Tech

The Latest Tech News in Crypto and Blockchain

Dec. 13: The layer-1 blockchain COTI unveiled plans to become the “first privacy-preserving Ethereum layer-2,” according to the team: “To better serve the needs of Web3 companies and consumers, COTI will become an Ethereum-compatible layer 2 that solves the challenges of scalability, liquidity and privacy. COTI V2 will use a specialized cryptographic technology known as Garbled Circuits, performing 10 times more efficiently than ZK (Zero-Knowledge) solutions. The devnet release of COTI V2 is scheduled for Q2 2024.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

Hedera Council Names Former Aptos, Polygon Executive Charles Adkins as President

Dec. 13: The Hedera Council today announced the appointment of Charles Adkins as its new president. “A former leader at Aptos and Polygon, Adkins brings a wealth of experience in Web3 technology, as well as in finance, government, and consumer brands. This diverse experience makes Adkins a valuable addition to the Hedera leadership team, while bringing a new set of relationships to the Hedera ecosystem.” (HBAR)

Liquid Collective Says BitGo to Offer Qualified Custody for LsETH

Dec. 13: Liquid Collective, “an institutional liquid staking protocol that achieved 900% TVL growth in Q3 alone, announced that BitGo has joined as a custodian to offer Qualified Custody for LsETH, Liquid Collective’s receipt token,” according to the team. “This move represents BitGo’s entrance into the institutional liquid staking space, as Liquid Collective’s LsETH is the first and only Liquid Staking Token (LST) that BitGo offers custody support for. BitGo’s support of LsETH will allow all BitGo users and LsETH holders to participate securely in the largest DeFi sector.”

Interchain Foundation, Supporting Cosmos, Plans $26.4M of 2024 Funding

Dec. 13: The Interchain Foundation, which supports the Cosmos blockchain ecosystem, detailed $26.4 million of planned funding in 2024. That compares with a $40 million budget estimate for 2023, released in February 2023, though final spending numbers are not in yet.

-

$3,000,000 will be allocated to ensure the continued modularity, efficiency, and stability of CometBFT, the Byzantine fault-tolerant engine for state machine replication.

-

$4,500,000 will be allocated to expand composability of the Cosmos SDK, the world’s most popular framework for building secure and highly performant application-specific blockchains.

-

$7,500,000 will be allocated to the Inter-Blockchain Communication Protocol, the leading blockchain interoperability protocol, enabling secure and permissionless transfer of arbitrary data for dedicated expansion across blockchain ecosystems.

-

$2,500,000 will be allocated to CosmWasm, the smart contract framework focusing on security, performance, and interoperability to enhance dApp functionality and IBC connectivity.

-

$155,000 will be allocated to CosmJS, a library that helps developers integrate their JavaScript-based clients – frontend user interfaces or server-side clients – with Cosmos SDK blockchain to bridge gaps in Cosmos SDK compatibility.

-

$1,500,000 will be allocated towards security audits for the Interchain Stack.

Fetch.ai, SingularityNET to Tackle AI ‘Hallucination,’ Non-Determinism

Dec. 13: Fetch.ai and SingularityNET, two organizations in AI and Web3, said they will “join forces to solve critical issues in the AI space, according to the team. “These include ‘hallucination,’ when LLMs give nonsensical/irrelevant outputs, and non-determinism. Harnessing the core technologies of both, the pair will introduce AI models that are more reliable and have enhanced reasoning so developers can access the tools needed to create their own, more reasoning-capable LLMs via simple APIs and traditional programming languages. Available in 2024, the interface will merge LLMs and AI agents for an open, dynamic marketplace that connects users to services.”

Hyperion Decimus, CoinDesk Indices Announce ‘HD CoinDesk TrendMax Strategy’

Dec. 13: Hyperion Decimus (HD), a digital asset management firm and a sponsor of a multi-strategy crypto hedge fund, and CoinDesk Indices (CDI), a subsidiary of CoinDesk and the leading provider of digital asset indices by AUM since 2014, announced the launch of the HD CoinDesk TrendMax Strategy. According to the team: “This quantitative trading strategy is built on weighted signals from CoinDesk Indices’ proprietary Bitcoin Trend Indicator (BTI) and Ether Trend Indicator (ETI), which each convey the presence, direction and strength of the trend in the price of bitcoin and ether respectively by using purpose-built, non-discretionary algorithms.”

Dec. 12: Celestia, a so-called data availability (DA) solution designed to provide a cheaper alternative for verifying data generated from blockchain transactions, announced Tuesday that it will become an option for blockchain builders using Polygon’s software tools to spin up new layer-2 networks atop Ethereum.

