News

DMG Blockchain Solutions annuncia la collaborazione con PayPal per decarbonizzare la blockchain di Bitcoin

DMG Blockchain Solutions Inc.

VANCOUVER, Columbia Britannica, 24 aprile 2024 (GLOBE NEWSWIRE) — DMG Blockchain Solutions Inc. (TSX-V: DMGI) (OTCQB US: DMGGF) (FRANCOFORTE: 6AX), una società di tecnologia blockchain e data center integrata verticalmente, ha ha annunciato una collaborazione strategica con PayPal (NASDAQ: PYPL) (www.paypal.com) e Energy Web (EWT) (www.energyweb.org) per esplorare modi per decarbonizzare la blockchain di Bitcoin. Le aziende stanno lavorando insieme allo sviluppo di metodi per effettuare transazioni sulla rete Bitcoin che ne amplierebbero l’uso come sistema di pagamento a zero emissioni di carbonio, facendo avanzare così la sua applicazione.

DMG, Energy Web e PayPal stanno lavorando insieme per pubblicare un documento di ricerca, che collettivamente riteniamo possa avvantaggiare gli utenti della rete Bitcoin che desiderano sfruttare le opzioni a zero emissioni di carbonio nelle loro transazioni. PayPal, concentrandosi sullo sviluppo della sua piattaforma di pagamento bitcoin, è stato leader nelle nuove tecnologie di pagamento con l’introduzione dei suoi servizi avanzati integrando la tecnologia blockchain, lanciando la stablecoin PayPal USD (PYUSD) con Paxos Trust Company nell’agosto 2023 per transazioni efficienti .

Energy Web, un’organizzazione no-profit indipendente che sviluppa software open source per soluzioni di energia pulita, ha lanciato il suo Prove verdi per Bitcoin (GP4BTC), un’iniziativa prima nel suo genere per stabilire un sistema di misurazione dell’energia indipendente e standardizzato per l’industria mineraria di Bitcoin, di cui DMG è stata una delle prime cinque società a ricevere un punteggio di energia pulita.

DMG, con la sua attenzione su un pool minerario di bitcoin a zero emissioni di carbonio e sulla tecnologia per spostare bitcoin tra utenti senza aggiungere carbonio alle loro transazioni, porta il suo stack tecnologico unico e la sua esperienza nell’ingegneria del software Bitcoin Core. PayPal, Energy Web e DMG, ciascuno con la propria competenza nel settore, sono orgogliosi del successo nei test ottenuto finora e sono desiderosi di consentire alla comunità più ampia di rivedere i progressi in questa “Green Mining Initiative”.

Il CEO di DMG, Sheldon Bennett, ha commentato: “Siamo lieti di dedicare risorse a questa collaborazione con PayPal e Energy Web, che integra i nostri continui sforzi per decarbonizzare la blockchain di Bitcoin. Poiché DMG è già leader del settore con Terra Pool, il primo pool minerario a zero emissioni di carbonio del settore con Petra, una tecnologia di transazione che sfrutta Terra Pool, siamo entusiasti di lavorare con un grande partner aziendale; Le ampie capacità di PayPal accelereranno senza dubbio i progressi che abbiamo avviato, facendo avanzare in modo significativo le nostre pratiche sostenibili”.

Edwin Aoki, Chief Technology Officer del gruppo Blockchain, Crypto e Valuta Digitale di PayPal, ha aggiunto: “Siamo entusiasti di lavorare con DMG per esplorare soluzioni per ridurre l’impronta di carbonio delle reti finanziarie decentralizzate a livello globale. La loro esperienza nello sviluppo di software di rete Bitcoin e l’accesso a un’infrastruttura mineraria a zero emissioni di carbonio sono elementi preziosi per un ecosistema crittografico più sostenibile”.

La storia continua

L’amministratore delegato di Energy Web, Jesse Morris, ha commentato: “Collaborare con l’approccio innovativo di DMG alla sostenibilità blockchain costituisce un valido esempio per il settore. Avere leader del settore come DMG impegnati attivamente nelle nostre iniziative migliora significativamente i nostri sforzi per integrare pratiche sostenibili in tutti gli aspetti della tecnologia blockchain”.

