News

Beyond sharding and rollups: a new approach to blockchain scalability

Vitalik Buterin he still produced another well argued piece on why one approach to scaling Ethereum (ZK rollup) is better than others (Ethereum sharding). I agree with almost everything Vitalik has written on the subject, yet I fundamentally disagree with the vision he paints. The reason is that his arguments fail to address the fundamental issue: the intrinsic structure of the Blockchain is the real obstacle to scalability. As long as the enterprise layer, which provides value and experience, is coupled with the network layer, which provides scalability, we will not be able to deliver value at scale.

Scalability: the great dilemma of Blockchain

dilemma (noun): a choice between two (or, generically, more) alternatives, which are or appear equally unfavorable – oed

Public blockchain ecosystems like Ethereum have a problem. Monolithic “L1” mainnets are neither suitable nor sufficiently performant and economical for all intended use cases. This problem is usually condensed into talking about “blockchain scalability”.

This problem is serious. Vitalik Buterin, co-founder of Ethereum, wrote about “blockchain scalability” for over 10 years. Many solution approaches have been proposed and implemented: Lightning, Sharding, Optimistic rollups, Rollup ZK, Plasmas, Valid, Baselines, Subnets, Chain guard, Appchain… The pros and cons of the approaches are hotly debated.

Choosing the right option from those listed above is a real dilemma. The problem is real, ecosystems like Ethereum have to make a choice. But all the above choices are equally unfavorable.

As with any good dilemma, arguments can be made as to why one choice is better than another. The Ethereum ecosystem is aligning around rollups and Vitalik Buterin he claims in the long term this will converge towards ZK rollups. His arguments are strong and revolve around the benefits of heterogeneity and developer independence, as well as the technical advantages of efficient proofs on data.