Matter Labs, Chainlink Labs Announce Price Feeds Now on zkSync Era

Dec. 12: Matter Labs and Chainlink Labs announced that Chainlink Price Feeds are live on zkSync Era, the zkEVM Ethereum layer-2 scaling solution. According to the team: “This collaboration, part of the Chainlink SCALE program, aims to enhance DeFi protocols on zkSync, reducing gas costs and providing reliable oracle services.”

Vertex Protocol Partners With Axelar on Cross-Chain Collateral Deposits

Dec. 12: Decentralized exchange Vertex Protocol has partnered with Axelar to enable cross-chain collateral deposits through an integration of the Squid Router, according to the team: “Traders can now bridge and deposit from eight different chains (Ethereum, Binance Smart Chain, Optimism, Polygon, Avalanche, Base Chain, Mantle and Fantom) directly into their trading accounts, through seamless deposits within an average processing time of only two minutes.

Pi Network Debuts ‘Decentralized Moderation’ on Fireside Forum App

Dec. 12: Pi Network debuted “Decentralized Moderation” on its Web3 app Fireside Forum, according to the team: “This cultivates a self-sustaining environment where users are active contributors in shaping the content narrative. Key aspects: Unique Tiered Moderation: a system where each tier has its own responsibilities with token-based incentives and disincentives; Tokenomics and Stakes: every decision and action in the system is backed by real stakes – if an action is challenged and overridden, it translates into a cost; Structured Fairness: curated token rewards and penalties are devised with fairness and accountability in mind.”

Nil Foundation Releases Features of New zkEVM

Dec. 12: Nil Foundation announced the features of its new Type-1 zkEVM powered by zkLLVM, “making it the first zkEVM with core components built automatically, preventing insecurities that result from manual circuit definition,” according to the team: “Nil’s zkEVM is designed to have security as a fundamental feature enabled by its proprietary zkLLVM compiler. The zkLLVM quickly and automatically compiles high-level code (C++ or Rust) into efficient zk-SNARK circuits. Starkly contrasting the current industry standard of manually defining circuits, which is time-intensive, creates overly complex circuits, and can introduce human error.”

Nym, Protocol Labs, Oasis, Aztec Create Universal Privacy Alliance

Dec. 12: A group of Web3 companies including Nym, Protocol Labs, Filecoin Foundation, Oasis and Aztec have founded the Universal Privacy Alliance (UPA), according to a message from the team, led by Nym: “This is the first alliance of its kind which aims to advocate for global digital privacy rights, represent privacy-focused tech firms and engage with policymakers on critical issues like eIDAS and the Digital Services Act. The founders have collectively contributed funds to support immediate advocacy efforts + mission includes policy education.”

Verida, inDAO Collaborate on Uzbekistan Web3 Focus

Dec. 12: Verida, a self-sovereign digital identity provider, and inDAO have collaborated for “36M Uzbekistan citizens to enter Web3 economy,” according to the team: “Leveraging inDAO’s blockchain and Verida’s Web3 wallet, the initiative includes projects such as zero-knowledge credentials for students as proof of their completed studies, safe healthcare data access and real estate digitization. The customized Verida wallet, integrated with the inDAO blockchain, showcase how self-sovereign digital technology can drive economic growth and transform Uzbekistan into a digital-first and efficient economy.”

Oasys Enables Single-Click ‘Verse’ Building

Dec. 12: Oasys, the blockchain gaming hub, has been “working to enable Verse building on their platform with a single click while simplifying blockchain gaming and metaverse launches on the Oasys ecosystem,” according to the team: “Through a new partnership with AltLayer, the decentralized interlayer for rollups, Oasys is enabling one-click deployment through AltLayer’s no-code rollup launcher. Users can now create and launch their Verse on the Oasys platform with all of AltLayer’s user-friendly dashboards, and with just one click, can build blockchain games on Layer 2.”

SSV, for Ethereum Distributed Validator Technology, Goes Permissionless

Dec. 12: SSV.Network, an Ethereum distributed validator technology (DVT) staking infrastructure, announces its permissionless launch, marking a significant advancement in ETH staking, according to the team: “Following three years of development, it democratizes Ethereum staking, breaking entry barriers and inviting public validators and node operators into the network. The launch, promoting decentralization and offering robust infrastructure, is accompanied by a year-long incentivization program, earmarking 1 million $SSV tokens to reward validator registrations.”

Bitget Invests in Layer 2 Consumer-Centric Blockchain Morph

Dec. 11: Bitget, a crypto derivatives exchange, is making a multimillion-dollar Investment in the Ethereum layer-2 consumer-centric blockchain Morph (whose name recently changed from Morphism), according to the Morph team: “Morph’s innovative roll-up technology combines optimistic and ZK rollups to offer cost-effective, secure, and scalable transactions. The company is dedicated to bridging the divide between the present state of blockchain technology and everyday practical dApps that extend beyond traditional cryptocurrency transactions.” Exact terms weren’t disclosed.

