Bitcoin

Bitcoin Price Drops Either Side of $64K After US Inflation Data

Last updated: April 26, 2024 5:24 pm EDT | 3 minutes reading

Bitcoin Price Drops Either Side of $64,000 After Latest US Inflation Report – Here’s What You Need to Know / Source: Cryptonews

Bitcoin Price Drops Either Side of $64,000 After Latest US Inflation Report – Here’s What You Need to Know / Source: Cryptonews

Bitcoin (BTC) price fell on either side of the $64,000 level on Friday following the latest US inflation data report, which showed the Core PCE index rising 0.3% monthly in March. in line with market expectations.

A monthly inflation rate of 0.3% translates into an annualized inflation rate of around 3.6%. This is well above the Fed’s 2% inflation target, pointing to still uncomfortably high inflation in the US.

Economists highlighted that stubbornly high inflation in the real estate and utilities sector could keep monthly price pressures high for some time.

Here’s Powell’s favorite inflation gauge.

PCE Core Service Less Housing MoM rose almost 0.6%

TOO MUCH.. End of discussion pic.twitter.com/yEBlWeV1MA

-Andreas Steno Larsen (@AndreasSteno) February 24, 2023

This will likely encourage the Fed will keep interest rates higher for longer. Given the strong data reports over the past few weeks (manufacturing PMI, jobs, etc.), it is no surprise to see DXY and US bond yields near multi-month highs.

The unfavorable macro scenario where markets are pricing in tighter inflation and a Fed that is more reluctant to cut rates signals a near-term headwind for Bitcoin.

Bitcoin has historically performed better in an environment of falling US yields and a falling US dollar.

However, there is some evidence that the US economy is slowing. This week’s PMI flash report showed weakness in economic activity in April. And the latest GDP numbers for the first quarter were a disappointment.

Until this weakness translates into lower inflation, the Fed will likely remain cautious about rate cuts, which will continue to be a headwind for Bitcoin.

Bitcoin price analysis – What’s next for BTC?

Bitcoin price is currently locked near the lower limits of its multi-week range between $60,000 and $74,000.

BTC has maintained this range despite recent macro and slowing ETF flows which registered US$217 million on Thursday.

Tough day for the Cointucky derby and the #Bitcoin ETFs yesterday. 5 ETFs had outflows totaling -$217 million. Franklin was just an ETF with an inflow of $1.9 million. pic.twitter.com/9NF9iXi2GN

-James Seyffart (@JSeyff) April 26, 2024

Some cited strength in stablecoin growth as indicative of still strong flows in the crypto market.

According to Llama DeFiThe stablecoin market capitalization is at its highest level since June 2022 at $158 billion.

This represents an increase of $34 billion since the end of October, and continued growth could keep the price of Bitcoin elevated.

Any weakness in the stablecoin’s growth could be a harbinger of a lower Bitcoin price to come.

Currently, Bitcoin is at risk of falling below its low range around $60,000, which would open the door for a drop towards the $53,000 support.

Bitcoin (BTC) price remains at risk of a short-term drop south of $60,000. Source: TradingView

Bitcoin (BTC) price remains at risk of a short-term drop south of $60,000. Source: TradingView

Bitcoin’s long-term bullish thesis remains

In the long term, however, most people are confident that Bitcoin will enter a bull market.

Last week we saw the fourth Bitcoin quadrennial halving take place. The cut in the BTC issuance rate from previous halvings without fail helped drive the price to new all-time highs within a few quarters.

When you zoom out

You will have no doubt$BTC #BitcoinHalving #Bitcoin pic.twitter.com/GzTPReAlCH

-Rekt Capital (@rektcapital) April 24, 2024

Breaking from its previous historical pattern, Bitcoin reached all-time highs ahead of the halving this time thanks to ETF demand.

This undoubtedly increases the risk of a post-halving correction. But it should not harm long-term prospects.