Collaborando con PayPal, DMG spera di stabilire un nuovo standard industriale per le applicazioni blockchain nei servizi finanziari, spingendo il settore verso l’adozione di tecnologie più sostenibili dal punto di vista ambientale. Rappresenta un approccio proattivo per affrontare le preoccupazioni ambientali associate alle operazioni di criptovaluta, contribuendo così alla decarbonizzazione dell’economia globale. Leggi la collaborazione tra DMG, Energy Web, PayPal: Innovazione Sostenibile.

Informazioni su Energy Web

Energy Web è un’organizzazione no-profit globale che accelera la transizione verso l’energia pulita sviluppando tecnologie open source per i sistemi energetici. Le soluzioni di livello aziendale di Energy Web migliorano il coordinamento tra mercati energetici complessi, liberando tutto il potenziale delle risorse energetiche pulite e distribuite per aziende, operatori di rete e clienti. L’ecosistema Energy Web comprende aziende leader, aziende energetiche, servizi di pubblica utilità, sviluppatori di energia rinnovabile, major del settore dei trasporti e leader delle telecomunicazioni. Maggiori informazioni su Energy Web sono disponibili all’indirizzo www.energyweb.org. Segui Energy Web su Twitter @EnergyWebX.

Informazioni su DMG Blockchain Solutions Inc.

DMG Blockchain Solutions Inc. è un’azienda leader e attenta all’ambiente, impegnata nello sviluppo e nella gestione di soluzioni basate su blockchain. Con una strategia incentrata sulla monetizzazione dell’ecosistema blockchain attraverso soluzioni digitali innovative end-to-end, DMG continua a promuovere i progressi tecnologici aderendo ai suoi principi di sostenibilità. Le operazioni dell’azienda sono razionalizzate attraverso le strategie Core e Core+, sottolineando l’impegno di DMG verso l’integrazione verticale e la sostenibilità ambientale.

Per ulteriori informazioni su DMG Blockchain Solutions e le sue iniziative, visitare www.dmgblockchain.com. Segui @dmgblockchain su Twitter e iscriviti al canale YouTube di DMG per rimanere aggiornato con gli ultimi sviluppi e approfondimenti.

Per ulteriori informazioni, contattare:

A nome del Consiglio di Amministrazione,

Sheldon Bennett, amministratore delegato e direttore

Tel: 516-222-2560

E-mail: [email protected]

Ragnatela: www.dmgblockchain.com

Contatto per le relazioni con gli investitori

NUCLEO IR 516-222-2560

Per richieste da parte dei media

Jules Abramo

NUCLEO IR

917-885-7378

[email protected]

Né il TSX Venture Exchange né il suo fornitore di servizi di regolamentazione (come tale termine è definito nelle politiche del TSX Venture Exchange) si assumono la responsabilità per l’adeguatezza o l’accuratezza del presente comunicato stampa.

Nota cautelativa riguardante le informazioni previsionali

Il presente comunicato stampa contiene informazioni o dichiarazioni previsionali basate sulle aspettative attuali. Le dichiarazioni previsionali contenute nel presente comunicato stampa includono dichiarazioni riguardanti la collaborazione con PayPal sulla rete bitcoin, le strategie e i piani di DMG, il potenziale e i vantaggi di Terra Pool, la fornitura di prodotti che consentono la monetizzazione delle transazioni bitcoin, lo sviluppo e l’esecuzione dei prodotti dell’azienda e servizi, l’aumento dell’autoestrazione, il lancio di prodotti e servizi, eventi, linee d’azione e il potenziale della tecnologia e delle operazioni della Società, tra gli altri, sono tutte informazioni lungimiranti.

I futuri cambiamenti nel tasso di difficoltà di mining a livello di rete Bitcoin o nell’hash rate di Bitcoin potrebbero influenzare materialmente le prestazioni future della produzione di bitcoin di DMG, e i futuri risultati operativi potrebbero anche essere materialmente influenzati dal prezzo di bitcoin e da un aumento della difficoltà di mining dell’hash rate.