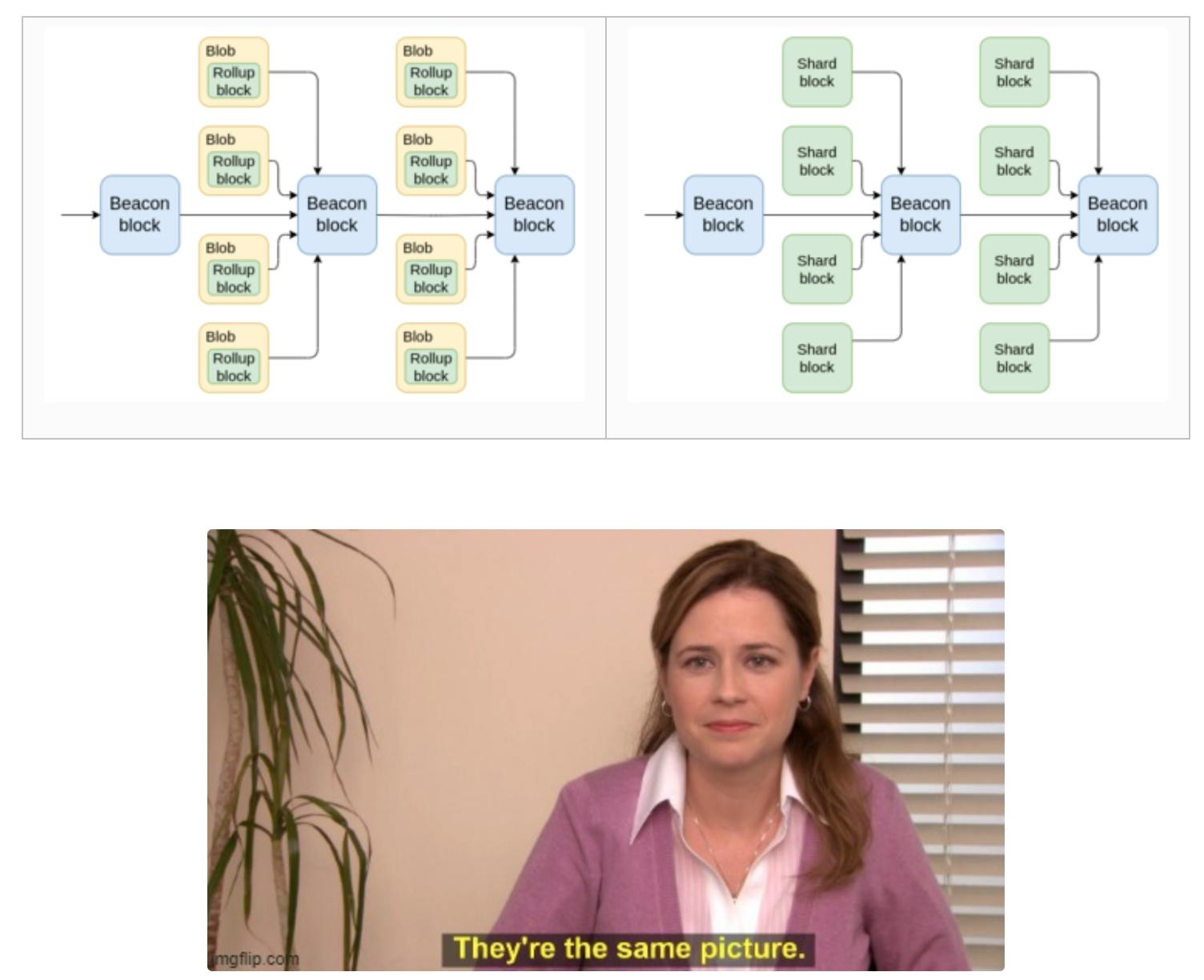

But in the same paper he also underlines that all the options taken into consideration are essentially the same.

“Layer 2” and “sharding” are often described in public discourse as two opposing strategies for how to scale a blockchain. But when you look at the underlying technology, a puzzle arises: the current approaches to scaling are exactly the same. You have some sort of data sharing… The main difference is: who is responsible for creating and updating those parts and how much autonomy do they have?

And they are all the same in the sense that the fragments/rollups/subnets are in a very real sense independent chains. Arguments about whether to use one type of rollup or another are akin to arguing which type of glue is best suited for piecing together the fragments (pun intended) of something that is fundamentally broken.

The way Vitalik talks about this is how to preserve the “feeling” that the ecosystem is a coherent thing, i.e. how to best hide the glued seams:

As Ethereum branches, the challenge is to preserve the fundamental property that it still looks like “Ethereum” and has the network effect of being Ethereum rather than being N separate chains…

Moving tokens from one layer 2 to another often requires centralized bridge platforms and is complicated for the average user.

These problems are known, understood and a lot of effort is being made to iron out these problems. I’ve already discussed why Bridges won’t cut it. But why try to glue together something that is fundamentally broken and not design something that solves the fundamental problem?

The Internet analogy: decoupling business and networking

Everyone in the space loves Internet analogies, and for good reason: The Internet works. It provides connectivity between applications, resources and users and is virtually infinitely scalable. It has many of the properties espoused by blockchain networks.

- Common experience: It has the fundamental property of feeling uniformly like “the Internet” and creating network effects within it. It doesn’t look like N-peering layer 1/2/3 subnets are actually there. The browser provides this experience.

- Heterogeneity: Centralized controls and standards are minimal (TCP/IP, BGP, DNS, etc.). It is possible for developers to try almost anything new. Application operators have complete control of their system, from data permissions to SLAs.

- Modularity: Public-facing APIs can be composited together into new experiences on the underlying apps.

- Scalability: Just add a new server or router to extend.

One of the key design differences between the Internet and blockchains like Ethereum is that the business layer is completely decoupled from the network layer. I’ve pointed out before that the Internet at the network level is really a glued-together mosaic. Traffic is automatically (thanks to BGP) routed through independently controlled peer networks. We experience this in some way only when it goes wrong and a service like Facebook, which runs on its own subnet, disappears from the Internet.