Seamless Protocol Issues SEAM, Bags First Base-Blockchain Token Listing on Coinbase

Dec. 11: Seamless Protocol, a project on Coinbase’s Base ecosystem, issued governance tokens that will trade on the crypto exchange with the ticker SEAM starting at 18:00 UTC Monday. Seamless is a lending and borrowing protocol. It is among the top platforms on the layer-2 blockchain, with a total value locked (TVL) of over $10 million. SEAM will be the first Base token listed on Coinbase. It was airdropped to users based on their involvement on the Seamless platform, such as funds supplied to and borrowed from the various trading pools. There was no public or private sale of SEAM tokens.

Decentralized Exchange Uniswap Expands to Bitcoin Sidechain Rootstock

Taiwan Completes Wholesale CBDC Technical Study, Central Bank Official Says

Dec. 11: Taiwan’s central bank has finished a technical study of a wholesale central bank digital currency (CBDC), according to Deputy Governor Chu Mei-lie.

Connext, Protocol for Cross-Chain Apps, Plans Bacco Upgrade Next Week

Dec. 8: Connext, a modular protocol for securely passing funds and data between chains and building cross-chain apps, announced that their latest network upgrade, Bacco, is coming Dec. 14. This follows several months of development with core development teams Proxima Labs and Wonderland, according to the team: “Bacco will upgrade the existing ‘slow path’ of Connext to operate optimistically, reducing the operational costs of supporting new chains by 90%. Additionally, the upgrade paves the way for many new chains and L2s to operate on Connext, with approval for support of 20 new chains and L2s already on the way.”

Diva Staking, Octant in Partnership for 100K ETH ($220M Allocation)

Dec. 8: Diva Staking, an Ethereum liquid staking protocol powered by distributed validator technology, said in a press release that it has “joined forces” with Octant, a platform for experiments in participatory public goods funding, to “decentralize Ethereum’s staking landscape,” according to the team. “The Golem Foundation is planning a phased transition of its validators to Diva’s DVT, contingent on the maturity and extensive testing of their technology. This includes allocating up to 100,000 ETH to Diva Staking, worth approximately $220M at the time of writing. The news follows Diva Staking’s ‘Early Stakers Initiative,’ powered by Enzyme Finance, with over 18,000 stETH (approximately $40M) secured in Diva’s vault as of Dec. 5.” (ETH)

Diagram of Diva Staking’s distributed validator technology setup. (Diva Staking)

Brahma Raises $2.5M After Launching ‘On-Chain Execution’ Platform Console

Dec. 8: Brahma, developer of Console, an institutional on-chain execution and automation platform using Safe smart accounts for custody, raised a $2.5M seed extension, according to the team. Investors included Greenfield, joined by Framework, Safe Foundation, Maven11 and Bitscale. The product launch was announced earlier in the week. “Brahma Console enables asset managers, DAOs and power users to delegate and automate their on-chain execution collaboratively. Console sports Access Control and delegation capabilities with Sub-Accounts and granular transaction policies, an automation module with on/off-chain trigger support, as well as an Execution toolkit which fully manages gas, RPC routing and transaction lifecycle. Console users maintain ownership and independent access to their Safes.”

Chainlink Staking Program Quickly Pulls in $600M, Hitting Limit

Dec. 8: Chainlink, the biggest blockchain data-oracle project, saw a powerful uptake for its expanded crypto-staking program, pulling in over $632 million worth of its LINK tokens and filling up to the limit just six hours after the start of an early-access period, the company said in a press release. (LINK)

Avail, for Data Availability, Sees ‘Solid Foundation’ for Q1 Mainnet Launch

Dec. 8: Avail, a modular blockchain data availability solution, said its testnet, launched Oct. 31, is seeing engagement levels “suggesting a solid foundation” for network security ahead of a planned mainnet launch in the first quarter of 2024, according to a message from the team. A little over a month in, the testnet boasts 220 validators. For comparison, the rival data availability network Celestia, which launched its mainnet on in late October, has 170 total validators, according to data on Mintscan.

Flare Onboards Ankr, Figment as Both Validators, Data Providers

Dec. 8: Flare, a layer-1 blockchain compatible with Ethereum’s EVM standard, has onboarded Ankr, Figment, Restake, Luganodes and NorthStake as both validators and data providers for the network’s native oracles and for the first time in crypto, according to a web post. “With this move, Flare becomes the first smart-contract platform for whom these institutional validators also provide decentralized data feeds for builders on the network and provide a far wider variety of decentralized data,” based on a message from the team. The press release added: “Flare currently has a total of 91 network validators across the globe, all of whom also act as data providers for the Flare Time Series Oracle (FTSO).”