Le dichiarazioni previsionali consistono in affermazioni che non sono puramente storiche, comprese eventuali dichiarazioni riguardanti convinzioni, piani, aspettative o intenzioni riguardanti il futuro. Tali informazioni possono generalmente essere identificate mediante l’uso di diciture lungimiranti come “può”, “aspettarsi”, “stimare”, “anticipare”, “intendere”, “credere” e “continuare” o il loro negativo o variazioni simili . Si avvisa il lettore che le ipotesi utilizzate nella preparazione di qualsiasi informazione previsionale potrebbero rivelarsi errate. Eventi o circostanze potrebbero far sì che i risultati effettivi differiscano sostanzialmente da quelli previsti, a causa di numerosi rischi noti e sconosciuti, incertezze e altri fattori, molti dei quali sono fuori dal controllo della Società, inclusi ma non limitati a, mercato e altri fattori condizioni, volatilità del prezzo di negoziazione delle azioni ordinarie della Società, condizioni commerciali, economiche e del mercato dei capitali; la capacità di gestire le spese operative, che potrebbero influire negativamente sulla situazione finanziaria della Società; la capacità di rimanere competitivi mentre altri concorrenti meglio finanziati sviluppano e rilasciano prodotti competitivi; incertezze normative; accesso alle attrezzature; condizioni di mercato, domanda e prezzi dei prodotti; la domanda e il prezzo dei bitcoin; minacce alla sicurezza, inclusa la perdita/furto dei bitcoin di DMG; I rapporti di DMG con i propri clienti, distributori e partner commerciali; l’incapacità di aggiungere più energia alle strutture di DMG; La capacità di DMG di definire, progettare e rilasciare con successo nuovi prodotti in modo tempestivo che soddisfino le esigenze dei clienti; la capacità di attrarre, trattenere e motivare personale qualificato; concorrenza nel settore; l’impatto dei cambiamenti tecnologici sui prodotti e sull’industria; mancato sviluppo di prodotti nuovi e innovativi; la capacità di mantenere e far valere con successo i nostri diritti di proprietà intellettuale e difendere le pretese di terzi di violazione dei loro diritti di proprietà intellettuale; l’impatto del contenzioso sulla proprietà intellettuale che potrebbe influenzare materialmente e negativamente l’attività; la capacità di gestire il capitale circolante; e la dipendenza dal personale chiave. DMG potrebbe non realizzare effettivamente i suoi piani, proiezioni o aspettative. Tali dichiarazioni e informazioni si basano su numerosi presupposti riguardanti le strategie aziendali presenti e future e l’ambiente in cui la Società opererà in futuro, inclusa la domanda per i suoi prodotti, la capacità di sviluppare con successo software, l’assenza di regolamenti o leggi che impediranno alla Società di gestire la propria attività, i costi previsti, la capacità di garantire capitale sufficiente per completare i propri piani aziendali, la capacità di raggiungere gli obiettivi e il prezzo del bitcoin. Considerati questi rischi, incertezze e ipotesi, non dovresti fare eccessivo affidamento su queste dichiarazioni previsionali. I titoli della DMG sono considerati altamente speculativi a causa della natura dell’attività della DMG. Per ulteriori informazioni riguardanti questi e altri rischi e incertezze, fare riferimento ai documenti depositati dalla Società su www.sedarplus.ca. Inoltre, la performance finanziaria passata di DMG potrebbe non costituire un indicatore affidabile della performance futura.

I fattori che potrebbero far sì che i risultati effettivi differiscano sostanzialmente da quelli contenuti nelle dichiarazioni previsionali includono il mancato ottenimento dell’approvazione normativa, la continua disponibilità di capitale e finanziamenti, guasti alle apparecchiature, mancanza di fornitura di apparecchiature, energia e infrastrutture, mancato ottenimento di eventuali permessi necessari per gestire l’attività, l’impatto dei cambiamenti tecnologici sul settore, l’impatto del Covid-19 o di altri virus e malattie sulla capacità della Società di operare, proteggere le attrezzature e assumere personale, concorrenza, minacce alla sicurezza inclusi bitcoin rubati da DMG o i suoi clienti, la fiducia dei consumatori nei confronti dei prodotti, dei servizi e della tecnologia blockchain di DMG in generale, il mancato sviluppo di prodotti nuovi e innovativi, contenziosi, eventi meteorologici o climatici avversi, aumento dei costi operativi, aumento dei costi di attrezzature e manodopera, guasti alle apparecchiature, diminuzione del prezzo di Bitcoin, mancato adempimento degli obblighi contrattuali da parte delle controparti, regolamenti governativi, perdita di dipendenti e consulenti chiave e condizioni economiche, di mercato o commerciali generali. Le dichiarazioni previsionali contenute nel presente comunicato stampa sono espressamente qualificate da questa dichiarazione cautelativa. Si avvisa il lettore di non fare eccessivo affidamento su qualsiasi informazione previsionale. Le dichiarazioni previsionali contenute nel presente comunicato stampa sono effettuate alla data del presente comunicato stampa. Fatto salvo quanto richiesto dalla legge, la Società declina qualsiasi intenzione e non si assume alcun obbligo di aggiornare o rivedere eventuali dichiarazioni previsionali, sia come risultato di nuove informazioni, eventi futuri o altro. Inoltre, la Società non si assume alcun obbligo di commentare le aspettative o le dichiarazioni fatte da terzi in merito alle questioni sopra discusse.