The only thing that matters to you as a user is having sufficient connectivity to one of Facebook’s servers, the enterprise layer of the Internet. This works because Facebook and you have agreed to allow your traffic (hopefully TLS encrypted) to be routed through some third-party infrastructure (backbones, ISPs, etc.). The business layer (authentication, reading and sending data, creating a post, etc.) is only between you, the user, and Facebook as the application provider.

Fully replicated blockchains like Ethereum, as well as the “sharding” techniques mentioned above, are fundamentally different. The network serves as a network and messaging channel (gossip protocols), data persistence layer (storage and service blocks), logic execution/validation (smart contracts), ordering (mining), etc. It’s all integrated, which makes each network/shard a monolithic silo, a “virtual mainframe”. The enterprise topology of the Internet, that is, the connections between users and apps, as well as the composability between apps, is forced to follow the network topology. Ergo, splitting the network layer for scalability fragments the business layer, creating hard-to-cross boundaries, fragmented experiences, and ultimately new silos.

Canton Network was designed from the ground up to decouple the business and network layers such as the Internet. The enterprise layer, which is what we most often call “blockchain,” is entirely between the participants involved: the “participating nodes” of users and application providers, which are analogous to servers on the Internet. They make dynamic use of infrastructures, so-called “synchronizers”, which are only concerned with transmitting and ordering (encrypted) messages, equivalent to routers, subnets or ISPs on the Internet. They do just enough to ensure deterministic execution, atomicity of transactions, and double-spending protection between participants. This allows the business layer to grow seamlessly, organically, and without raw glue. No fragments, no silos.

