Ethereum

MIT brothers accused of mining Ethereum to steal $25 million

Many cryptocurrency traders are playing fast and loose with the systems in place to bolster decentralized finance (DeFi), using a variety of hacks to gain an advantage in their trades – from sandwich attacks to sweepstakes scams – and losses typically amount to tens of millions. dollars per month.

Yet two traders – brothers who both graduated from the Massachusetts Institute of Technology – took their plan too far, exploiting a vulnerability in a common component used by traders on the Etherium blockchain to make nearly $25 million in a attack that lasted 12 seconds, the U.S. Department of Justice charged on May 16. The two brothers — Anton Peraire-Bueno of Boston and James Peraire-Bueno of New York — discovered the software flaw in 2022, prepared and planned the attacks for months, then executed the theft in April. 2023, say law enforcement.

The attack worried traders and technologists, calling into question “the very integrity of blockchain,” Damian Williams, U.S. Attorney for the Southern District of New York, said in a statement. a statement from the Department of Justice announcing the indictment.

“The brothers, who studied computer science and mathematics at one of the most prestigious universities in the world, allegedly used their specialized skills and education to alter and manipulate the protocols that millions of data users rely on. “Ethereum across the world,” he said. “And once they put their plan into action, their heist lasted only 12 seconds. This alleged scheme was new and has never been charged before.”

Cryptocurrency has gained legitimacy over the past fifteen years, but continues – in many ways – to be a Wild West. In 2023, over $24 billion in transactions ended up in illicit cryptocurrency wallets or addresses – although more than half of the total belonged to sanctioned organizations and countries, and the total fraud rate is only 0.34%, according to Chainalysis, a blockchain intelligence firm.

While ransomware gangs prefer Bitcoin, Ethereum has seen its share of attacks, since the $60 million DAO hack in 2016 this led to a hard fork – a rewrite of the Ethereum ledger – towards the over $600 million in Ethereum stolen from Ronin network players.

In many ways, the ecosystem behind cryptocurrencies is suffering from the growing challenges that the Internet has faced over the past three decades, says Oded Vanunu, chief Web 3.0 technologist and head of product vulnerability research at within the cybersecurity company Check Point Software Technologies.

“It’s crazy, because we’re seeing tactics already implemented on Web 2 platforms that take a different form in Web 3 protocols,” he says.

Memory pools and maximum extractable value

Cryptocurrency transfers, the proposal of a smart contract, and the execution of smart contracts are all transactions recorded on the blockchain — in the case of Ethereum, a public distributed state machine. However, before being recorded, each transaction is placed in a memory pool, or memory poolwhile waiting for validation and execution, which usually takes a few steps.

A participant in the ecosystem known as a “block builder” will create a set – or block – of transactions and be paid by the initiator of each transaction for its completion, while a “block proposer” will choose blocks according to the costs announced by the manufacturer. , validates them and sends these transactions to its peers on the blockchain network. Typically, a builder attempts to structure blocks based on a maximum extractable value (MEV) strategy, seeking to maximize profits.

Dividing participants into proposers and builders – what is called a proposer-builder split (PBS) – divides the responsibility for validating transactions to limit monopolization of the process by large traders who might order transactions in specific ways for generate profits. MEV bots help traders identify and create trade sets that maximize their profits on a trade.

Yet there is still much traders can do to tip the scales. In a sandwich attack, for example, the trader benefits from natural price increases or decreases caused by large cryptocurrency transactions. When a large buy order appears, a manufacturer can place a buy order for the cryptocurrency before the order, and a corresponding sell order afterward, thereby taking advantage of the price change caused by the initial buy order. .

For many DeFi participants, MEV traders are little better than the equivalent of modern-day ticket scalpers, but they play a vital role, says Adam Hart, product manager at Chainalysis.

“To many, MEV strategies look like hyper-sophisticated, deep-pocketed traders using their resources to profit by forcing less sophisticated traders to accept worse prices,” he says. “However, others argue that MEV is inevitable in an open and transparent blockchain network, and that MEV traders play a positive role in ensuring that arbitrage opportunities are exploited quickly so that asset prices remain aligned between protocols.”

An attack on MEV traders

The Peraire-Bueno brothers discovered a vulnerability in an open source component of a common tool, known as MEV-Boost Relay, according to a post-mortem analysis of the incident. MEV-Boost is a protocol aimed at limiting the centralization of the two components of the Ethereum blockchain – the proposers and the builders – and the monopolization of profits, which could have historically led to a few players dominating the blockchain process.