News

Terra Can’t Catch a Break as Blockchain Gets $6 Million Exploited

The attack, which exploited a vulnerability disclosed in April, drained around 60 million ASTRO tokens, sending the price plummeting.

The Terra blockchain has been exploited for over $6 million, forcing developers to take a momentary break the chain.

Beosin Cyber Security Company reported that the protocol lost 60 million ASTRO tokens, 3.5 million USDC, 500,000 USDT, and 2.7 BTC or $180,000.

Terra developers paused the chain on Wednesday morning to apply an emergency patch that would address the attack. Moments later, a 67% majority of validators upgraded their nodes and resumed block production.

The ASTRO token has plunged as much as 75%. It is now trading at $0.03, a 25% decline on the day. Traders who took advantage of the drop are now on 195%.

The vulnerability that took down the Cosmos-based blockchain was disclosed in April and involved the deployment of a malicious CosmWasm contract. It opened the door to attacks via what is called an “ibc-hooks callback timeout reentrancy vulnerability,” which is used to invoke contracts and enable cross-chain swaps.

Terra 2.0 also suffered a massive drop in total value locked (TVL) in April, shortly after the vulnerability was discovered. It plunged 80% to $6 million from $30 million in TVL and has since lost nearly half of that value, currently sitting at $3.9 million.

The current Earth chain emerged from the rubble as a hard fork after the original blockchain, now called Terra Classic, collapsed in 2022. Terra collapsed after its algorithmic stablecoin (UST) lost its peg, causing a run on deposits. More than $50 billion of UST’s market cap was wiped out in a matter of days.

Terraform Labs, the company behind the blockchain, has been slowly unravelling its legal woes since its mid-2022 crash. Founder Do Kwon awaits sentencing in Montenegro after he and his company were found liable for $40 billion in customer funds in early April.

On June 12, Terraform Labs settled with the SEC for $4.4 billion, for which the company will pay about $3.59 billion plus interest and a $420 million penalty. Meanwhile, Kwon will pay $204.3 million, including $110 million in restitution, interest and an $80 million penalty, a court filing showed.