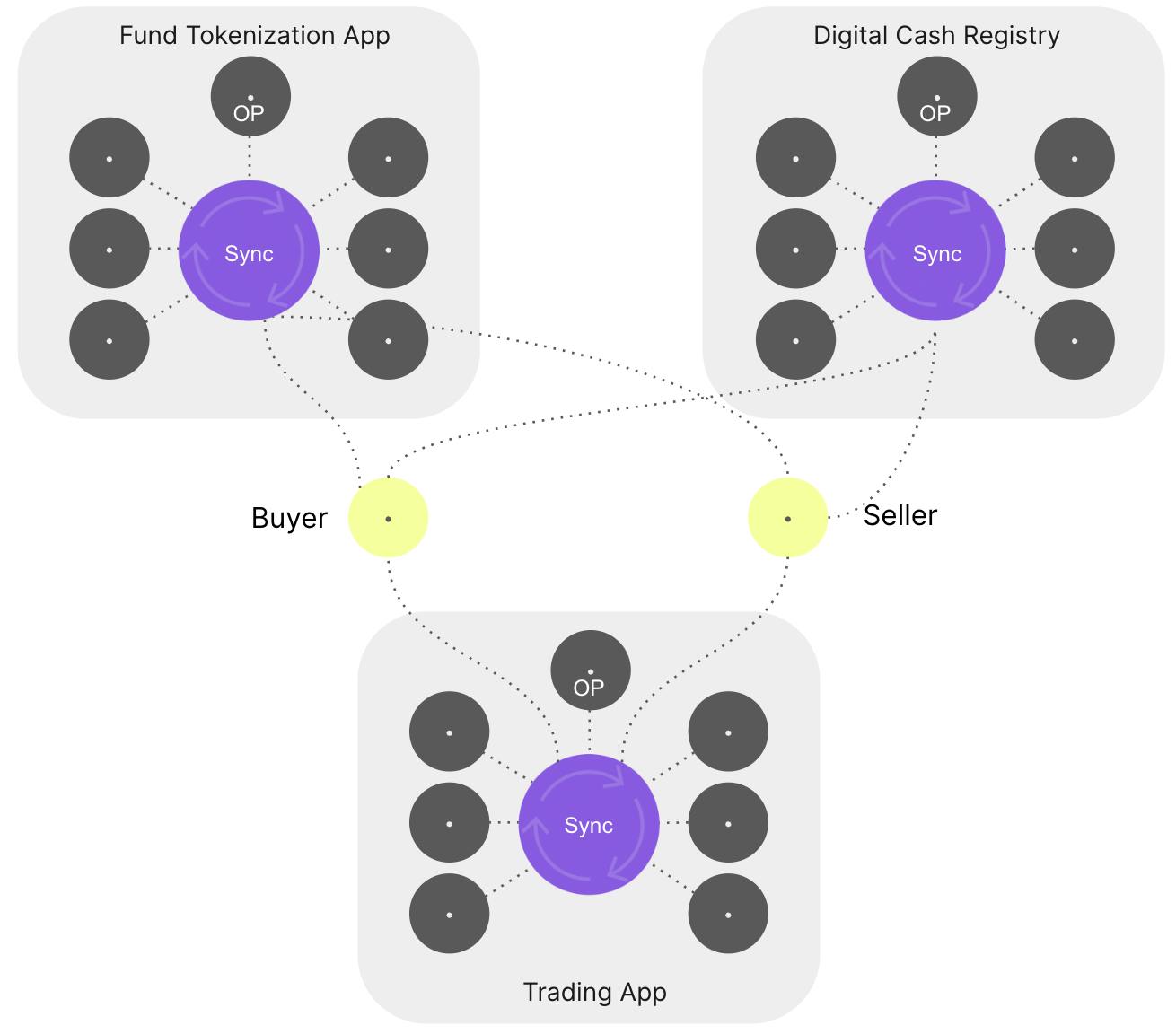

For example, imagine you have funds, cash and a trading app, each using only their own dedicated sync infrastructures and managed by their respective operators (OP pictured).

The buyer and seller would like to do a trade, but can’t since there is no common connectivity – you effectively have three apps, each running on its own LAN to which the buyer and seller are connected.

