Ethereum

ETHE) Begins Trading on NYSE Arca as a Spot Ethereum ETP

Grayscale Investments

Grayscale Investments®’s new ETPs have launched on NYSE Arca under the symbols “ETH” and “ETHE”

STAMFORD, Conn., July 23, 2024 (GLOBE NEWSWIRE) — Grayscale Investments®the world’s largest crypto asset manager*, offering over 20 crypto investment products, today announced that Grayscale Ethereum Trust (Ticker: ETHE) and Grayscale Ethereum Mini Trust (Ticker: ETH) have begun trading on NYSE Arca starting at 4:00 a.m. ET today as Ethereum spot ETPs following recent regulatory approval by the U.S. Securities and Exchange Commission (SEC). The launch and commencement of trading for ETH and ETHE represents a groundbreaking achievement for Grayscale’s clients and the broader Ethereum community.

Grayscale Ethereum Mini Trust (“ETH”) and Grayscale Ethereum Trust (“ETHE”) are not registered funds under the Investment Company Act of 1940 and are not subject to regulation under the Investment Company Act of 1940, unlike most mutual funds or ETFs. Investing involves substantial risks, including possible loss of principal. Trusts may not be suitable for all investors.

ETHE has become the largest spot Ethereum ETP with $9.19 billion in AUM as of July 23, 2024, and has come to market with an established and diversified investor base across retail and institutional investors.

ETH launched today as a low-fee spot Ethereum ETP** through the innovative seeding mechanics by distributing 10% of ETHE’s underlying Ethereum. As such, ETH began trading as the second-largest spot Ethereum ETP*, with a uniquely diversified investor base and $1.02 billion in assets under management as of July 22, 2024. The ETHE distribution event is colloquially known as a “spin-off” and is a corporate action that is not expected to be a taxable event for ETHE or any beneficial owner of ETHE shares as of the transaction date. previously announced Record date of July 18, 2024. Investors are encouraged to consult a tax advisor for related tax advice.

“The Grayscale team couldn’t be more excited that ETH and ETHE will begin trading today as Ethereum Spot ETPs on NYSE Arca,” said David LaValle, Senior Managing Director and Global Head of ETFs at Grayscale. “Ethereum Spot ETPs will provide U.S. investors, financial professionals, and asset allocators with reliable and convenient access to Ethereum for the first time in the familiar and proven ETP wrapper. This is a significant milestone for investors and the ETF market, and demonstrates Grayscale’s continued commitment to advancing digital asset investing in the U.S..”

Grayscale remains committed to meeting the growing investor and market demand for Ether by expanding its suite of Ethereum-focused investment products – aiming to create a suite of products that can meet the unique needs of investors at every stage of their Ether investment journey. Grayscale has been and remains resolutely focused on working constructively with its investors, partners, regulators and policymakers to help deepen the understanding of Ethereum and the Ethereum Fee Protocol to broaden familiar access to the second-largest crypto asset by market cap***.

The story continues

“ETH and ETHE will enable investors to invest in Ethereum’s potential to create markets, transform financial systems, leverage decentralized finance (DeFi), and drive innovation through the trusted ETP wrapper – without the need to purchase, store, or manage Ethereum directly,” said John Hoffman, Grayscale’s Managing Director and Head of Distribution and Strategic Partnerships. “Client demand is growing as the crypto asset class matures, and Grayscale is proud to deliver pioneering financial products that provide our clients with choice when considering convenient, registered exposure to crypto assets, like Ethereum.”

For more information about ETH, please visit: https://etfs.grayscale.com/eth For more information about ETHE, please visit: https://etfs.grayscale.com/ethe.

*By AUM as of July 22, 2024

**Low cost based on a 0% gross expense ratio for the first six months of trading on the first $2.0 billion. Once the fund reaches $2.0 billion in assets or after a 6-month waiver period, the fee will be 0.15%. Brokerage and other charges may still apply. See the prospectus for additional information on fee waiver.

*** By market capitalization as of July 22, 2024

NO OFFER OR SOLICITATION

This communication is for informational purposes only, in your capacity as an ETHE shareholder, and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No shareholder approval of the distribution is required by applicable law, and we are not seeking approval of ETHE shareholders.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

A definitive information statement on Schedule 14C will be provided to ETHE shareholders for the purpose of informing ETHE shareholders of the distribution, in substantial compliance with Regulation 14C under the Exchange Act. The information statement will describe the Grayscale Ethereum Mini Trust, the risks associated with holding shares of the Grayscale Ethereum Mini Trust and other details regarding the distribution, and will be made available on our website at www.grayscale.com/documents#regulatoryfilings. ETHE shareholders will not need to pay any consideration, exchange or dispose of existing ETHE shares, or take any other action to receive shares of the Grayscale Ethereum Mini Trust in connection with the distribution.