News

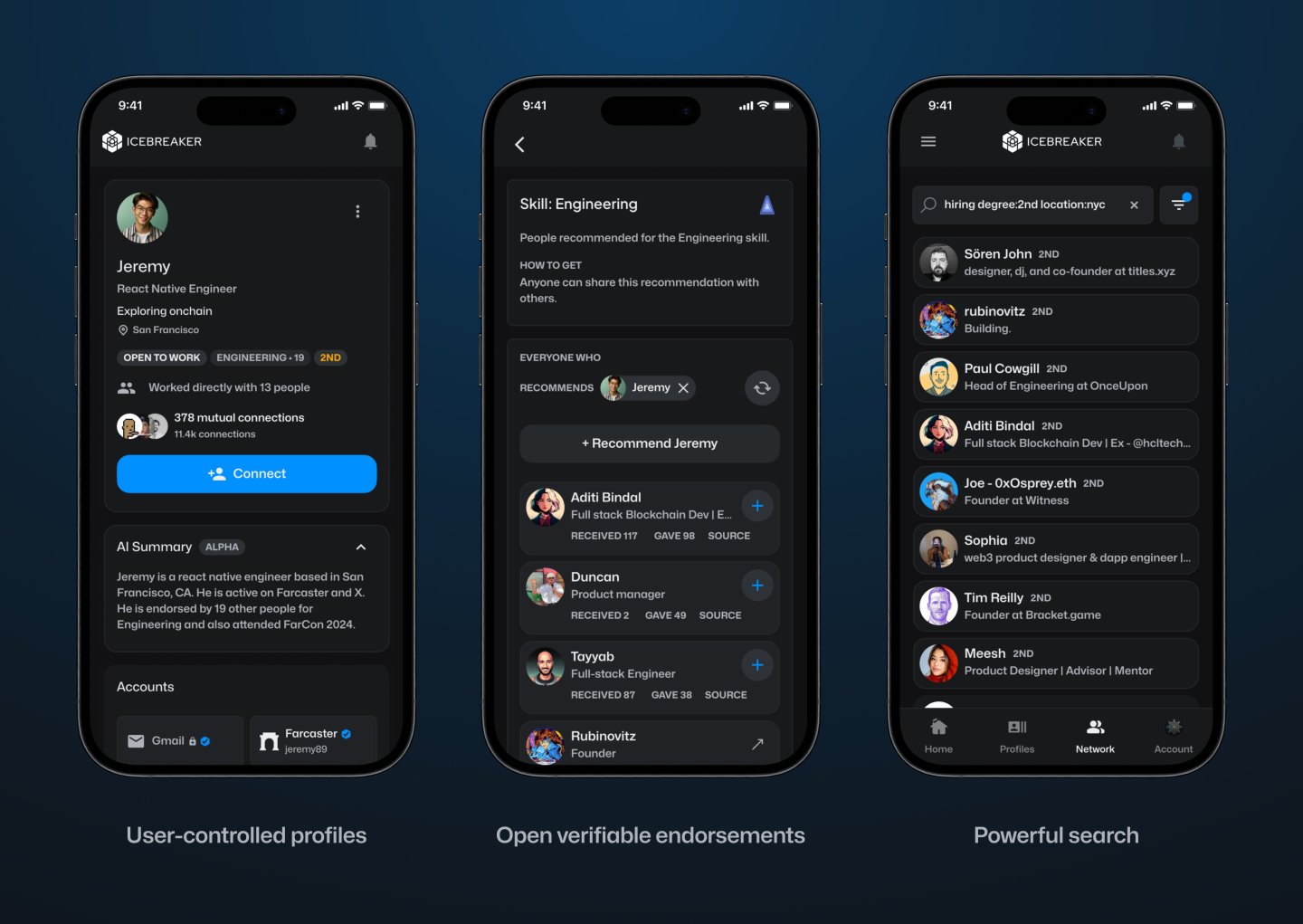

Google and Coinbase Veterans Raise $5M to Build Icebreaker, Blockchain’s Answer to LinkedIn

Icebreaker: Think LinkedIn but on a Blockchain—announced Wednesday that it has secured $5 million in seed funding. CoinFund led the round, with participation from Accomplice, Anagram, and Legion Capital, among others.

The company, which is valued at $21 million, aims to become the world’s first open-source network for professional connections. Its co-founders, Dan Stone and Jack Dillé, come from Google AND Monetary base; Stone was a product manager at the cryptocurrency giant and also the co-creator of Google’s largest multi-identity measurement and marketing platform, while Dillé was a design manager for Google Working area.

The pair founded Icebreaker on the shared belief that the imprint of one’s digital identity (and reputation) should not be owned by a single entity, but rather publicly owned and accessible to all. Frustrated that platforms like LinkedIn To limit how we leverage our connections, Dillé told Fortune he hopes to remove paywalls and credits, which “force us to pay just to browse our network.” Using blockchain technology, Icebreaker lets users transfer their existing professional profile and network into a single, verified channel.

“Imagine clicking the login button and then seeing your entire network on LinkedIn, ChirpingFarcaster and email? Imagine how many introductions could be routed more effectively if you could see the full picture of how you’re connected to someone,” Stone told Fortune.

Users can instantly prove their credentials and provide verifiable endorsements for people in their network. The idea is to create an “open graph of reputation and identity,” according to the founders. They hope to challenge LinkedIn’s closed network that “secures data,” freeing users to search for candidates and opportunities wherever they are online. By building on-chain, the founders note, they will create a public ledger of shared context and trust.