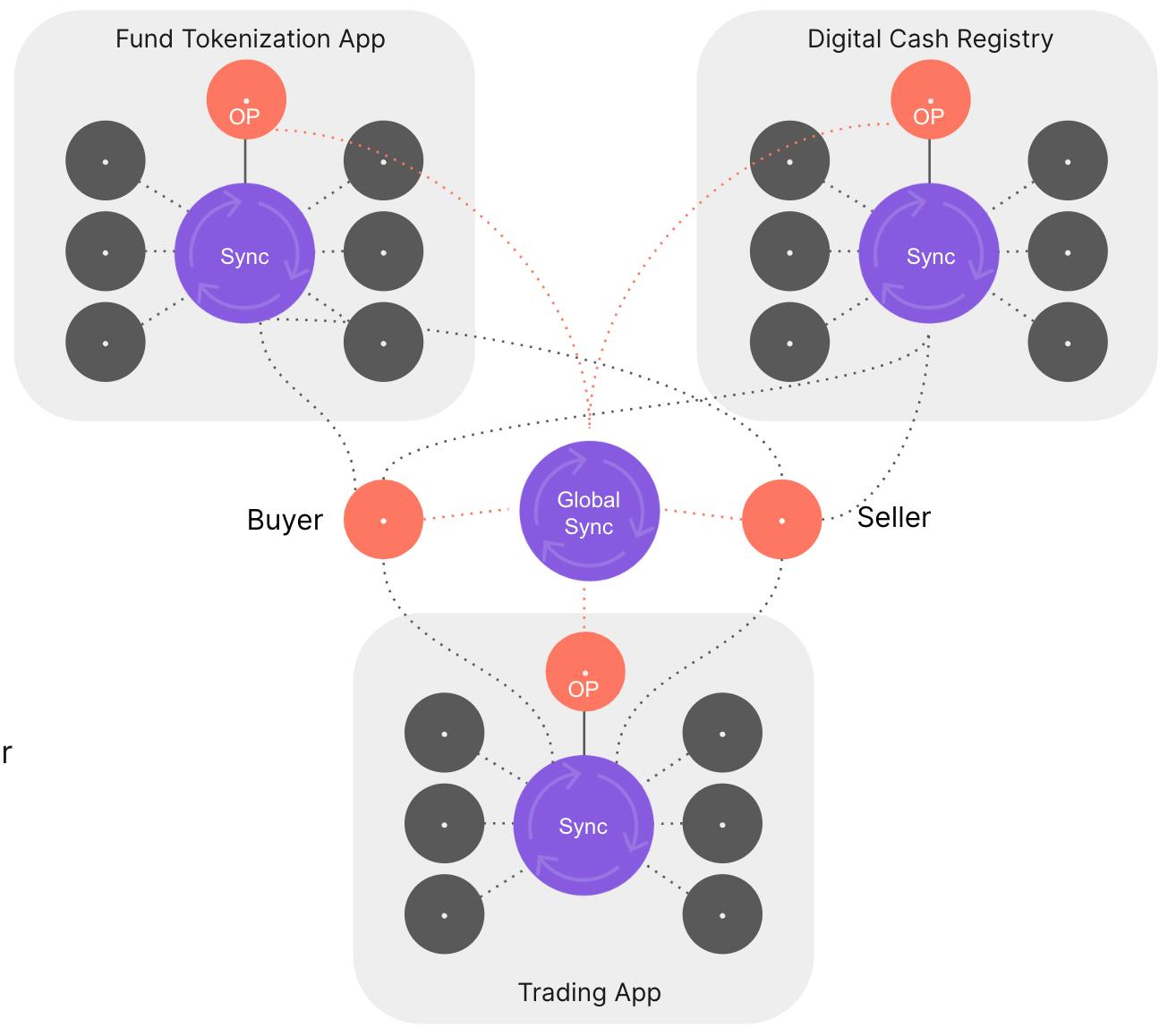

With Canton all you need to do is add a common synchronizer, the equivalent of a WAN or Internet backbone.

There is no need to create bridges, no need to “move” tokens, and no need for app/resource operators to modify their application. All the participants need is to connect to an additional common synchronizer. Once this is done, they can coordinate the consensus needed to add an atomic transaction involving all three apps to the “chain.” Sure, you need to put trust in this new infrastructure to properly perform its basic tasks, but trust for the ordering and delivery of messages is a solved problem. Choose a reliable centralized operator (ISP, backbone operator) or use a BFT algorithm (like a blockchain). And when in doubt, you can remove or change the synchronizer as easily as you added it, without migrating your application to a new server.

Conclusion

The whole discussion about sharding and blockchain rollups is a debate about which remedy for a terminal illness is the least serious. The fundamental problem with blockchains like Ethereum is that they tightly couple the business topology with the network topology. Scalable networks are inherently patchwork: as demonstrated by the Internet, the ability to add “patches” is what scalability means. But at the enterprise level, such patchworks are antithetical to the uniform experience and universal composability we need to realize blockchain’s value proposition. Merging independent silos with messaging standards and bridges is not innovation. Networks like SWIFT have optimized this model to a large extent.

What we need is a middle ground that can provide the atomic composability and uniformity of enterprise-level L1 blockchains, while offering the flexible network topology, subnet independence, and scalability of something like Internet.

News

Terra Can’t Catch a Break as Blockchain Gets $6 Million Exploited

The attack, which exploited a vulnerability disclosed in April, drained around 60 million ASTRO tokens, sending the price plummeting.

The Terra blockchain has been exploited for over $6 million, forcing developers to take a momentary break the chain.

Beosin Cyber Security Company reported that the protocol lost 60 million ASTRO tokens, 3.5 million USDC, 500,000 USDT, and 2.7 BTC or $180,000.

Terra developers paused the chain on Wednesday morning to apply an emergency patch that would address the attack. Moments later, a 67% majority of validators upgraded their nodes and resumed block production.

The ASTRO token has plunged as much as 75%. It is now trading at $0.03, a 25% decline on the day. Traders who took advantage of the drop are now on 195%.

