Tech

Bitcoin Set to Turn Bullish in July Based on Historical Performance

After a disappointing performance in June, Bitcoin could recover significantly in July, based on historical price trends.

BTC lost nearly 7% of its gains in June as sellers dominated the market. Tracing Bitcoin’s price pattern since 2013, Coinglass data reveals that historically the average price of Bitcoin has dropped by 0.35% in June.

The data also revealed that every time Bitcoin closed June lower in previous years, it posted a massive rally in July, averaging 7.4% gains. Upon further analysis, Coinglass revealed that Bitcoin has posted monthly gains of at least 8% in seven of the last eleven July trading periods in previous years.

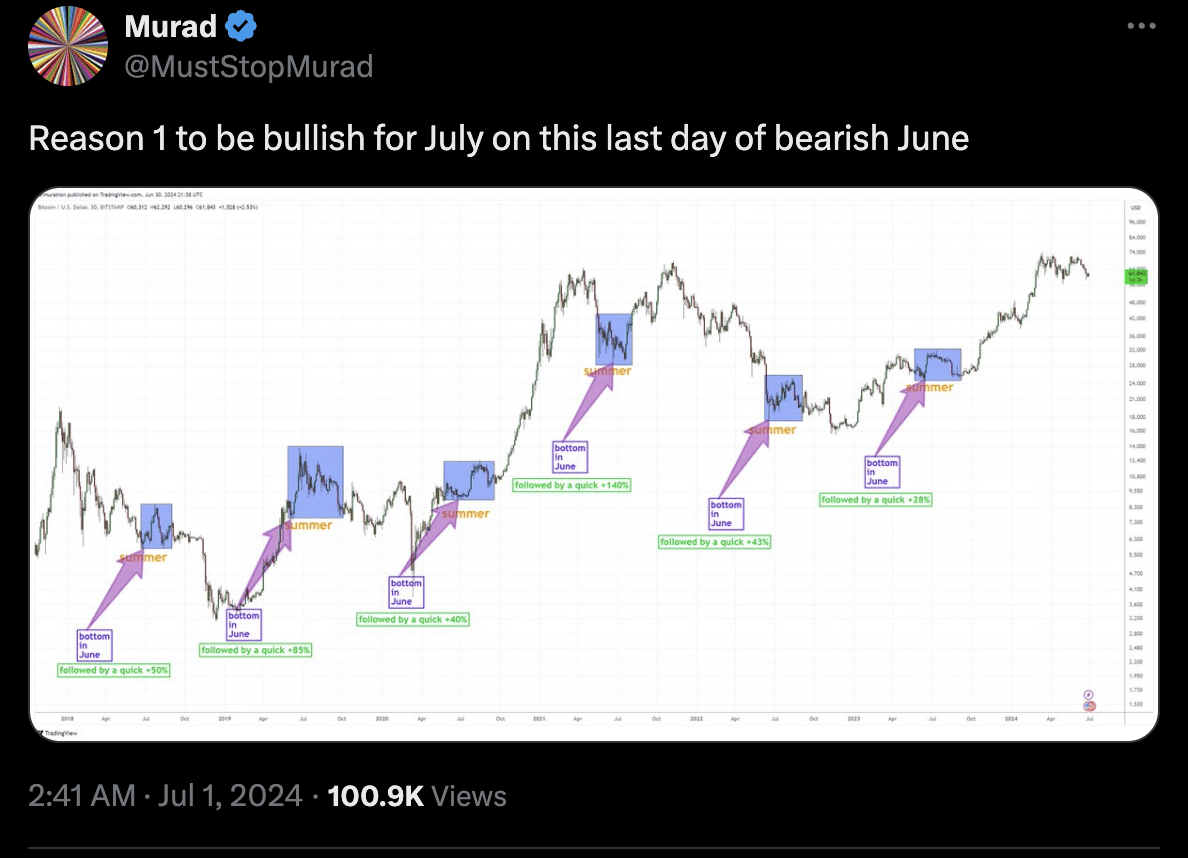

Cryptocurrency Analyst Believes Bitcoin Will Repeat Historic Bounce

Cryptocurrency Analyst Murad He also considered the significant historical rebounds of Bitcoin in July. The analyst noted that BTC has seen minimum gains of 28% in the first weeks of July for six consecutive years. Hence, he believes that Bitcoin will repeat a similar pattern this July.

However, other cryptocurrency analysts believe that this July could be a bearish trend due to the German the recent government sale of BTC tokens.

Furthermore, the planned Mount Gox The refunds, which will return $8.5 billion worth of BTC tokens to creditors starting in the first week of July, could put pressure on BTC supply and force a price drop. However, other analysts suggest that the impact of these Mt. Gox refunds may not be much.

Meanwhile, cryptocurrency analyst Ali Martinez supported the claim that Bitcoin often bounces in July after a negative performance in June. His analysis of Bitcoin’s historical performance revealed that Bitcoin had shown an average return of 7.98% and a median return of 9.60 in July.

Also, billionaire investor and financial expert Robert Kiyosaki was quite bullish in his early June assessment of the price of Bitcoin. He predicted that BTC could rise to $350,000 by August 25.

How is Bitcoin doing?

Bitcoin has recovered from the lows of $59,950 to trade above the $60,000 price level. Bitcoin bids increased on June 30 as the weekly, monthly and quarterly candlesticks approached their close.

According to Daan Crypto on June 29 X sendBitcoin has seen over $500 million in supply, with open interest rising significantly, indicating growing interest from investors.

BTC has formed three consecutive green candles on the daily chart as buyers begin to rally in July. BTC has flipped the $62,500 resistance level into support and the long upper wick on today’s candle shows increased buying pressure.

Bitcoin is facing resistance at the $63,800 price level as buyers continue to force a recovery rally. The candle is approaching the middle band of the Donchian Channel (DC) and a break above this band will confirm the uptrend.

Furthermore, the RSI indicator has risen from the oversold region to the neutral zone with a value of 44.37, confirming the entry of buyers into the market. Hence, Bitcoin is likely to break out of the $63,800 resistance level in the coming days if buyers maintain their momentum.

However, cryptocurrency prices are highly volatile, often changing course unexpectedly. Therefore, it is advisable to apply appropriate risk management techniques, such as lot size management.

Disclaimer: The views expressed in this article do not constitute financial advice. We encourage readers to conduct their own research and determine their own risk tolerance before making any financial decisions. Cryptocurrency is a highly volatile and high-risk asset class.

The technical report editorial policy is focused on providing useful and accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge of the topics they cover, including the latest developments in technology, online privacy, cryptocurrency, software, and more. Our editorial policy ensures that every topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards and every article is 100% written by real authors.