A key criterion of the MEV-Boost protocol is that the proposer undertakes to validate a block according to the price, before knowing its content. The brothers reportedly discovered that signing the header gave them the information contained in the block, even if the signature was not valid, the autopsy stated.

“The attack…was possible because the exploited relay revealed block bodies to the submitter, provided the submitter correctly signed a block header,” the analysis states. “However, the relay did not check whether the signed block header was valid.”

Although the vulnerability could have continued to cause problems for traders, it was not an attack directly against the Ethereum network or its validators, but rather against a specific – albeit common – third-party component, explains Mario Rivas, manager global blockchain security practices. at NCC Group.

“The attack exploited a vulnerability in the relay code, which caused the relay to send private transactions to the block builder when it signed a block with invalid headers,” he explains. “This vulnerability was quickly fixed, mitigating the risk of similar attacks unless additional vulnerabilities are identified.”

Law enforcement achieves victory

The investigation and indictment, however, constitute a victory for the DOJ. American law enforcement is increasingly cracking down on scams, hacking and other questionable practices linked to cryptocurrencies. In August, for example, the U.S. Securities and Exchange Commission accused correctional officer of creating worthless cryptocurrency and sell it to other members of law enforcement.

Yet other attacks have fallen short of the threshold for prosecution. In one 2021 attack, for example, a trader admitted to selling an illiquid token to a rival – in what is known as a salmonella attack – and making money through the automated system of his rival by buying the worthless coin, according to a Forbes report.

The brothers’ alleged attack stands out from these controversial tactics, says Check Point’s Vanunu.

“In essence, while both types of attacks are harmful, the MIT brothers’ actions were explicitly illegal due to their direct and unauthorized exploitation of the vulnerabilities to steal funds, whereas [a] Salmonella attack lever[s] market manipulation and deception, staying within the darkest confines of legality in the crypto world,” he says.

The investigation into this scheme and subsequent indictment underscore that government officials and their private partners are keeping pace with the latest innovative attacks. Despite the sophistication of the exploit and the laundering of the proceeds, investigators traced the funds, identified two suspects and made their arrests, Chainalysis’ Hart said.

“The exploit by the Peraire-Bueno brothers is an incredibly innovative and technically sophisticated attack, and is the first time a bad actor has managed to abuse the MEV system widely used by Ethereum block builders in this way and at this degree,” he said. . “This is what makes this indictment so impressive and a promising sign for the future in the fight against cryptocurrency-based crime.”

Ethereum

Ethereum (ETH) Whales Are Getting Incredibly Bullish: Details

Cover image via www.freepik.com

Disclaimer: The opinions expressed by our editors are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial loss incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

Ethereum (ETH) Whales are making major moves in the cryptocurrency market, suggesting strong bullish sentiment despite short-term price volatility. According to crypto analyst Ali Martinez, these big investors have accumulated over 126,000 ETH in the last 48 hours, or about $440 million.

In a tweet, Ali wrote: “Ethereum whales have accumulated over 126,000 ETH in the last 48 hours, worth around $440 million.”

According to CryptoQuant CEO Ki-Young-JuWhales may be preparing for the next move in the market. Ju wrote in a tweet that “whales may be preparing for the next rally in altcoins.” He noted that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place.

Ethereum’s recent developments, including the recent launch of Ethereum spot ETFs in the US, appear to have increased its appeal among large holders, known as crypto whales. Ethereum recently celebrated nine years since its inception, and as the ETH network continues to evolve, it is likely to attract more institutional interest.

Related

According to data from Farside Investors, fund flows into U.S.-listed Ethereum spot exchange-traded funds turned net positive daily for the first time since their inception on July 31, primarily due to a decrease in outflows from the Grayscale Ethereum Trust.

Ethereum Price Drops Due to Market Crash

Bitcoin and Ethereum, along with the majority of other crypto assets, appear to be underperforming during Thursday’s trading session.

According to CoinMarketCap dataAt the time of writing, Bitcoin’s price was $64,034, down 2.77% from the previous day. Ethereum’s price is down 4.21% from $3,175, where it was 24 hours ago. Several cryptocurrencies were posting larger losses; Solana’s Dogwifhat was down 12% in the past 24 hours, and PEPE was down 7% in the same period.

According to CoinGlass, price followers have led to the liquidation of $225 million worth of derivatives contracts over the past day.