The vulnerability that took down the Cosmos-based blockchain was disclosed in April and involved the deployment of a malicious CosmWasm contract. It opened the door to attacks via what is called an “ibc-hooks callback timeout reentrancy vulnerability,” which is used to invoke contracts and enable cross-chain swaps.

Terra 2.0 also suffered a massive drop in total value locked (TVL) in April, shortly after the vulnerability was discovered. It plunged 80% to $6 million from $30 million in TVL and has since lost nearly half of that value, currently sitting at $3.9 million.

The current Earth chain emerged from the rubble as a hard fork after the original blockchain, now called Terra Classic, collapsed in 2022. Terra collapsed after its algorithmic stablecoin (UST) lost its peg, causing a run on deposits. More than $50 billion of UST’s market cap was wiped out in a matter of days.

Terraform Labs, the company behind the blockchain, has been slowly unravelling its legal woes since its mid-2022 crash. Founder Do Kwon awaits sentencing in Montenegro after he and his company were found liable for $40 billion in customer funds in early April.

On June 12, Terraform Labs settled with the SEC for $4.4 billion, for which the company will pay about $3.59 billion plus interest and a $420 million penalty. Meanwhile, Kwon will pay $204.3 million, including $110 million in restitution, interest and an $80 million penalty, a court filing showed.

News

Google and Coinbase Veterans Raise $5M to Build Icebreaker, Blockchain’s Answer to LinkedIn

Icebreaker: Think LinkedIn but on a Blockchain—announced Wednesday that it has secured $5 million in seed funding. CoinFund led the round, with participation from Accomplice, Anagram, and Legion Capital, among others.

The company, which is valued at $21 million, aims to become the world’s first open-source network for professional connections. Its co-founders, Dan Stone and Jack Dillé, come from Google AND Monetary base; Stone was a product manager at the cryptocurrency giant and also the co-creator of Google’s largest multi-identity measurement and marketing platform, while Dillé was a design manager for Google Working area.

The pair founded Icebreaker on the shared belief that the imprint of one’s digital identity (and reputation) should not be owned by a single entity, but rather publicly owned and accessible to all. Frustrated that platforms like LinkedIn To limit how we leverage our connections, Dillé told Fortune he hopes to remove paywalls and credits, which “force us to pay just to browse our network.” Using blockchain technology, Icebreaker lets users transfer their existing professional profile and network into a single, verified channel.

“Imagine clicking the login button and then seeing your entire network on LinkedIn, ChirpingFarcaster and email? Imagine how many introductions could be routed more effectively if you could see the full picture of how you’re connected to someone,” Stone told Fortune.

Users can instantly prove their credentials and provide verifiable endorsements for people in their network. The idea is to create an “open graph of reputation and identity,” according to the founders. They hope to challenge LinkedIn’s closed network that “secures data,” freeing users to search for candidates and opportunities wherever they are online. By building on-chain, the founders note, they will create a public ledger of shared context and trust.

Verified channels are now launched for

Chirping

Online Guide

Wallet

Discord

Telephone

TeleporterYou can find them in Account -> Linked Accounts Italian: https://t.co/mRDyuWW8O2

— Icebreaker (@icebreaker_xyz) April 3, 2024

“Digital networking is increasingly saturated with noise and AI-driven fake personas,” the founders said in a statement. For example: Dillé’s LinkedIn headline reads “CEO of Google,” a small piece of digital performance art to draw attention to unverifiable information on Web2 social networks that can leave both candidates and recruiters vulnerable to false claims.

“Icebreaker was created to enable professionals to seamlessly tap into their existing profiles and networks to surface exceptional people and opportunities, using recent advances in cryptographically verifiable identity,” the company said, adding that the new funding will go towards expanding its team and developing products.

“One of the next significant use cases for cryptocurrency is the development of fundamental social graphs for applications to leverage… We are proud to support Dan, Jack and their team in their mission to bring true professional identity ownership to everyone online,” said CoinFund CIO Alex Felix in a statement.