Tether Provides Tech Support to El Salvador’s ‘Freedom Visa’ Program

Dec. 8: Tether, issuer of USDT, the world’s biggest stablecoin at $90 billion, is participating in El Salvador’s new “Freedom Visa” program as a tech provider. CEO Paolo Ardoino said in a press release: “It represents a unique opportunity for us to utilize our technological capabilities to foster growth and innovation in the region. Being chosen as the tech provider underscores the importance of robust infrastructure in driving meaningful change. This partnership reinforces our dedication to advancing technology, empowering nations, and enabling individuals to invest in a future where innovation and progress go hand in hand.”

El Salvadoran President Nayib Bukele. (Government of El Salvador, modified by CoinDesk)

El Salvadoran President Nayib Bukele. (Government of El Salvador, modified by CoinDesk)

Animoca Raises Additional $11.9M for Mocaverse

Dec. 8: Animoca Brands disclosed raising $11.9 million in a second tranche of funding for Mocaverse, following a previous $20 million raise announced in September. “Participants in this second tranche of funding for Mocaverse included Block1, OKX Ventures, Foresight Ventures, Polygon Ventures, Dapper Labs, and others. In both tranches Animoca Brands raised the funds via the issue of new ordinary shares at a price per share of A$4.50; as part of each raise, the Company granted to the investors in each round a free-attaching utility token warrant on a 1:1 dollar basis,” according to a press release.

SKALE Wins Vote to Approve Chain Pricing

Dec. 8: SKALE is the first blockchain to embrace an appchain infrastructure with zero gas fees for the end user, based on a vote by the community. According to the team: “The SKALE Chain Pricing proposal brings sustainability to the blockchain, where chain owners’ subscription payments offer validators an additional revenue stream and eliminate user gas fees. This vote will propel the network into the next phase, making it one of the only blockchains to run in an economically viable manner where without inflation. The network runs at a profit for decentralized workers and stakers.”

Engineering Association IEEE to Issue Credentials on Avalanche C-Chain

Dec. 8: The Institute of Electrical and Electronics Engineers, with over 426,000 members in more than 160 countries, plans to issue credentials and certificates on the Avalanche C-Chain, according to a tweet. The effort will “make the verification process tamper-proof, instant and secure,” the post read. The team wrote in a message: “As a leader in setting technical standards, IEEE’s embrace of the blockchain for credentialing marks a significant milestone in the adoption of Web3.” (AVAX)

Blockaid Releases ‘Transaction Safety’ Feature for Rainbow Wallet

Dec. 8: Blockaid, a provider of Web3 security tools, announced a new “Transaction Safety” feature on Rainbow wallet, according to the team: “This security upgrade will provide millions of Rainbow wallet users with real-time protection against malicious sites and apps, and full transparency into the path of each Web3 transaction before signing any confirmations.”

Lantern Launches Staking Platform in 15 U.S. states

Dec. 7: Lantern Finance, a Web3 startup, has launched its user-friendly staking platform in 15 U.S. states, including major markets like California, Pennsylvania, Illinois, Virginia, and Massachusetts, according to the team: “Inspired by the cofounders’ experiences with the 2022 crypto bankruptcies, Lantern aims to redefine the crypto landscape with an emphasis on clarity, security, and regulatory adherence. The platform’s goal is to democratize access to crypto banking services, making complex tasks like staking and taking on loans accessible and intuitive for everyday users, while upholding the highest standards of safety and compliance.”

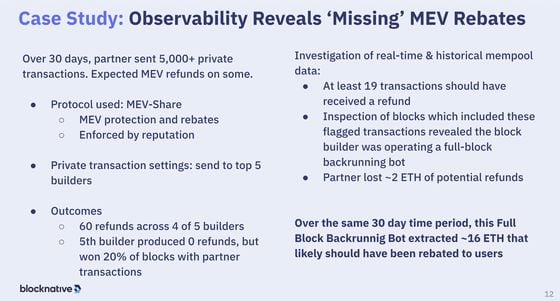

Blocknative Releases New Ethereum Mempool Explorer, to Help With MEV Protection

Dec. 7: Blocknative, a blockchain infrastructure company that cut staff in October after suspending work on a major business project, is releasing a new tool to examine the “mempool” of pending transactions awaiting processing on Ethereum, an effort that could ultimately help to reduce instances of block-level manipulation and protect users from front-running bots. The real-time explorer tool is called ethernow.xyz, which gives insights into Ethereum mempool data and the block building process, and Blocknative CEO Matt Cutler described it as the Etherscan for pre-chain data.

Slide from a Dec. 6 presentation by Blocknative CEO Matt Cutler at a Columbia University blockchain conference in New York. (Blocknative)

Slide from a Dec. 6 presentation by Blocknative CEO Matt Cutler at a Columbia University blockchain conference in New York. (Blocknative)

Orchid, Decentralized Bandwidth Marketplace, Could Expand to Data Storage With ‘Storchid’

Dec. 7: The community supporting Orchid, the decentralized bandwidth marketplace and VPN app, has a new open-source initiative, “Storchid,” which expands the Orchid to include data storage and address the trust and security holes in the current centralized data storage standards, according to the team: “The initiative builds on existing core technologies such as erasure coding, bonded commitments and stake-weighted random selection for incentive alignment. A core component is the Orchid Directory Mechanism where clients and providers alike are incentivized to maintain marketplace security.”