Verified channels are now launched for

Chirping

Online Guide

Wallet

Discord

Telephone

TeleporterYou can find them in Account -> Linked Accounts Italian: https://t.co/mRDyuWW8O2

— Icebreaker (@icebreaker_xyz) April 3, 2024

“Digital networking is increasingly saturated with noise and AI-driven fake personas,” the founders said in a statement. For example: Dillé’s LinkedIn headline reads “CEO of Google,” a small piece of digital performance art to draw attention to unverifiable information on Web2 social networks that can leave both candidates and recruiters vulnerable to false claims.

“Icebreaker was created to enable professionals to seamlessly tap into their existing profiles and networks to surface exceptional people and opportunities, using recent advances in cryptographically verifiable identity,” the company said, adding that the new funding will go towards expanding its team and developing products.

“One of the next significant use cases for cryptocurrency is the development of fundamental social graphs for applications to leverage… We are proud to support Dan, Jack and their team in their mission to bring true professional identity ownership to everyone online,” said CoinFund CIO Alex Felix in a statement.

Learn more about all things cryptocurrency with short, easy-to-read flashcards. Click here to Fortune’s Crash Course in Cryptocurrency.

Fuente

News

Luxembourg proposes updates to blockchain laws | Insights and resources

On July 24, 2024, the Ministry of Finance proposed Blockchain Bill IVwhich will provide greater flexibility and legal certainty for issuers using Distributed Ledger Technology (DLT). The bill will update three of Luxembourg’s financial laws, the Law of 6 April 2013 on dematerialised securitiesTHE Law of 5 April 1993 on the financial sector and the Law of 23 December 1998 establishing a financial sector supervisory commissionThis bill includes the additional option of a supervisory agent role and the inclusion of equity securities in dematerialized form.

DLT and Luxembourg

DLT is increasingly used in the financial and fund management sector in Luxembourg, offering numerous benefits and transforming various aspects of the industry.

Here are some examples:

- Digital Bonds: Luxembourg has seen multiple digital bond issuances via DLT. For example, the European Investment Bank has issued bonds that are registered, transferred and stored via DLT processes. These bonds are governed by Luxembourg law and registered on proprietary DLT platforms.

- Fund Administration: DLT can streamline fund administration processes, offering new opportunities and efficiencies for intermediaries, and can do the following:

- Automate capital calls and distributions using smart contracts,

- Simplify audits and ensure reporting accuracy through transparent and immutable transaction records.

- Warranty Management: Luxembourg-based DLT platforms allow clients to swap ownership of baskets of securities between different collateral pools at precise times.

- Tokenization: DLT is used to tokenize various assets, including real estate and luxury goods, by representing them in a tokenized and fractionalized format on the blockchain. This process can improve the liquidity and accessibility of traditionally illiquid assets.

- Tokenization of investment funds: DLT is being explored for the tokenization of investment funds, which can streamline the supply chain, reduce costs, and enable faster transactions. DLT can automate various elements of the supply chain, reducing the need for reconciliations between entities such as custodians, administrators, and investment managers.

- Issuance, settlement and payment platforms:Market participants are developing trusted networks using DLT technology to serve as a single source of shared truth among participants in financial instrument investment ecosystems.

- Legal framework: Luxembourg has adapted its legal framework to accommodate DLT, recognising the validity and enforceability of DLT-based financial instruments. This includes the following:

- Allow the use of DLT for the issuance of dematerialized securities,

- Recognize DLT for the circulation of securities,

- Enabling financial collateral arrangements on DLT financial instruments.

- Regulatory compliance: DLT can improve transparency in fund share ownership and regulatory compliance, providing fund managers with new opportunities for liquidity management and operational efficiency.

- Financial inclusion: By leveraging DLT, Luxembourg aims to promote greater financial inclusion and participation, potentially creating a more diverse and resilient financial system.

- Governance and ethics:The implementation of DLT can promote higher standards of governance and ethics, contributing to a more sustainable and responsible financial sector.

Luxembourg’s approach to DLT in finance and fund management is characterised by a principle of technology neutrality, recognising that innovative processes and technologies can contribute to improving financial services. This is exemplified by its commitment to creating a compatible legal and regulatory framework.

Short story

Luxembourg has already enacted three major blockchain-related laws, often referred to as Blockchain I, II and III.

Blockchain Law I (2019): This law, passed on March 1, 2019, was one of the first in the EU to recognize blockchain as equivalent to traditional transactions. It allowed the use of DLT for account registration, transfer, and materialization of securities.