Ethereum

Ethereum (ETH) Price Hits $50,000? Target Updated by Analyst

Vladislav Sopov

Extreme skepticism from Ethereum (ETH) detractors has prompted a veteran researcher to double down on Ether

Read U.TODAY on

Google News

Ethereum (ETH) proponent and AI enthusiast Adriano Feria has presented an extremely optimistic Ether price prediction. After the reaction of skeptics, he reconsidered the target, increasing it by 100%. His views are aligned with those of major institutional players, according to recent data.

Ethereum (ETH) bullish hypothesis should get us there: researcher

Ethereum (ETH) could hit $50,000 early in the current cryptocurrency market cycle. At the same time, a “bullish scenario” could push the price of the second-largest cryptocurrency to six-digit values, Web3 and AI educator Adriano Feria told X.

In a tweet shared with his 14,000 followers, Feria stressed that he is confident in the promising prospects of Ethereum (ETH) despite the massive wave of hatred against Crypto X. The doubters will regret their skepticism, the researcher admits:

If you hold ETH today, you are truly part of the global elite, because the bullish scenario for ETH should take us to $100,000. You think this is a joke, but there are real financial institutions around the world that have set bullish targets that are close to this. And no, this is not a joke.

Three days ago, he “increased” the $28,000 per ETH prediction published by Eric Conner, a veteran of the Ethereum (ETH) ecosystem and co-author of EIP 1559.

These ultra-bullish statements come amid growing disbelief triggered by ETH’s weak short-term performance.

The second-largest cryptocurrency failed to take off following the launch of the Ether ETF in the United States. At press time, Ethereum (ETH) was trading at $3,311, down nearly 6% from the local peak set after the ETF launched on July 23.

Insane BTC and ETH Price Predictions Released Every Day

As previously reported by U.Today, in February, Feria noted the rapid increase in popularity of ETH staking based on on-chain data.

In recent days, more and more analysts are sharing incredibly high predictions for Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies.

For example, US asset management heavyweight VanEck has suggested two scenarios for the price of BTC in 2050.

The most optimistic scenario sees BTC surpassing $52 million per coin, while the $2.9 million mark is considered a “baseline” scenario by VanEck.

About the Author

Vladislav Sopov

Blockchain analyst and writer with a scientific background. 6+ years in computer analysis, 3+ years in blockchain.

I have worked in independent analysis as well as in start-ups (Swap.online, Monoreto, Attic Lab etc.)

Ethereum

Lloyd’s of London-backed insurance policies can now be paid in crypto on Ethereum

