Ethereum

Virtu Financial: Outperforms on Clear Ethereum Catalyst (NASDAQ:VIRT)

Torsten Asmus

Virtu Financial Presentation

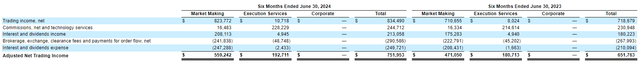

Virtu Financial (NASDAQ:VIRT) outperformed yesterday. Volatility and volumes are down, so some downside was to be expected, but they managed to grow. In particular, some outperformance came from VIRT being reliant on crypto volumes and trading which are up year-over-year as the risk-on environment has returned as well as the launch of institutionally backed crypto exchange-traded products. This is probably also where some of the short interest is coming from as we get about 10% of daily net trading revenue in these products on a per-day basis. The buyback on the earnings outperformance continues, which markets must be liking at about 1% buyback yield this quarter, hence the price rally on the earnings release, and also the news of Ethereum (ETH-USD) could make a difference to the results. We think Virtu seems a bit underrated, taking a crude approach to dampening crypto activity, but that comes from that crypto exposure.

Financial Benefits of Virtu

Let’s start with the Ethereum aspect, perhaps. There are several points to make here.

So, we’re sitting here today. If you had said to me three years ago, hey, you’re going to have over $600,000 of adjusted net transactions and almost $700,000 coming from those three categories, which effectively resulted in a zero P&L three years ago.

Douglas Cifu, CEO of Virtuin reference to various crypto products and options so far and their daily trading net income figures.

It is worth noting here that company-wide run rates are around $6 million in daily trading net profit, so crypto products already account for 10%.

Ethereum products have been allowed to be traded in force with the accessible spot products, and Virtu will create markets for these products. These products come to market on the July 23. It is critical to note that much of the infrastructure currently used to distribute and create markets for block products will be the same for Ethereum products. Analysts on the call attempted to determine the relative popularity of Ethereum products versus other block products based on launch numbers, hoping for half as much popularity, but with the cannibalization effects on volumes and the rate at which issuers are approved, the number is likely closer to a third. Whatever activity levels it eventually reaches will be monetized at a net margin of 100%, as those margin dollars are virtually costless on today’s fixed infrastructure and network.

So whether it’s half or a third of the size, I think it’s probably closer to a third than a half, is what I would say. So, look, it’s, and the marginal dollars that actually flow into Virtu’s bottom line after we pay the exchange fees and the SEC fees and all that kind of stuff is essentially 100%.

– Douglas Cifu

Investors can hope that this will ultimately lead to a terminal increase of around 30-50% in crypto-related product activity, which should be reflected in net trading revenue as growth of that magnitude. Ultimately, one would expect major operating leverage effects that could see EBITDA increase by 12% from this effect, which would take an additional $200,000 of net trading per day and put it directly on the operating income line. This would take perhaps around three years, which is how long it has taken the current suite of blockchain products to scale, assuming of course that crypto doesn’t crash again, which could easily be the case.

Snapshot (8-K)

In terms of most recent resultsWhile not necessarily looking ahead, performance was definitely ahead of peers. Most volumes were down across most markets, including fixed income and equities, both sequentially and year-over-year. In crypto, volumes were down sequentially across the market by 30%. Overall, institutional and retail activity was mixed to down. This is consistent with the Brokerage results We see this in other financial choices. Market makers and brokers, both of whom are money generators for Virtu, want volume and volatility in order to maximize spreads and commissions and maximize. Despite the poor fundamentals of the industry, they have managed to decent sequential performance of around 4%in net business income growth, and they achieved a good annual performance in terms of net business income of around 39%.

Conclusion

Valuation is a challenge. A brokerage would have a PE of ~18x, based on US peers. Market makers would likely be about the same, and Virtu has a mix anyway. However, the operating leverage and 10% (and growing) reliance on crypto products is likely where investors pause, as forward PEs are ~10x, with LTM PEs ~19x. Crypto going live is not something a reasonable market participant can trust to stay sustainable, as it is a market that crashes regularly. Roughly speaking, we would say that discounting the crypto business, a 14x PE is what comes out of futures, wiping ~$600k per day of net trading revenue from the operating line. 14x is a discounted multiple compared to the ~18x you get on brokerages. Furthermore, this ignores the benefits that will come from creating markets for crypto products, even if it ends up being nothing more than a bargain. It’s not a bad proposition. It’s on sale, but the reasons are surely cryptographic, so it’s not to our taste.

Ethereum

Ethereum (ETH) Whales Are Getting Incredibly Bullish: Details

Cover image via www.freepik.com

Disclaimer: The opinions expressed by our editors are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial loss incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

Ethereum (ETH) Whales are making major moves in the cryptocurrency market, suggesting strong bullish sentiment despite short-term price volatility. According to crypto analyst Ali Martinez, these big investors have accumulated over 126,000 ETH in the last 48 hours, or about $440 million.

In a tweet, Ali wrote: “Ethereum whales have accumulated over 126,000 ETH in the last 48 hours, worth around $440 million.”