Jack Dorsey’s Block Bitkey Bitcoin Wallet Comes to Market in More Than 95 Countries

Dec. 7: Jack Dorsey’s fintech company Block (SQ) has unveiled its self-custody bitcoin wallet Bitkey for pre-order in more than 95 countries. Bitkey consists of a mobile app, hardware device and a set of recovery tools, Block announced on Thursday.

Bitkey includes a mobile app, hardware device, and a set of recovery tools, according to the company. (Block/Business Wire)

Bitkey includes a mobile app, hardware device, and a set of recovery tools, according to the company. (Block/Business Wire)

Uphold Launches Vault for ‘Assisted Self-Custody,’ Starting With XRP

Dec. 7: Uphold, a Web3 financial platform, on Thursday launched the beta version of its new assisted self-custody wallet, Vault, which uniquely addresses the UX issues that plague users of typical crypto wallets and self-custody solutions, according to a press release. “The first digital asset that will be supported on Vault is the XRP token, the native token of the XRP Ledger, a decentralized layer 1 blockchain. Vault will expand to offer additional chains starting with BTC in Q1,” according to the release.

Neon EVM Integrates With Web3 Marketing Protocol Tide

Dec. 7: Neon EVM, a smart-contract program on the Solana blockchain that accepts Ethereum-like transactions, integrates with Tide, a Web3 marketing and data analytics protocol, according to the team: “Tide’s approach incentivizes repeated community and product engagement, tracking on-chain transactions and fostering vibrant decentralized communities. With Neon’s cutting-edge dApp ecosystem and Tide’s features like building brand awareness, learn-to-earn incentives, Web3 quests and referral programs, users can participate in the first Neon EVM campaigns on Tide to earn badges and tokens on the newly launched chain.”

Aori Launches, Aims to Bridge ‘CEX/DEX Gap’

Dec. 7: Aori, an off-chain orderbook protocol with permissionless settlement, launches today to create more capital efficient peer-to-peer markets on Ethereum, according to the team: “Aori uses MEV ‘searchers’ as market makers for quicker settlements, bridging the CEX/DEX gap. It focuses on gasless order creation, fair pricing and speedy settlements. Aori is intended to feel like a CEX experience but is entirely self-custodied. All transactions clear through Seaport, also utilized by OpenSea. Aori seeks to move existing on-chain infrastructure off-chain, to minimize smart contract risk wherever possible.”

Safe, Sygnum Bank, CoinCover Launch ‘RecoveryHub’

Dec. 7: Safe is joining forces with Sygnum Bank and CoinCover to launch Safe{RecoveryHub}, offering a suite of crypto recovery options ranging from fully self-custodial to fully custodial, catering to individual and institutional needs, according to the team: “With Safe{RecoveryHub}, users can recover access to their accounts through designated recoverers, which can be personal backup devices, family members and collaborators, also known as social recovery. In addition, trusted third-party services like Sygnum and CoinCover can be designated as recoverers to facilitate the recovery of assets in the case of lost keys.”

Namada Makes Initial NAM Token Allocations Under Retroactive Public Goods Funding

Dec. 7: Namada, a protocol that introduced to the world the concept of privacy as a public good, and scheduled to launch early next year, has initiated the Retroactive Public Goods Funding (RPGF) program, allocating 6.5% of its total NAM token supply to acknowledge and reward the invaluable contributions of individuals in the privacy, zero-knowledge (ZK) technology, and related ecosystems, according to the team. This distribution extends to:

– Developers of Zcash infrastructure.

– Rust dependencies vital for Namada.

-Contributors to various cryptographic protocols.

– Decentralized privacy solutions.

HyperOracle Integtes zkOracle Protocol With Polygon CDK

Dec. 7: HyperOracle integrates its zkOracle protocol with Polygon CDK, enhancing DeFi and on-chain AI capabilities, according to the team: “This collaboration enables the creation of advanced dApps, including decentralized stablecoins and AI-powered applications. Polygon CDK’s launch of ZK-powered layer-2 chains on Ethereum is augmented by HyperOracle’s zkOracle, offering verifiable compute and historical on-chain data access. The collaboration aims to drive innovation in DeFi, with HyperOracle co-developing a new zk-WASM based proving backend for Polygon CDK.”

