Bitcoin

Where will Bitcoin be in 5 years?

It would take more than a few minutes to find an asset that has produced a better return over the past five years than Bitcoin (CRYPTO: BTC). During this period, the world’s most valuable cryptocurrency soared by 1,000%. For comparison purposes, heavy technology Nasdaq-100 the index rose 128% during this period.

Bitcoin has performed fantastically over the last year and a half in particular. But things are cooling down as the price is 13% below the peak price (on the morning of May 5th). Investors are likely viewing this as a potential buying opportunity.

If we look at the next five years, where could Bitcoin be?

A unique asset

I think Bitcoin’s main value proposition is that it is a scarce asset. There will only be 21 million coins in circulation, with a scheduled inflation rate that has yet to change in Bitcoin’s roughly 15-year history. As demand for a fixed asset increases, so does the price.

This is in stark contrast to Bitcoin’s main competitor, fiat currencies. Thanks to irresponsible fiscal and monetary policies, especially in the USA, these currencies are constantly losing their purchasing power. Bitcoin’s structure seeks a more controlled solution.

Another factor driving the price of Bitcoin is the advent of a more robust financial services infrastructure. The most recent development in this regard was the approval of spot ETF products in January. So far, these have been largely successful in driving capital flows into Bitcoin. Furthermore, the Securities and Exchange Commission’s decision to approve ETFs can be seen as a regulatory stamp of approval.

There are many companies, from Wall Street banks to scrappy start-ups, all working on different Bitcoin-related products and services. Therefore, it is easy to believe that this asset will reach more portfolios over time.

I am quite confident that in five years the price of Bitcoin could be double what it is today. However, if history is any indication, this may prove to be a very conservative perspective.

Risks to take into account

After learning about some of Bitcoin’s features, it’s hard not to be optimistic. This is a special asset worth owning. And I believe this has significant advantages in the long term. However, investors also need to be aware of any risks.

The main risk factor is that the US government bans Bitcoin within its borders, essentially making it illegal to own or mine the cryptocurrency. This would essentially leave out a huge pool of capital, resulting in weaker demand for Bitcoin. But as the value of Bitcoin continues to rise, and more people from the wealthy and political class begin to own it, the possibility of an outright ban diminishes.

The story continues

Another risk that we cannot ignore is of a more technical nature. Perhaps an approved update to the Bitcoin blockchain will create a software bug that exposes everyone’s private keys, rendering the network useless. Or progress towards quantum computing allows Bitcoin’s encryption to be broken, again undermining the security of the network.

But to help alleviate these potential threats, it’s best to realize that Bitcoin nodes will not approve any updates that could cause havoc. And when it comes to quantum computing, there is a high probability that Bitcoin developers will come up with a way to strengthen the security of the network.

Once you understand these risks, you can set more realistic expectations. While I don’t believe Bitcoin’s returns over the next five years will be similar to the last five years, it’s definitely worth taking a closer look at this cryptocurrency for your own portfolio. Just remember to maintain a long-term mindset and be prepared for the inevitable ups and downs.

Should you invest $1,000 in Bitcoin right now?

Before buying Bitcoin shares, consider the following:

The Motley Fool Stock Advisor analyst team just identified what they believe is the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 6, 2024

Neil Patel and its clients do not have a position in any of the stocks mentioned. The Motley Fool has positions and recommends Bitcoin. The motley fool has a disclosure policy.

Where will Bitcoin be in 5 years? was originally published by The Motley Fool

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

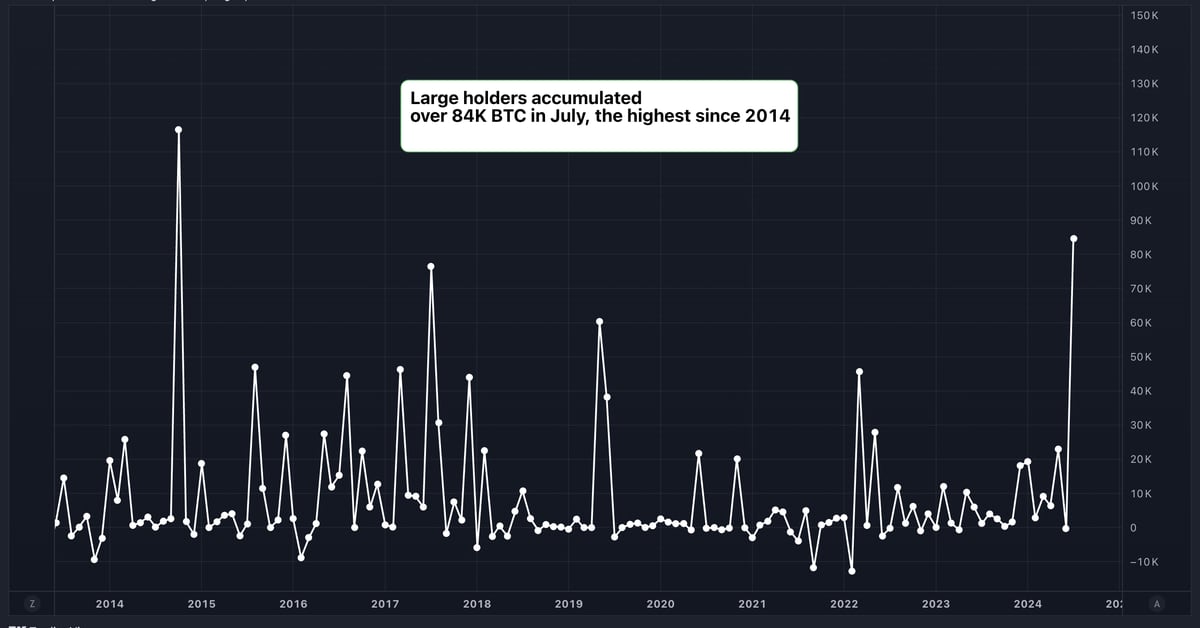

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!