According to CryptoQuant CEO Ki-Young-JuWhales may be preparing for the next move in the market. Ju wrote in a tweet that “whales may be preparing for the next rally in altcoins.” He noted that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place.

Ethereum’s recent developments, including the recent launch of Ethereum spot ETFs in the US, appear to have increased its appeal among large holders, known as crypto whales. Ethereum recently celebrated nine years since its inception, and as the ETH network continues to evolve, it is likely to attract more institutional interest.

Related

According to data from Farside Investors, fund flows into U.S.-listed Ethereum spot exchange-traded funds turned net positive daily for the first time since their inception on July 31, primarily due to a decrease in outflows from the Grayscale Ethereum Trust.

Ethereum Price Drops Due to Market Crash

Bitcoin and Ethereum, along with the majority of other crypto assets, appear to be underperforming during Thursday’s trading session.

According to CoinMarketCap dataAt the time of writing, Bitcoin’s price was $64,034, down 2.77% from the previous day. Ethereum’s price is down 4.21% from $3,175, where it was 24 hours ago. Several cryptocurrencies were posting larger losses; Solana’s Dogwifhat was down 12% in the past 24 hours, and PEPE was down 7% in the same period.

According to CoinGlass, price followers have led to the liquidation of $225 million worth of derivatives contracts over the past day.

Ethereum

Ethereum (ETH) Price Hits $50,000? Target Updated by Analyst

Vladislav Sopov

Extreme skepticism from Ethereum (ETH) detractors has prompted a veteran researcher to double down on Ether

Read U.TODAY on

Google News

Ethereum (ETH) proponent and AI enthusiast Adriano Feria has presented an extremely optimistic Ether price prediction. After the reaction of skeptics, he reconsidered the target, increasing it by 100%. His views are aligned with those of major institutional players, according to recent data.

Ethereum (ETH) bullish hypothesis should get us there: researcher

Ethereum (ETH) could hit $50,000 early in the current cryptocurrency market cycle. At the same time, a “bullish scenario” could push the price of the second-largest cryptocurrency to six-digit values, Web3 and AI educator Adriano Feria told X.

In a tweet shared with his 14,000 followers, Feria stressed that he is confident in the promising prospects of Ethereum (ETH) despite the massive wave of hatred against Crypto X. The doubters will regret their skepticism, the researcher admits:

If you hold ETH today, you are truly part of the global elite, because the bullish scenario for ETH should take us to $100,000. You think this is a joke, but there are real financial institutions around the world that have set bullish targets that are close to this. And no, this is not a joke.

Three days ago, he “increased” the $28,000 per ETH prediction published by Eric Conner, a veteran of the Ethereum (ETH) ecosystem and co-author of EIP 1559.

These ultra-bullish statements come amid growing disbelief triggered by ETH’s weak short-term performance.

The second-largest cryptocurrency failed to take off following the launch of the Ether ETF in the United States. At press time, Ethereum (ETH) was trading at $3,311, down nearly 6% from the local peak set after the ETF launched on July 23.

Insane BTC and ETH Price Predictions Released Every Day

As previously reported by U.Today, in February, Feria noted the rapid increase in popularity of ETH staking based on on-chain data.

In recent days, more and more analysts are sharing incredibly high predictions for Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies.

For example, US asset management heavyweight VanEck has suggested two scenarios for the price of BTC in 2050.

The most optimistic scenario sees BTC surpassing $52 million per coin, while the $2.9 million mark is considered a “baseline” scenario by VanEck.

About the Author

Vladislav Sopov

Blockchain analyst and writer with a scientific background. 6+ years in computer analysis, 3+ years in blockchain.

I have worked in independent analysis as well as in start-ups (Swap.online, Monoreto, Attic Lab etc.)

Ethereum

Lloyd’s of London-backed insurance policies can now be paid in crypto on Ethereum