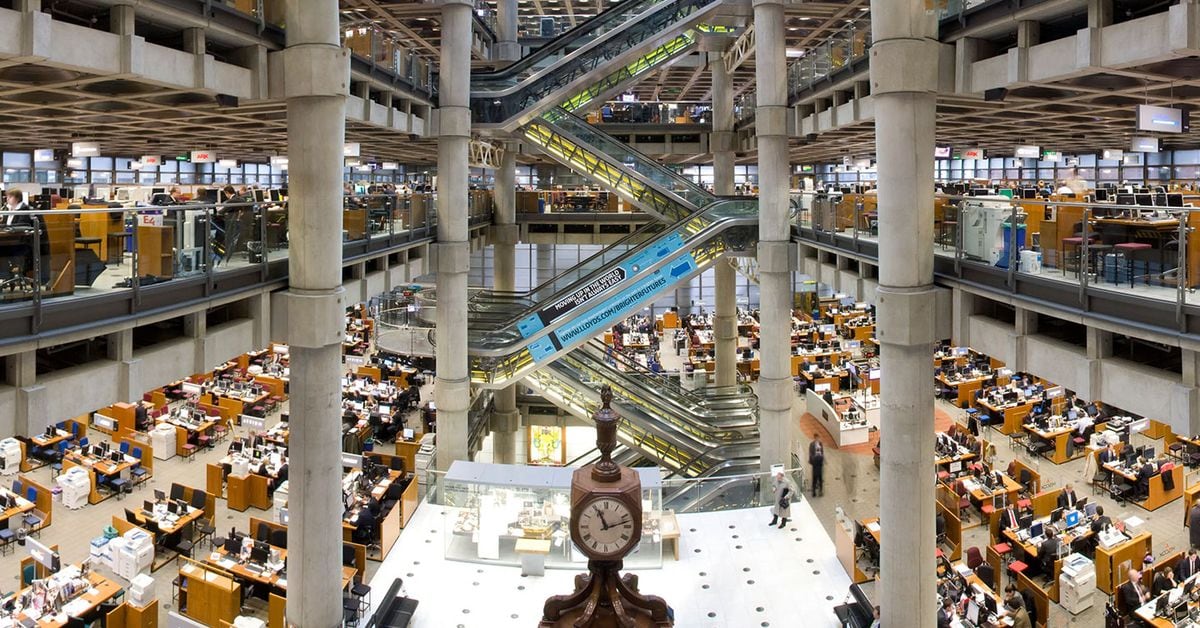

Lloyd’s of London, the three-century-old insurance marketplace, is supporting digital asset protection policies curated on the Ethereum public blockchain that can be paid for natively, on-chain, using cryptocurrency, through Lloyd’s Coverholder Evertas and smart contract insurance provider Nayms.

Not so long ago, any kind of cryptocurrency insurance coverage Finding solutions was difficult. Aside from the efficiency benefits of paying for insurance policies in cryptocurrency and using blockchain to streamline the burdensome paperwork of intermediaries, a consortium of Lloyd’s of London syndicates backing cryptocurrency-native, on-chain insurance shows how far the industry has come in the last two years.

“We’re enabling people using public blockchain infrastructure to interact with traditional, highly regulated, fiat-backed institutions in a transparent way,” Evertas CEO J. Gdanski said in an interview. “Whether it’s paying in USDC or native cryptocurrency, or placing policies entirely on-chain with blockchain helping coordinate between a broker, the policyholder, and insurers, we believe this is a foundational infrastructure.”

Nayms, a digital marketplace where brokers and underwriters connect with crypto capital investment, is a play on Lloyd’s “names,” the collection of individuals and companies that underwrite risks in the historic insurance market.

“The native cryptocurrency expertise we bring to the underwriting process gives us a deep understanding of the risks we insure,” Nick Selby, the company’s head of European underwriting, said in an interview. “It means we’re very explicit about what we do and don’t cover, and we can pay insured claims faster than anyone else.”

Ethereum

10 Years of Crypto Innovations! Here’s How Buterin Sees the Future of Ethereum!

2h45 ▪ 3 min read ▪ by Eddy S.

At the EDCON2024 conference, Vitalik Buterin unveiled the future directions of Ethereum, with a focus on innovative application development and wallet security. He presented promising projects and innovative ideas to improve privacy and accessibility for cryptocurrency users.

Ethereum’s new innovations by Vitalik Buterin!

Vitalik Buterin delivered a key speech on the future of Ethereum in the next ten years. He stressed that the priority of the crypto blockchain will now be to develop applications. Some of the already successful applications include decentralized finance (DeFi), decentralized identities (DID) with the Ethereum Name Service (ENS), DAOs and NFTs.

Vitalik also highlighted several promising projects. These include the prediction market Polymarket, the social media aggregator Firefly, the wallet Daimo, and the voting tool Rarimo. These applications illustrate the diversity and potential of Ethereum-based technologies to transform various sectors of crypto.

Vitalik also proposed several innovative ideas to improve the security and accessibility of Ethereum wallets. One of his proposals is to encrypt the private key directly into the cell phone’s chip! Thus turning the phone into a secure crypto wallet. Another idea is to place part of the private key in a regulatory-compliant custodial institution, thus providing an additional layer of security.

Vitalik also mentioned the use of zero-knowledge (ZK) proof technology to link KYC information to the wallet. This approach would ensure the privacy of cryptocurrency users while meeting regulatory requirements.

Security and Privacy: Two Requirements for Cryptocurrency Users

These proposals aim to improve the security and privacy of cryptocurrency users while facilitating the adoption of the technology by a wider audience. By combining technological innovations with practical applications, Ethereum continues to position itself as a leader in the cryptocurrency and blockchain ecosystem.

Vitalik Buterin’s speech highlighted Ethereum’s many advancements and future prospects. With a focus on application development and innovative proposals for crypto wallet security, Ethereum is well-positioned to continue to grow and innovate in the years to come.

Optimize your Cointribune experience with our “Read to Earn” program! Earn points for each article read and access exclusive rewards. Sign up now and start earning benefits.

Click here to join “Read to Earn” and turn your passion for crypto into rewards!

Eddy S.

The world is changing and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in everything that is closely or remotely related to blockchain and its derivatives. To share my experience and promote a field that fascinates me, there is nothing better than writing informative and relaxed articles.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be considered investment advice. Do your own research before making any investment decision.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!