Bitcoin

Don’t expect quick gains just because of spot Bitcoin ETFs

Disclosure: The opinions and views expressed here belong solely to the author and do not represent the views and opinions of the crypto.news editorial.

If we were to judge the immediate effects of SEC approval 11 Bitcoin ETFs in Spot in January, as an indicator of its long-term price response, HODLers would likely have been disappointed with just a 6% price increase in just over a month. While the approvals brought a new wave of positive attention and robust institutional activity in the crypto market, the instant price jump everyone predicted failed to materialize.

Of course, now we are witnessing Bitcoin rises to record prices and the beginning of a full-scale bull market unfolding right before our eyes. With major asset managers like BlackRock and Fidelity bringing crypto to their clients, the attention was worth it, even if it stalled momentarily early on.

But are ETFs the only reason for BTC’s significant price jump? Yes, the convenience of ETFs has unlocked new demand, but it is delaying the real adoption of BTC as a sovereign store of value.

What the ETF approvals brought to the industry was a revitalized sense of confidence in the crypto market after a harrowing crypto winter. We can attribute this renewal to the safer membership of trusted financial institutions and them guiding the way to wider adoption.

The more professional image is truly welcome and lays out a clear roadmap for how large institutions and the general public can incorporate cryptography and other facets of blockchain technology without completely reorienting their financial reality.

While this risks creating a situation where the majority of BTC is held in spot ETFs, thus consolidating a decentralized financial instrument within the confines of traditional, centralized control – the odds of this happening are greatly reduced as of now. .

It is also inaccurate to say that ETFs are the only contributors to the bullish momentum the crypto market finds itself in today. Although they probably play an important role thanks to all their contributions, both monetary and in terms of image, it is reductive to say that other factors are not at play here.

Bitcoin ETFs play a dual role, bringing attention and funds to BTC itself and also sharing the spotlight with other industry sectors.

The bear market helped facilitate a critical push for crypto projects to step away from the spotlight and focus on rebuilding and developing products that could withstand any type of regulatory, technological, or institutional scrutiny. Ignoring the advances that creative projects have made in infrastructure and that are now contributing to this renaissance would be harmful.

In fact, many of these developments would not be possible if they were not explicitly due to the immense advances made in the blockchain ecosystem. While many blockchain builders were aware of the need to build a framework that would enable sustainable growth, it took a while to see this come to fruition.

Now, blockchain infrastructure is the cornerstone of the ecosystem’s growth. Only since the beginning of 2024, infrastructure projects created about $800 million in equity financing, and last year recorded more than $1.1 billion in the same quarter. While this year’s numbers represent a decline, they show how proactive financing in these infrastructure projects is now bearing fruit through institutional interest.

Likewise, the rapid development of layer 2 projects for Bitcoin has also planted the seeds of scalability. And that’s before even diving into the weight pulled by the Ethereum ecosystem and several other altcoins that are also witnessing a surge in activity and development. Think about where industry and development would be without something as instrumental as, say, zero-knowledge rollups (zk-rollups) or other scaling technologies.

In such a short period, it is difficult to say whether ETFs are responsible for the market turnaround we have witnessed. Did they draw attention to developments that would have happened regardless, even if the ETFs were rejected? Or did they trigger advancement beyond what the industry could have imagined of its own volition?

Bitcoin ETFs will add value to the broader crypto ecosystem and promote adoption by giving the industry a more professional image – which will compel retail investors to learn and understand the asset class over time. Even with the recent negative net inflows of BTC ETF activity, the outlook remains extremely positive on the effect these advancements and more will bring to the space.

Yes, we can probably expect more price swings, and it would be wrong for HODLers to assume they will make quick gains just because of ETFs. But what they achieve is creating a new foundational pillar for institutional attention and investment that will ultimately bolster Bitcoin and all cryptocurrencies in the long term.

James Wo

James Woan experienced entrepreneur and investor in the crypto space, established DFG in 2015. Currently manages a portfolio of over one billion dollars in assets. With a background as an early investor, James has backed companies such as LedgerX, Ledger, Coinlist, Circle, and ChainSafe. Additionally, he was an early investor and supporter of protocols such as Bitcoin, Ethereum, and Polkadot.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

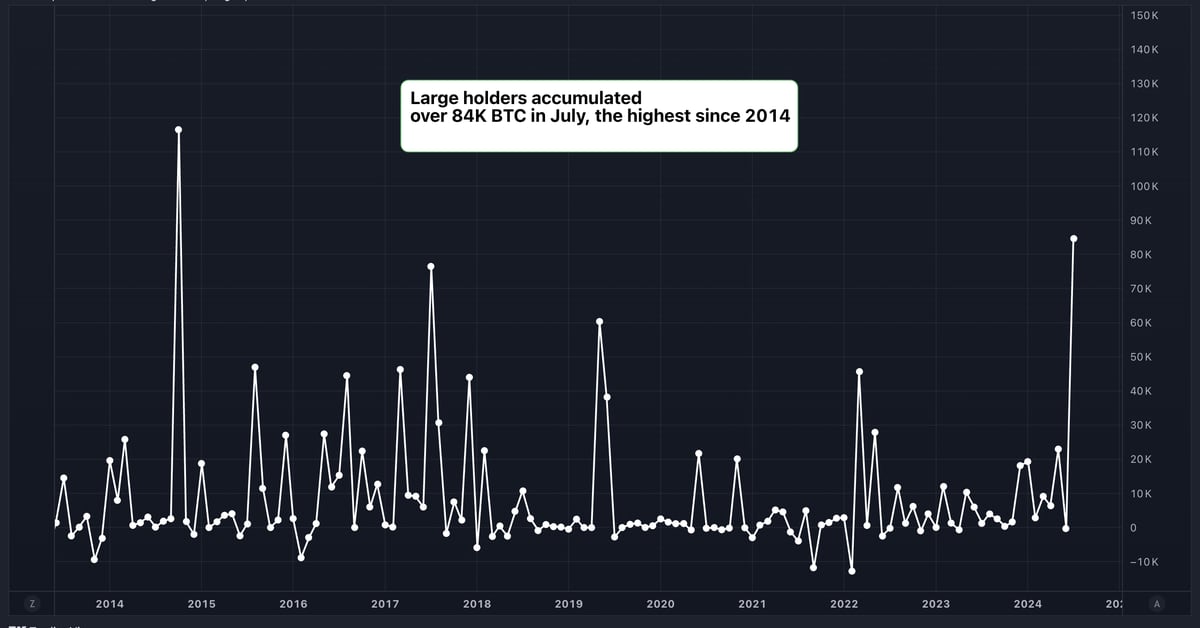

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!