Bitcoin Project Babylon Raises $18M to Bolster Development of Staking Protocol

Dec. 7: Bitcoin-focused project Babylon raised $18 million in an investment round led by Polychain Capital and Hack VC. Babylon is a marketplace offering bitcoin (BTC) as a staking asset, allowing proof-of-stake chains to acquire funding from the swells of capital stored in the largest cryptocurrency. Babylon will use the funds to advance the development of the staking protocol, according to an emailed statement shared with CoinDesk on Thursday. Framework Ventures, Polygon Ventures, Castle Island Ventures, OKX Ventures, Finality Capital, Breyer Capital and Symbolic Capital also participated in the fundraise.

Beam to Launch on Immutable zkEVM, Gaming-Focused L2 With Polygon Tech

Dec. 6: Beam, an open-source blockchain specialized for gaming and run by Merit Circle DAO, will now launch on Immutable zkEVM, a groundbreaking scaling solution powered by Polygon, according to the team: “Beam is an ecosystem and a blockchain. We want to remain chain-agnostic. Where we started as a subnet on Avalanche, we don’t want to limit ourselves to the Avalanche ecosystem. Right now, we’re working with Immutable to launch some of our products on the zkEVM, and integrate that network into our products as well.”

Tech

Hollywood.ai by FAME King Sheeraz Hasan Promulgates a Complete Ecosystem that Unites Web3, Cryptography, AI and Entertainment for Spectacular Global Tech Innovation

The one and only FAME King Sheeraz Hasan is launching Hollywood.ai, a revolutionary platform designed to integrate the cutting-edge realms of Web3, cryptocurrency, AI, finance and entertainment. This revolutionary initiative is set to create a seamless, interactive and intuitive ecosystem where the world’s leading technology luminaries can collaborate on innovations, ultimately redefining the future of digital interaction.

Hollywood.ai represents the convergence of the most complex technologies of all time. Fusing Web3 principles, cryptocurrency utilities, AI advances, and financial machinery, Sheeraz’s platform aims to become the nucleus for innovation and modernization. It provides a high-tech environment where technology and creativity collide harmoniously, paving the way for new paths in the digital economy.

A defining feature of Hollywood.ai is the integration of cryptocurrency into the AI ecosystem, transforming AI into a tokenized asset with full cryptographic utility. Sheeraz’s novel approach presents new avenues to leverage the myriad capabilities of AI in the financial realm, unlocking unprecedented opportunities for developers and users alike. Through the amalgamation of AI and cryptocurrency, Hollywood.ai is paving the way for an incredibly interconnected digital space unlike anything seen before.

The platform’s design emphasizes the undeniable symbiosis between various technology sectors. Under Sheeraz’s careful orchestration, Web3 technologies facilitate decentralized collaboration, while AI tools offer enhanced potential for data analytics, content creation, and audience engagement. Additionally, the inclusion of financial innovations ensures rapid mobility of both monetization and investments, providing a holistic environment that meets the ever-evolving demands of the technology and entertainment segments.

Sheeraz’s Hollywood.ai is poised to become the premier hub for industry leaders, developers, and creators to support and empower the next generation of digital experiences. This initiative aspires to drive the emergence of new tools, applications, and services that set new standards for advanced engagement and interaction.

Known for making the impossible possible, Sheeraz envisions a future where global audiences actively participate in designing the next A-list stars from scratch. Hollywood.ai will allow users to watch their creations evolve from simple concepts to 3D talents that can act, sing and perform just like human actors.

The Hollywood.ai platform leverages AI technology to deliver personalized fan engagement, real-time sentiment analysis, and informed content creation. By combining cutting-edge AI capabilities with Sheeraz’s deep understanding of celebrity branding, Hollywood.ai gains immense control over public figures.

Undeniably, FAME’s number one strategist Sheeraz Hasan continues to cement his reputation as a pioneer in the fields of FAME and technology. The power and influence of this latest development brings him closer to total world domination.