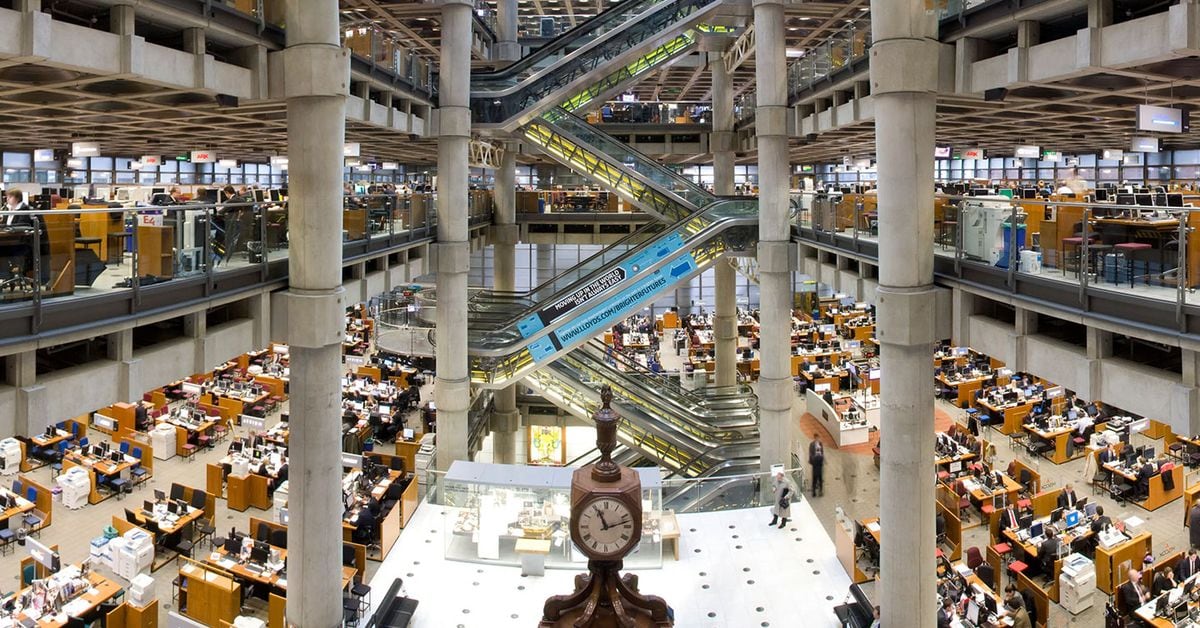

Lloyd’s of London, the three-century-old insurance marketplace, is supporting digital asset protection policies curated on the Ethereum public blockchain that can be paid for natively, on-chain, using cryptocurrency, through Lloyd’s Coverholder Evertas and smart contract insurance provider Nayms.

Not so long ago, any kind of cryptocurrency insurance coverage Finding solutions was difficult. Aside from the efficiency benefits of paying for insurance policies in cryptocurrency and using blockchain to streamline the burdensome paperwork of intermediaries, a consortium of Lloyd’s of London syndicates backing cryptocurrency-native, on-chain insurance shows how far the industry has come in the last two years.

“We’re enabling people using public blockchain infrastructure to interact with traditional, highly regulated, fiat-backed institutions in a transparent way,” Evertas CEO J. Gdanski said in an interview. “Whether it’s paying in USDC or native cryptocurrency, or placing policies entirely on-chain with blockchain helping coordinate between a broker, the policyholder, and insurers, we believe this is a foundational infrastructure.”

Nayms, a digital marketplace where brokers and underwriters connect with crypto capital investment, is a play on Lloyd’s “names,” the collection of individuals and companies that underwrite risks in the historic insurance market.

“The native cryptocurrency expertise we bring to the underwriting process gives us a deep understanding of the risks we insure,” Nick Selby, the company’s head of European underwriting, said in an interview. “It means we’re very explicit about what we do and don’t cover, and we can pay insured claims faster than anyone else.”

Ethereum

10 Years of Crypto Innovations! Here’s How Buterin Sees the Future of Ethereum!

2h45 ▪ 3 min read ▪ by Eddy S.

At the EDCON2024 conference, Vitalik Buterin unveiled the future directions of Ethereum, with a focus on innovative application development and wallet security. He presented promising projects and innovative ideas to improve privacy and accessibility for cryptocurrency users.

Ethereum’s new innovations by Vitalik Buterin!

Vitalik Buterin delivered a key speech on the future of Ethereum in the next ten years. He stressed that the priority of the crypto blockchain will now be to develop applications. Some of the already successful applications include decentralized finance (DeFi), decentralized identities (DID) with the Ethereum Name Service (ENS), DAOs and NFTs.

Vitalik also highlighted several promising projects. These include the prediction market Polymarket, the social media aggregator Firefly, the wallet Daimo, and the voting tool Rarimo. These applications illustrate the diversity and potential of Ethereum-based technologies to transform various sectors of crypto.

Vitalik also proposed several innovative ideas to improve the security and accessibility of Ethereum wallets. One of his proposals is to encrypt the private key directly into the cell phone’s chip! Thus turning the phone into a secure crypto wallet. Another idea is to place part of the private key in a regulatory-compliant custodial institution, thus providing an additional layer of security.

Vitalik also mentioned the use of zero-knowledge (ZK) proof technology to link KYC information to the wallet. This approach would ensure the privacy of cryptocurrency users while meeting regulatory requirements.

Security and Privacy: Two Requirements for Cryptocurrency Users

These proposals aim to improve the security and privacy of cryptocurrency users while facilitating the adoption of the technology by a wider audience. By combining technological innovations with practical applications, Ethereum continues to position itself as a leader in the cryptocurrency and blockchain ecosystem.

Vitalik Buterin’s speech highlighted Ethereum’s many advancements and future prospects. With a focus on application development and innovative proposals for crypto wallet security, Ethereum is well-positioned to continue to grow and innovate in the years to come.

Optimize your Cointribune experience with our “Read to Earn” program! Earn points for each article read and access exclusive rewards. Sign up now and start earning benefits.

Click here to join “Read to Earn” and turn your passion for crypto into rewards!

Eddy S.

The world is changing and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in everything that is closely or remotely related to blockchain and its derivatives. To share my experience and promote a field that fascinates me, there is nothing better than writing informative and relaxed articles.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be considered investment advice. Do your own research before making any investment decision.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!