Learn more about all things cryptocurrency with short, easy-to-read flashcards. Click here to Fortune’s Crash Course in Cryptocurrency.

Fuente

News

Luxembourg proposes updates to blockchain laws | Insights and resources

On July 24, 2024, the Ministry of Finance proposed Blockchain Bill IVwhich will provide greater flexibility and legal certainty for issuers using Distributed Ledger Technology (DLT). The bill will update three of Luxembourg’s financial laws, the Law of 6 April 2013 on dematerialised securitiesTHE Law of 5 April 1993 on the financial sector and the Law of 23 December 1998 establishing a financial sector supervisory commissionThis bill includes the additional option of a supervisory agent role and the inclusion of equity securities in dematerialized form.

DLT and Luxembourg

DLT is increasingly used in the financial and fund management sector in Luxembourg, offering numerous benefits and transforming various aspects of the industry.

Here are some examples:

- Digital Bonds: Luxembourg has seen multiple digital bond issuances via DLT. For example, the European Investment Bank has issued bonds that are registered, transferred and stored via DLT processes. These bonds are governed by Luxembourg law and registered on proprietary DLT platforms.

- Fund Administration: DLT can streamline fund administration processes, offering new opportunities and efficiencies for intermediaries, and can do the following:

- Automate capital calls and distributions using smart contracts,

- Simplify audits and ensure reporting accuracy through transparent and immutable transaction records.

- Warranty Management: Luxembourg-based DLT platforms allow clients to swap ownership of baskets of securities between different collateral pools at precise times.

- Tokenization: DLT is used to tokenize various assets, including real estate and luxury goods, by representing them in a tokenized and fractionalized format on the blockchain. This process can improve the liquidity and accessibility of traditionally illiquid assets.

- Tokenization of investment funds: DLT is being explored for the tokenization of investment funds, which can streamline the supply chain, reduce costs, and enable faster transactions. DLT can automate various elements of the supply chain, reducing the need for reconciliations between entities such as custodians, administrators, and investment managers.

- Issuance, settlement and payment platforms:Market participants are developing trusted networks using DLT technology to serve as a single source of shared truth among participants in financial instrument investment ecosystems.

- Legal framework: Luxembourg has adapted its legal framework to accommodate DLT, recognising the validity and enforceability of DLT-based financial instruments. This includes the following:

- Allow the use of DLT for the issuance of dematerialized securities,

- Recognize DLT for the circulation of securities,

- Enabling financial collateral arrangements on DLT financial instruments.

- Regulatory compliance: DLT can improve transparency in fund share ownership and regulatory compliance, providing fund managers with new opportunities for liquidity management and operational efficiency.

- Financial inclusion: By leveraging DLT, Luxembourg aims to promote greater financial inclusion and participation, potentially creating a more diverse and resilient financial system.

- Governance and ethics:The implementation of DLT can promote higher standards of governance and ethics, contributing to a more sustainable and responsible financial sector.

Luxembourg’s approach to DLT in finance and fund management is characterised by a principle of technology neutrality, recognising that innovative processes and technologies can contribute to improving financial services. This is exemplified by its commitment to creating a compatible legal and regulatory framework.

Short story

Luxembourg has already enacted three major blockchain-related laws, often referred to as Blockchain I, II and III.

Blockchain Law I (2019): This law, passed on March 1, 2019, was one of the first in the EU to recognize blockchain as equivalent to traditional transactions. It allowed the use of DLT for account registration, transfer, and materialization of securities.

Blockchain Law II (2021): Enacted on 22 January 2021, this law strengthened the Luxembourg legal framework on dematerialised securities. It recognised the possibility of using secure electronic registration mechanisms to issue such securities and expanded access for all credit institutions and investment firms.