Blockchain Law II (2021): Enacted on 22 January 2021, this law strengthened the Luxembourg legal framework on dematerialised securities. It recognised the possibility of using secure electronic registration mechanisms to issue such securities and expanded access for all credit institutions and investment firms.

Blockchain Act III (2023): Also known as Bill 8055, this is the most recent law in the blockchain field and was passed on March 14, 2023. This law has integrated the Luxembourg DLT framework in the following way:

- Update of the Act of 5 August 2005 on provisions relating to financial collateral to enable the use of electronic DLT as collateral on financial instruments registered in securities accounts,

- Implementation of EU Regulation 2022/858 on a pilot scheme for DLT-based market infrastructures (DLT Pilot Regulation),

- Redefining the notion of financial instruments in Law of 5 April 1993 on the financial sector and the Law of 30 May 2018 on financial instruments markets to align with the corresponding European regulations, including MiFID.

The Blockchain III Act strengthened the collateral rules for digital assets and aimed to increase legal certainty by allowing securities accounts on DLT to be pledged, while maintaining the efficient system of the 2005 Act on Financial Collateral Arrangements.

With the Blockchain IV bill, Luxembourg will build on the foundations laid by previous Blockchain laws and aims to consolidate Luxembourg’s position as a leading hub for financial innovation in Europe.

Blockchain Bill IV

The key provisions of the Blockchain IV bill include the following:

- Expanded scope: The bill expands the Luxembourg DLT legal framework to include equity securities in addition to debt securities. This expansion will allow the fund industry and transfer agents to use DLT to manage registers of shares and units, as well as to process fund shares.

- New role of the control agent: The bill introduces the role of a control agent as an alternative to the central account custodian for the issuance of dematerialised securities via DLT. This control agent can be an EU investment firm or a credit institution chosen by the issuer. This new role does not replace the current central account custodian, but, like all other roles, it must be notified to the Commission de Surveillance du Secteur Financier (CSSF), which is designated as the competent supervisory authority. The notification must be submitted two months after the control agent starts its activities.

- Responsibilities of the control agent: The control agent will manage the securities issuance account, verify the consistency between the securities issued and those registered on the DLT network, and supervise the chain of custody of the securities at the account holder and investor level.

- Simplified payment processesThe bill allows issuers to meet payment obligations under securities (such as interest, dividends or repayments) as soon as they have paid the relevant amounts to the paying agent, settlement agent or central account custodian.

- Simplified issuance and reconciliationThe bill simplifies the process of issuing, holding and reconciling dematerialized securities through DLT, eliminating the need for a central custodian to have a second level of custody and allowing securities to be credited directly to the accounts of investors or their delegates.

- Smart Contract Integration:The new processes can be executed using smart contracts with the assistance of the control agent, potentially increasing efficiency and reducing intermediation.

These changes are expected to bring several benefits to the Luxembourg financial sector, including:

- Fund Operations: Greater efficiency and reduced costs by leveraging DLT for the issuance and transfer of fund shares.

- Financial transactions: Greater transparency and security.

- Transparency of the regulatory environment: Increased attractiveness and competitiveness of the Luxembourg financial centre through greater legal clarity and flexibility for issuers and investors using DLT.

- Smart Contracts: Potential for automation of contractual terms, reduction of intermediaries and improvement of transaction traceability through smart contracts.

Blockchain Bill IV is part of Luxembourg’s ongoing strategy to develop a strong digital ecosystem as part of its economy and maintain its status as a leading hub for financial innovation. Luxembourg is positioning itself at the forefront of Europe’s growing digital financial landscape by constantly updating its regulatory framework.

Local regulations, such as Luxembourg law, complement European regulations by providing a more specific legal framework, adapted to local specificities. These local laws, together with European initiatives, aim to improve both the use and the security of projects involving new technologies. They help establish clear standards and promote consumer trust, while promoting innovation and ensuring better protection against potential risks associated with these emerging technologies. Check out our latest posts on these topics and, for more information on this law, blockchain technology and the tokenization mechanism, do not hesitate to contact us.

We are available to discuss any project related to digital finance, cryptocurrencies and disruptive technologies.

This informational piece, which may be considered advertising under the ethics rules of some jurisdictions, is provided with the understanding that it does not constitute the rendering of legal or other professional advice by Goodwin or its attorneys. Past results do not guarantee a similar outcome.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!

ASTRO Price

ASTRO Price