Tech

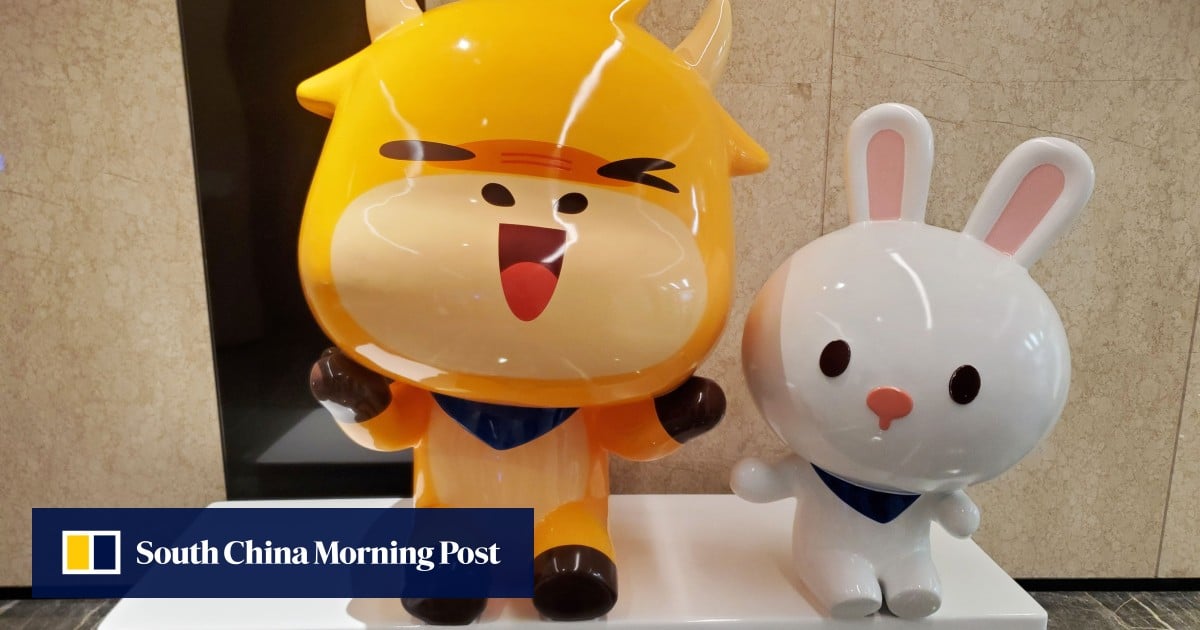

Online Broker Futu Offers Cryptocurrency Trading in Hong Kong, With Nvidia and Alibaba Stock as Rewards

Futu Securities International, Hong Kong’s largest online broker, has launched retail cryptocurrency trading in the city, offering shares of Alibaba Holding Group AND Nvidia as a reward in an attempt to attract investors. Futu has begun allowing Hong Kong residents to trade Bitcoin and ether, the world’s two largest cryptocurrencies, directly on the brokerage platform using Hong Kong or U.S. dollars, the company announced Thursday.

The online retail broker said last month that it had received an upgrade to its securities license from the Securities and Futures Commission (SFC), allowing Futu to offer virtual asset trading services to both professional and retail clients in the city.

Futu’s move comes as Hong Kong seeks to boost its attractiveness as a business hub for virtual assets, with the city government launching a series of new cryptocurrency policy initiatives over the past two years, including a mandatory licensing regime for cryptocurrency exchanges.

In addition to offering cryptocurrency trading on its flagship brokerage app, Futu is also seeking a cryptocurrency trading license for its new PantherTrade platform. That platform is among 11 in Hong Kong that are currently “deemed licensed” for cryptocurrency trading, an arrangement that allows them to operate in the city while they await full approval from the SFC.

Hong Kong’s progress in becoming a crypto hub has encountered various challenges, including exit of the major global platforms and relatively low trading activity for cryptocurrency exchange-traded funds offered on local stock exchanges.

Futu is now offering a series of incentives to potential investors, amid a cryptocurrency bull market that has seen the price of bitcoin rise 45 percent this year.

Hong Kong investors who open accounts in August and deposit HK$10,000 (US$1,280) over the next 60 days can receive HK$600 worth of bitcoin, a HK$400 supermarket voucher or a single Chinese stock. e-commerce giant Alibaba. Alibaba owns the South China Morning Post.

By holding 80,000 U.S. dollars for the same period, users can get 1,000 Hong Kong dollars in bitcoin or a share of U.S. artificial intelligence (AI) chip maker Nvidia, whose shares have risen more than 140 percent this year.

A Futu representative said the brokerage firm will also waive cryptocurrency trading fees starting Thursday until further notice.

Futu is the first online brokerage in Hong Kong to allow retail investors to buy cryptocurrency directly on its platform. SFC rules require it to offer this service through a tie-up with a licensed cryptocurrency exchange. Futu is partnering with HashKey Exchange, one of only two licensed exchanges in Hong Kong, according to the representative.

Futu’s local rival Tiger Brokers also said in May that it had begun offering cryptocurrency trading services to professional investors on its platform following a license update. The SFC defines professional investors as those with more than HK$8 million in their investment portfolios or corporate entities with assets exceeding HK$40 million.

Tech

Tech Crash: $2.6 Trillion Market Cap Vanishes as ‘Magnificent 7’ Prices Stumble

A group of seven megacap tech stocks, often called the Magnificent 7, have lost more than $2.6 trillion in value over the past 20 days, or an average of $125 billion per day over the period. In total, these stocks have lost “three times the value of the entire Brazilian stock market.”

This according to the economic news agency Letter from Kobeissiwho noted on the microblogging platform X (formerly known as Twitter) that the Magnificent 7 batch “is worth as much as Nvidia’s entire current market cap in 20 days,” with Nvidia itself having lost $1 trillion from its high.

