve both the use and the security of projects involving new technologies. They help establish clear standards and promote consumer trust, while promoting innovation and ensuring better protection against potential risks associated with these emerging technologies. Check out our latest posts on these topics and, for more information on this law, blockchain technology and the tokenization mechanism, do not hesitate to contact us.

We are available to discuss any project related to digital finance, cryptocurrencies and disruptive technologies.

This informational piece, which may be considered advertising under the ethics rules of some jurisdictions, is provided with the understanding that it does not constitute the rendering of legal or other professional advice by Goodwin or its attorneys. Past results do not guarantee a similar outcome.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos9 months ago

Videos9 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!

ASTRO Price

ASTRO Price