Bitcoin

The crypto world expects breakthroughs this week in Washington

The crypto world is hoping to make some gains this week in Washington as it pushes for a new regulatory framework and new products that could expand its mainstream appeal.

The House is expected to vote Wednesday on legislation that would provide the kind of regulatory oversight the industry wants.

Separately, investors hope the Securities and Exchange Commission is close to approving the first exchange-traded funds that would invest directly in the cryptocurrency Ether (ETH-USD).

The main change proposed by the new legislation – known as the Financial Innovation and Technology for the 21st Century Act, or FIT21 – is that it would establish the Commodity Futures Trading Commission as a lead regulator of digital assets.

There would be clear divisions over what the CFTC will regulate and what would fall under the purview of the Securities and Exchange Commission, a longtime industry foe that has cracked down on traders with enforcement actions and lawsuits.

Rep. Patrick McHenry, R-N.C., lead sponsor of legislation that would offer a new regulatory framework for the crypto industry. (Tom Williams/CQ-Roll Call, Inc via Getty Images) (Tom Williams via Getty Images)

It would also establish consumer protections and prevent the kind of commingling of customer funds that played a role in the destruction of cryptocurrency exchange FTX in late 2021.

The industry has been lobbying for this framework, which it would prefer over the SEC’s aggressive enforcement.

“[This] marks the official end of the losing narrative that crypto isn’t here to stay,” said Cody Carbone, policy director at Digital Chamber, a crypto lobby group.

The bill faces opposition from some Democrats. Even if it passes, it could still face an uphill climb in the Senate.

“What the Senate will see is a full vote,” said Republican Rep. Patrick McHenry, the lead sponsor of this legislation. “I think this should make the members of the Senate look at this in a new way.”

The price of a specific cryptocurrency – ether – is rising this week as investors become more confident that the SEC will give the green light to invest in ether ETFs.

The SEC in January approved ETFs that invest directly in bitcoin (BTC-USD), a development that has expanded the general acceptance of the world’s largest cryptocurrency. Now investors are hopeful that the same will happen with the second-largest cryptocurrency.

“Given the ‘behind the scenes’ political drama, the approval will be seen as significant regulatory relief for the sector,” Bernstein analysts said in a note.

The crypto world expects the same from the legislation expected to be presented to the House on Wednesday.

Approximately 60 crypto companies and industry organizations including Block, Coinbase (COIN), Circle, Kraken, and Paxos, sent a letter to House leadership last week in support of the project.

The story continues

“The bill is well written,” said Kara Calvert, head of US policy at Coinbase. “It is the first bill that explicitly contemplates how to think about decentralization, how to think about something that stops looking like a security and starts looking like a commodity.”

Calvert says the project allows regulators to focus on creating rules for centralized tokens, allowing for more focused resource management rather than scattered regulation through enforcement.

Republican lawmakers say this legislation will bring clarity to a fundamental question: whether a given digital asset is a security or not. The SEC argued that many cryptocurrencies are, in fact, securities — and therefore should be overseen by the agency.

But a majority of House Democrats — led by Maxine Waters, ranking member of the House Financial Services Committee — oppose the bill.

Waters held an informational meeting for Democrats on Monday, urging them to vote against the bill. She warned that changes made to the bill since last summer would now result in mass deregulation of both crypto and some traditional securities.

In a letter reviewed by Yahoo Finance that was sent to House Democratic members, House Agriculture and Waters Committee Ranking Member David Scott wrote that the revised bill would “move most crypto and some traditional securities into a void regulatory, no primary regulator and virtually no laws or regulations.”

Democratic Rep. Maxine Waters Opposes New Crypto Regulation Bill. REUTERS/Elizabeth Frantz/File photo (Reuters/Reuters)

The end result, the letter states, would be a “proliferation of fraud that will have devastating consequences for consumers and investors.”

Democratic lawmakers argued that the definition of “digital assets” and the revised bill’s addition regarding “investment contract assets” would effectively deregulate most cryptocurrencies, removing them from the purview of the SEC.

They also fear that by making the CFTC the primary regulator, consumers and investors will not have the same types of protections they enjoy at the SEC.

It is unknown how much opposition the bill would face in the Senate.

Senate Banking Committee Chairman Sherrod Brown (D-OH) – who has prioritized cracking down on cryptocurrencies used for money laundering – is remaining silent so far on the House’s crypto legislation.

“We must ensure that crypto platforms follow the same rules as other financial institutions,” Brown said in a statement last month. “And we need to make sure we have the tools to crack down on illicit finance with digital assets, just as we would with any other asset.”

McHenry said he is hopeful the outcome of Wednesday’s vote will get senators’ attention.

“We will strive to get everything we can out of this Congress,” McHenry said when it comes to passing encryption policy.

“There is bipartisan support for this push. But no matter what happens in this Congress, this set of policies is inevitable, it will happen, just as the role of cryptography is here to stay.”

Click here for the latest crypto news, updates and more ethereal It is Bitcoin prices, crypto ETFs and market implications for cryptocurrencies

Read the latest financial and business news from Yahoo Finance

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

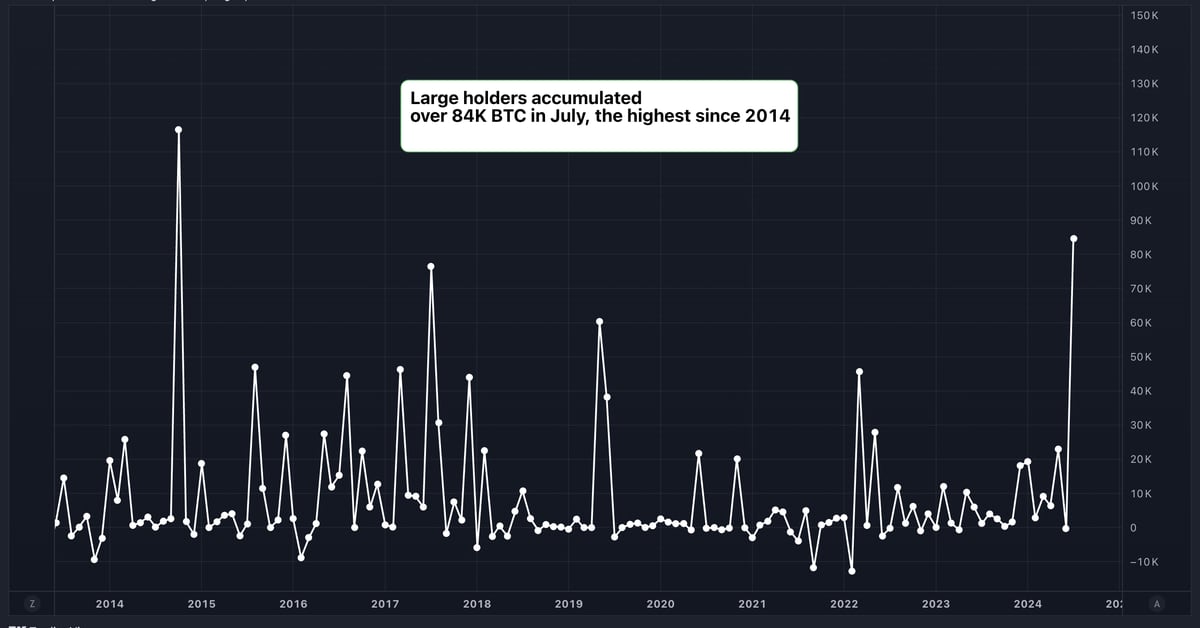

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!