Grayscale Ethereum Trust (ETHE) and Grayscale Ethereum Mini Trust (ETH) (collectively, the “Trusts”) have filed registration statements (including a prospectus) with the SEC for the offering to which this communication relates. Before investing, you should read the prospectuses in the registration statements and other documents the Trusts have filed with the SEC for more complete information about the Trusts and this offering. You may obtain these documents free of charge by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the Trusts or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903-2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101. Foreside Fund Services, LLC is the marketing agent for the Trusts.

Investing involves significant risks, including possible loss of principal. The Trust holds Ethereum; however, an investment in the Trust does not constitute a direct investment in Ethereum. There is no certainty that an active trading market for the shares will develop or be sustained, which would adversely affect the liquidity of the Trust’s shares.

Grayscale Ethereum Trust and Grayscale Ethereum Mini Trust Risk Disclosure:

An investment in the Grayscale Ethereum Trust or the Grayscale Ethereum Mini Trust may be considered speculative and is not intended to be a complete investment program. An investment in ETHE or the Grayscale Ethereum Mini Trust should be considered by individuals who are financially capable of maintaining their investment and who can bear the risk of total loss associated with an investment in ETHE or the Grayscale Ethereum Mini Trust. The extreme volatility in trading prices that many digital assets, including Ethereum, have experienced in recent periods and may continue to experience could have a material adverse effect on the value of ETHE and the Grayscale Ethereum Mini Trust and the shares could lose all or substantially all of their value. Digital assets represent a new and rapidly evolving industry. The value of ETHE and the Grayscale Ethereum Mini Trust depends on the acceptance of digital assets, the capabilities and development of blockchain technologies, and the fundamental investment characteristics of the digital asset. Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have a negative effect on the market price of the relevant digital asset. Digital assets may be held by concentrated owners and significant sales or distributions by holders of such digital assets could have a negative effect on the market price of such digital assets. The value of ETHE and ETH is directly linked to the value of the underlying digital asset, the value of which can be highly volatile and subject to fluctuations due to a number of factors.

A registration statement relating to Grayscale Ethereum Mini Trust has been filed with the SEC but has not yet become effective. No investment in the Grayscale Ethereum Mini Trust may be made, nor money accepted, until the registration statement becomes effective. An investor should carefully consider the investment objectives, risks, and charges and expenses of the Grayscale Ethereum Mini Trust before investing. A preliminary prospectus containing this and other information about Grayscale Ethereum Mini Trust may be obtained by sending an email to [email protected]The information contained in the preliminary prospectus is not complete and is subject to change. The final prospectus should be read carefully before investing and, when available, may be obtained from the same source. This communication does not constitute an offer to sell shares or a solicitation of an offer to buy shares in any state in which the offer or sale is not authorized.

Grayscale Investments, LLC is the sponsor of the Grayscale Ethereum Trust and the Grayscale Ethereum Mini Trust.

About Grayscale Investments®

Grayscale empowers investors to access the digital economy through a suite of forward-thinking investment products. Founded in 2013, Grayscale has a proven track record and deep expertise as the world’s largest crypto asset manager. Investors, advisors and allocators turn to Grayscale’s private placements, public offerings and ETPs for single-asset, diversified and thematic exposure. Grayscale products are distributed by Grayscale Securities, LLC (member FINRA/SIPC).

Media Contact

Jennifer Rosenthal

[email protected]

Ethereum

Ethereum (ETH) Whales Are Getting Incredibly Bullish: Details

Cover image via www.freepik.com

Disclaimer: The opinions expressed by our editors are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial loss incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

Ethereum (ETH) Whales are making major moves in the cryptocurrency market, suggesting strong bullish sentiment despite short-term price volatility. According to crypto analyst Ali Martinez, these big investors have accumulated over 126,000 ETH in the last 48 hours, or about $440 million.

In a tweet, Ali wrote: “Ethereum whales have accumulated over 126,000 ETH in the last 48 hours, worth around $440 million.”

According to CryptoQuant CEO Ki-Young-JuWhales may be preparing for the next move in the market. Ju wrote in a tweet that “whales may be preparing for the next rally in altcoins.” He noted that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place.

Ethereum’s recent developments, including the recent launch of Ethereum spot ETFs in the US, appear to have increased its appeal among large holders, known as crypto whales. Ethereum recently celebrated nine years since its inception, and as the ETH network continues to evolve, it is likely to attract more institutional interest.

Related

According to data from Farside Investors, fund flows into U.S.-listed Ethereum spot exchange-traded funds turned net positive daily for the first time since their inception on July 31, primarily due to a decrease in outflows from the Grayscale Ethereum Trust.