Source:Letter from Kobeissi on the X

The group, which includes Nvidia, Microsoft, Amazon, Apple, Alphabet, Meta and Tesla, has undergone a significant correction: in the last 20 days Nvidia has lost 23% of its value, or about $800 billion, while Tesla has fallen 19%, losing $164 billion.

Microsoft, Apple, Amazon, Alphabet and Meta all posted losses of between 9% and 15%, losing between $257 billion and $554 billion in market capitalization, wiping out a total of $200 billion more “than every single German stock market tock combined.”

Tech titans, which have outperformed the broader S&P 500 index since the market bottom of 2022, are now facing a reckoning as investors grow increasingly wary about the sustainability of their meteoric rise, with Nvidia taking the lead soaring 110% since the beginning of the year and over 2,300% in the last five years.

Earnings reports from these companies, starting with Microsoft and culminating with Nvidia in late August, will be closely watched for signs of weakness. Their performance could set the tone for broader market sentiment, with implications for everything from cryptocurrency to other high-risk assets.

Their poor performance comes after a leading macroeconomist, Henrik Zeberg, reiterated his forecast of an impending recession that will be preceded by a final wave in key sectors of the market, but which can potentially be the worst the market has seen since 1929the worst bear market in Wall Street history.

In particular, the Hindenburg Omen, a technical indicator designed to identify potential stock market crashes, began flashing just a month after its previous signal, raising concerns about a possible impending stock market downturn.

The indicator compares the percentage of stocks hitting new 52-week highs and lows to a specific threshold. When the number of stocks hitting both extremes exceeds a certain level, the indicator is said to be triggered, suggesting a greater risk of a crash.

Featured Image via Disinfect.

Tech

Trump Fights for Cryptocurrency Vote at Bitcoin Conference

To the Bitcoin Conference 2024 In Nashville, Tennessee, former President Donald Trump delivered a keynote speech.

Trump, the Republican presidential candidate, used the platform to appeal to the tech community and solicit donations for the campaign. During the conference, He said:

I promise the Bitcoin community that the day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over… If we don’t embrace cryptocurrency and Bitcoin technology, China will, other countries will. They will dominate, and we can’t let China dominate. They are making too much progress as it is.

Trump’s speech focused heavily on cryptocurrency policy, positioning it as a partisan issue. He said that if reelected, he would fire SEC Chairman Gary Gensler on his first day in office, a statement that drew enthusiastic applause from the audience. This statement marked a stark contrast to Gensler’s tenure, which has been characterized by rigorous oversight of the cryptocurrency industry.

The former president outlined several pro-crypto initiatives he would undertake if elected. These include transforming the United States into a global cryptocurrency hub, keeping all government-held Bitcoin as a “national Bitcoin reserve,” establishing a presidential advisory council on Bitcoin and cryptocurrency, and developing power plants to support cryptocurrency mining, emphasizing the use of fossil fuels.

Trump’s current embrace of cryptocurrencies represents a reversal from his stance in 2021, when described Bitcoin as a “scam against the dollar.” He also noted that his campaign has received $25 million in donations since accepting cryptocurrency payments two months ago.

The event featured other political figures, including Republican Senators Tim Scott and Tommy Tuberville, as well as Democratic Representatives Wiley Nickel and Ro Khanna. Independent presidential candidate Robert F. Kennedy Jr. also spoke at the conference.

Trump’s appearance at Bitcoin 2024 reflects growing support for his campaign from some tech leaders, including Tesla CEO Elon Musk and cryptocurrency entrepreneurs Cameron and Tyler Winklevoss.

While Trump has described the current administration as “anti-crypto,” Democratic Congressman Wiley Nickel said Vice President Kamala Harris is taking a “forward-thinking approach to digital assets and blockchain technology.”

This event underscores the growing political importance of cryptocurrency policy in the upcoming presidential election.

Kamala Harris and Democrats Respond on Cryptocurrencies

In a strategic move to repair strained relations, Vice President Kamala Harris’ team has initiated a dialogue with major cryptocurrency industry players. This outreach aims to restore the Democratic Party’s stance on digital assets and promote a more collaborative approach.

THE Financial Times reports that Harris’s advisors have reached out to representatives from industry leaders like Coinbase, Circle, and Ripple Labs. This move comes as the cryptocurrency community increasingly supports Republican candidate Donald Trump, reflecting growing dissatisfaction with the current administration’s cryptocurrency policies.

THE disclosure follows a letter from Democratic lawmakers and 2024 candidates urging the party to reevaluate its approach to digital assets. Harris’s team stresses that this effort is less about securing campaign contributions and more about engaging in constructive dialogue to develop sensible regulations.

The move is part of a broader strategy to reshape the Democratic Party’s image among business leaders, countering perceptions of an anti-business stance. Harris’ campaign aims to project a “pro-business, responsible business” message.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!