The long-term trend remains towards greater TradFi adoption and investment in the asset, accelerated now by the availability of ETFs.

The macro will also be a big favorable factor in the long term. Unsustainable debt by major economies means that global currency devaluation is likely to continue.

Amidst the growing narrative that Bitcoin is “digital gold” As promoted by Wall Street giants like BlackRock’s Larry Fink, Bitcoin will be a big winner, along with other hard assets.

Larry Fink is the CEO of BlackRock.

BlackRock is the largest money manager in the world, with $9,000,000,000,000.

He says #bitcoin It’s “digital gold” pic.twitter.com/lz30q6x7r5

— Documenting ₿itcoin 📄 (@DocumentingBTC) September 29, 2023

At the same time, Bitcoin will continue to benefit from its technological adoption.

Globally, more and more people understand the usefulness of decentralized, censorship-resistant, borderless and permissionless payment technology.

Fiat Brains: “But Bitcoin has no real use.”

My: “#Bitcoin it is decentralized, secure, neutral, permissionless energy money.”

Fiat Brains: “Yes, but what does it DO?”

Me: “laughs”

– Dr. Jeff Ross (@VailshireCap) April 26, 2024

Meanwhile, crypto companies continue to build their centralized and decentralized platforms, improving Usefulness of Bitcoin and accessibility to the masses.

Bitcoin is likely to challenge $100,000 sometime in 2024 or 2025.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You can lose all your capital.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

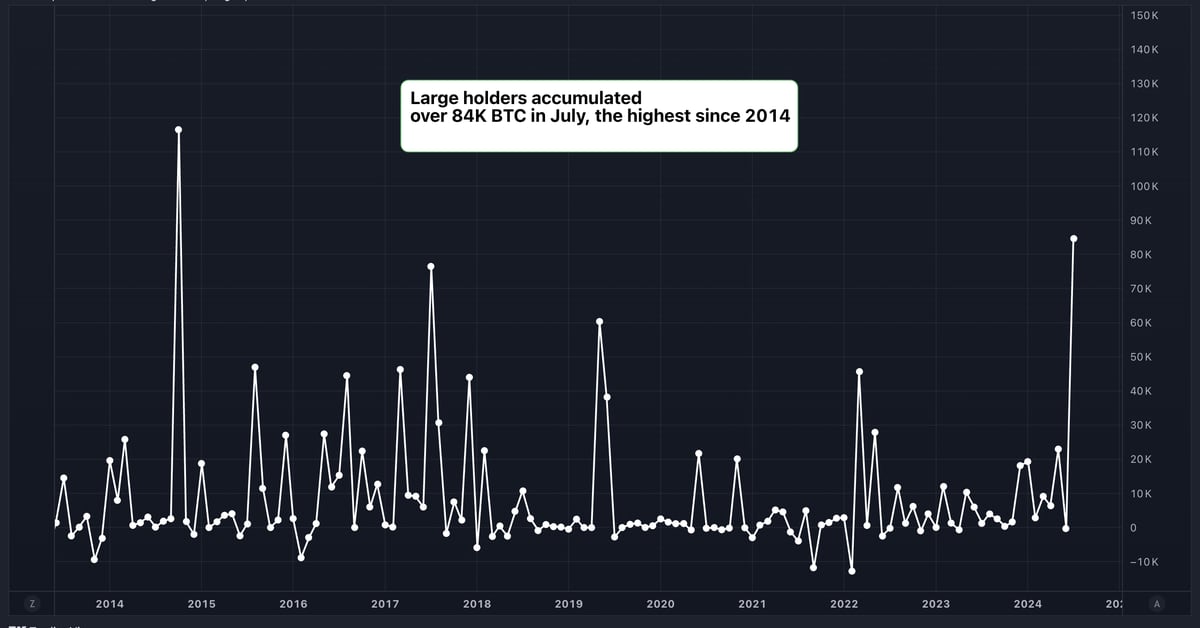

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!