Ethereum Price Drops Due to Market Crash

Bitcoin and Ethereum, along with the majority of other crypto assets, appear to be underperforming during Thursday’s trading session.

According to CoinMarketCap dataAt the time of writing, Bitcoin’s price was $64,034, down 2.77% from the previous day. Ethereum’s price is down 4.21% from $3,175, where it was 24 hours ago. Several cryptocurrencies were posting larger losses; Solana’s Dogwifhat was down 12% in the past 24 hours, and PEPE was down 7% in the same period.

According to CoinGlass, price followers have led to the liquidation of $225 million worth of derivatives contracts over the past day.

Ethereum

Ethereum (ETH) Price Hits $50,000? Target Updated by Analyst

Vladislav Sopov

Extreme skepticism from Ethereum (ETH) detractors has prompted a veteran researcher to double down on Ether

Read U.TODAY on

Google News

Ethereum (ETH) proponent and AI enthusiast Adriano Feria has presented an extremely optimistic Ether price prediction. After the reaction of skeptics, he reconsidered the target, increasing it by 100%. His views are aligned with those of major institutional players, according to recent data.

Ethereum (ETH) bullish hypothesis should get us there: researcher

Ethereum (ETH) could hit $50,000 early in the current cryptocurrency market cycle. At the same time, a “bullish scenario” could push the price of the second-largest cryptocurrency to six-digit values, Web3 and AI educator Adriano Feria told X.

In a tweet shared with his 14,000 followers, Feria stressed that he is confident in the promising prospects of Ethereum (ETH) despite the massive wave of hatred against Crypto X. The doubters will regret their skepticism, the researcher admits:

If you hold ETH today, you are truly part of the global elite, because the bullish scenario for ETH should take us to $100,000. You think this is a joke, but there are real financial institutions around the world that have set bullish targets that are close to this. And no, this is not a joke.

Three days ago, he “increased” the $28,000 per ETH prediction published by Eric Conner, a veteran of the Ethereum (ETH) ecosystem and co-author of EIP 1559.

These ultra-bullish statements come amid growing disbelief triggered by ETH’s weak short-term performance.

The second-largest cryptocurrency failed to take off following the launch of the Ether ETF in the United States. At press time, Ethereum (ETH) was trading at $3,311, down nearly 6% from the local peak set after the ETF launched on July 23.

Insane BTC and ETH Price Predictions Released Every Day

As previously reported by U.Today, in February, Feria noted the rapid increase in popularity of ETH staking based on on-chain data.

In recent days, more and more analysts are sharing incredibly high predictions for Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies.

For example, US asset management heavyweight VanEck has suggested two scenarios for the price of BTC in 2050.

The most optimistic scenario sees BTC surpassing $52 million per coin, while the $2.9 million mark is considered a “baseline” scenario by VanEck.

About the Author

Vladislav Sopov

Blockchain analyst and writer with a scientific background. 6+ years in computer analysis, 3+ years in blockchain.

I have worked in independent analysis as well as in start-ups (Swap.online, Monoreto, Attic Lab etc.)