Blockchain Act III (2023): Also known as Bill 8055, this is the most recent law in the blockchain field and was passed on March 14, 2023. This law has integrated the Luxembourg DLT framework in the following way:

- Update of the Act of 5 August 2005 on provisions relating to financial collateral to enable the use of electronic DLT as collateral on financial instruments registered in securities accounts,

- Implementation of EU Regulation 2022/858 on a pilot scheme for DLT-based market infrastructures (DLT Pilot Regulation),

- Redefining the notion of financial instruments in Law of 5 April 1993 on the financial sector and the Law of 30 May 2018 on financial instruments markets to align with the corresponding European regulations, including MiFID.

The Blockchain III Act strengthened the collateral rules for digital assets and aimed to increase legal certainty by allowing securities accounts on DLT to be pledged, while maintaining the efficient system of the 2005 Act on Financial Collateral Arrangements.

With the Blockchain IV bill, Luxembourg will build on the foundations laid by previous Blockchain laws and aims to consolidate Luxembourg’s position as a leading hub for financial innovation in Europe.

Blockchain Bill IV

The key provisions of the Blockchain IV bill include the following:

- Expanded scope: The bill expands the Luxembourg DLT legal framework to include equity securities in addition to debt securities. This expansion will allow the fund industry and transfer agents to use DLT to manage registers of shares and units, as well as to process fund shares.

- New role of the control agent: The bill introduces the role of a control agent as an alternative to the central account custodian for the issuance of dematerialised securities via DLT. This control agent can be an EU investment firm or a credit institution chosen by the issuer. This new role does not replace the current central account custodian, but, like all other roles, it must be notified to the Commission de Surveillance du Secteur Financier (CSSF), which is designated as the competent supervisory authority. The notification must be submitted two months after the control agent starts its activities.

- Responsibilities of the control agent: The control agent will manage the securities issuance account, verify the consistency between the securities issued and those registered on the DLT network, and supervise the chain of custody of the securities at the account holder and investor level.

- Simplified payment processesThe bill allows issuers to meet payment obligations under securities (such as interest, dividends or repayments) as soon as they have paid the relevant amounts to the paying agent, settlement agent or central account custodian.

- Simplified issuance and reconciliationThe bill simplifies the process of issuing, holding and reconciling dematerialized securities through DLT, eliminating the need for a central custodian to have a second level of custody and allowing securities to be credited directly to the accounts of investors or their delegates.

- Smart Contract Integration:The new processes can be executed using smart contracts with the assistance of the control agent, potentially increasing efficiency and reducing intermediation.

These changes are expected to bring several benefits to the Luxembourg financial sector, including:

- Fund Operations: Greater efficiency and reduced costs by leveraging DLT for the issuance and transfer of fund shares.

- Financial transactions: Greater transparency and security.

- Transparency of the regulatory environment: Increased attractiveness and competitiveness of the Luxembourg financial centre through greater legal clarity and flexibility for issuers and investors using DLT.

- Smart Contracts: Potential for automation of contractual terms, reduction of intermediaries and improvement of transaction traceability through smart contracts.

Blockchain Bill IV is part of Luxembourg’s ongoing strategy to develop a strong digital ecosystem as part of its economy and maintain its status as a leading hub for financial innovation. Luxembourg is positioning itself at the forefront of Europe’s growing digital financial landscape by constantly updating its regulatory framework.

Local regulations, such as Luxembourg law, complement European regulations by providing a more specific legal framework, adapted to local specificities. These local laws, together with European initiatives, aim to improve both the use and the security of projects involving new technologies. They help establish clear standards and promote consumer trust, while promoting innovation and ensuring better protection against potential risks associated with these emerging technologies. Check out our latest posts on these topics and, for more information on this law, blockchain technology and the tokenization mechanism, do not hesitate to contact us.

We are available to discuss any project related to digital finance, cryptocurrencies and disruptive technologies.

This informational piece, which may be considered advertising under the ethics rules of some jurisdictions, is provided with the understanding that it does not constitute the rendering of legal or other professional advice by Goodwin or its attorneys. Past results do not guarantee a similar outcome.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!

ASTRO Price

ASTRO Price