Ethereum

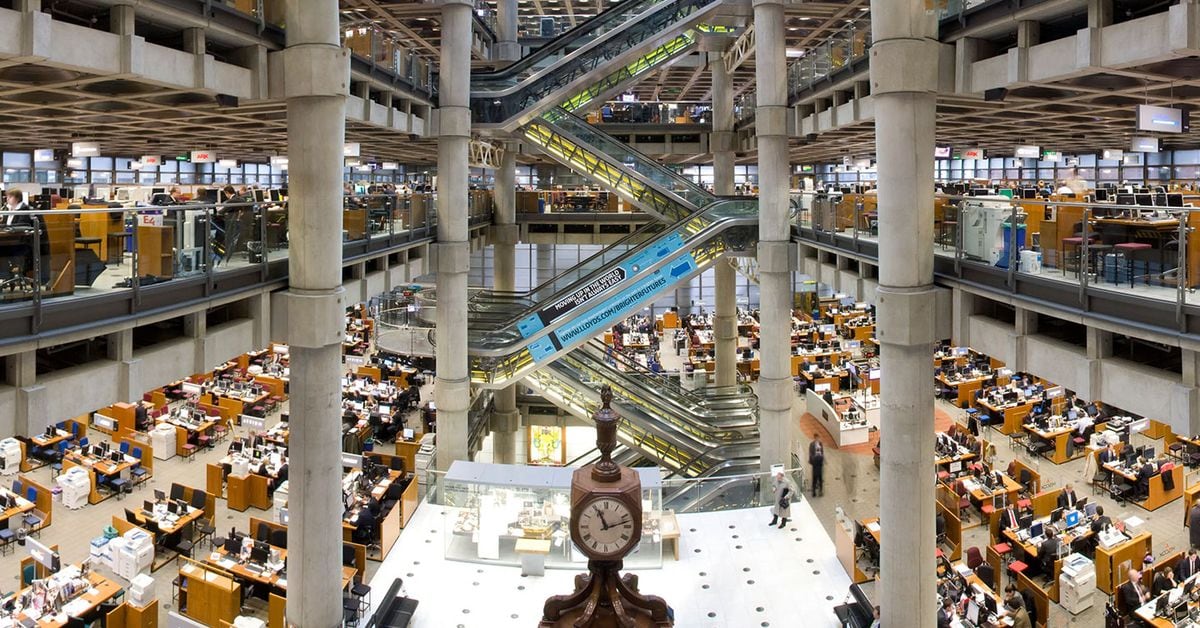

Lloyd’s of London-backed insurance policies can now be paid in crypto on Ethereum

Lloyd’s of London, the three-century-old insurance marketplace, is supporting digital asset protection policies curated on the Ethereum public blockchain that can be paid for natively, on-chain, using cryptocurrency, through Lloyd’s Coverholder Evertas and smart contract insurance provider Nayms.

Not so long ago, any kind of cryptocurrency insurance coverage Finding solutions was difficult. Aside from the efficiency benefits of paying for insurance policies in cryptocurrency and using blockchain to streamline the burdensome paperwork of intermediaries, a consortium of Lloyd’s of London syndicates backing cryptocurrency-native, on-chain insurance shows how far the industry has come in the last two years.

“We’re enabling people using public blockchain infrastructure to interact with traditional, highly regulated, fiat-backed institutions in a transparent way,” Evertas CEO J. Gdanski said in an interview. “Whether it’s paying in USDC or native cryptocurrency, or placing policies entirely on-chain with blockchain helping coordinate between a broker, the policyholder, and insurers, we believe this is a foundational infrastructure.”

Nayms, a digital marketplace where brokers and underwriters connect with crypto capital investment, is a play on Lloyd’s “names,” the collection of individuals and companies that underwrite risks in the historic insurance market.

“The native cryptocurrency expertise we bring to the underwriting process gives us a deep understanding of the risks we insure,” Nick Selby, the company’s head of European underwriting, said in an interview. “It means we’re very explicit about what we do and don’t cover, and we can pay insured claims faster than anyone else.”

Ethereum

10 Years of Crypto Innovations! Here’s How Buterin Sees the Future of Ethereum!

2h45 ▪ 3 min read ▪ by Eddy S.

At the EDCON2024 conference, Vitalik Buterin unveiled the future directions of Ethereum, with a focus on innovative application development and wallet security. He presented promising projects and innovative ideas to improve privacy and accessibility for cryptocurrency users.

Ethereum’s new innovations by Vitalik Buterin!

Vitalik Buterin delivered a key speech on the future of Ethereum in the next ten years. He stressed that the priority of the crypto blockchain will now be to develop applications. Some of the already successful applications include decentralized finance (DeFi), decentralized identities (DID) with the Ethereum Name Service (ENS), DAOs and NFTs.

Vitalik also highlighted several promising projects. These include the prediction market Polymarket, the social media aggregator Firefly, the wallet Daimo, and the voting tool Rarimo. These applications illustrate the diversity and potential of Ethereum-based technologies to transform various sectors of crypto.

Vitalik also proposed several innovative ideas to improve the security and accessibility of Ethereum wallets. One of his proposals is to encrypt the private key directly into the cell phone’s chip! Thus turning the phone into a secure crypto wallet. Another idea is to place part of the private key in a regulatory-compliant custodial institution, thus providing an additional layer of security.

Vitalik also mentioned the use of zero-knowledge (ZK) proof technology to link KYC information to the wallet. This approach would ensure the privacy of cryptocurrency users while meeting regulatory requirements.

Security and Privacy: Two Requirements for Cryptocurrency Users

These proposals aim to improve the security and privacy of cryptocurrency users while facilitating the adoption of the technology by a wider audience. By combining technological innovations with practical applications, Ethereum continues to position itself as a leader in the cryptocurrency and blockchain ecosystem.

Vitalik Buterin’s speech highlighted Ethereum’s many advancements and future prospects. With a focus on application development and innovative proposals for crypto wallet security, Ethereum is well-positioned to continue to grow and innovate in the years to come.

Optimize your Cointribune experience with our “Read to Earn” program! Earn points for each article read and access exclusive rewards. Sign up now and start earning benefits.

Click here to join “Read to Earn” and turn your passion for crypto into rewards!

Eddy S.

The world is changing and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in everything that is closely or remotely related to blockchain and its derivatives. To share my experience and promote a field that fascinates me, there is nothing better than writing informative and relaxed articles.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be considered investment advice. Do your own research before making any investment decision.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!