News

Blockchain May Solve the Cross-Border Payments Puzzle

With a market projection of $290 trillion by 2030, cross-border payments are the backbone of global commerce. Despite their critical importance, however, these transactions are frequently riddled with friction. According to a recent PYMNTS Intelligence survey, the failure rate for cross-border payments approaches 11%, accounting for $3.8 billion in lost sales in 2023 alone. Traditionally facilitated by financial institutions (FIs) through a complicated network of correspondent banks and clearinghouses, cross-border payments currently suffer from long processing times, high fees and a lack of transparency.

Blockchain could significantly increase cross-border payments’ speed and reduce fees by removing intermediaries, while its ledger technology ensures transparency with verifiable records. Blockchain’s high throughput, low fees and 24-hour availability could remove much of the friction of cross-border transactions, making each one as easy as sending a Venmo payment.

Blockchain payment adoption nevertheless has faced challenges. A 2024 consumer sentiment survey revealed that 44% of non-owners said they would never purchase blockchain-based currencies, with 40% naming unstable value as their greatest concern. These concerns have recently been mitigated with the growth of stablecoins that are pegged 1:1 with the United States dollar (USD).

Crucially, moreover, what once drew institutional skepticism has matured into a technically sound, credible solution to the shortcomings of traditional payment rails, with new USD-denominated assets allaying any worries about cryptocurrency fluctuations. Leading global financial players are now pioneering blockchain-based payment initiatives that are laying the groundwork for a new era in the digital-first global economy. The question is no longer whether blockchain can turbocharge cross-border payments but instead how quickly FIs and central banks can integrate the technology into their financial ecosystems.

Frustration Station: The Hurdles of Traditional Rails

High fees, slow settlement times and a lack of transparency on traditional payment rails are crippling cross-border commerce, costing businesses that depend on international sales time, money and trust.

Intermediaries add layers of friction to cross-border payments.

Traditional payment rails have long made cross-border payments a minefield of friction and frustration. Intermediary networks, diverse regulatory regimes and currency-exchange volatility are the omnipresent middlemen hampering the seamless flow of transnational commerce. Consumer cross-border payments of as little as $200 are subject to bank processing fees averaging more than 11%. Add in the rampant issues of fraud and a lack of transparency throughout the process, and the result is the payments equivalent of old steam locomotives operating in the age of bullet trains.

B2B cross-border payments take a bite out of businesses’ profits.

Traditional payment rails are a particular problem for business-to-business (B2B) cross-border payments. A fee structure that siphons an average 1.5% from these transactions along with processing timelines that can drag on for weeks are thorns in the side of international commerce. According to recent PYMNTS Intelligence research, nearly half of Citibank corporate clients see high cost as a top pain point in making cross-border payments, and 59% say the same about slow speed. In a digital age that waits for no one, businesses can no longer afford the sluggish and costly burden of legacy cross-border payment systems.

Why do cross border payments fail so often?

Another issue is the black box presented by traditional rails when it comes to understanding cross-border payments’ high failure rate. In 2023, 82% of eCommerce firms in the United States were unable to pinpoint why payments failed, accounting for an estimated $3.8 billion in lost sales. More than two-thirds of merchants said that regaining customer trust after a failed payment was virtually impossible. This means that cross-border payments’ average failure rate of nearly 11% is jeopardizing the viability of the more than one-third of merchants that rely heavily on international sales.

The Blockchain Alternative for Payments Across Borders

By eliminating intermediaries and providing verifiable records via distributed ledger technology, blockchain-based payments offer a leaner, more efficient and more transparent cross-border payments solution.

Blockchain streamlines cross-border payments.

80%

Estimated potential cost savings from using permissioned DeFi in cross-border payments

Blockchain is an example of a distributed ledger technology (DLT), a secure means of conducting, recording and storing transfers of digital assets that obviates the need for a central authority, such as a correspondent bank. DLT is “distributed” because far-flung participants all share copies of the ledger. In the case of blockchain, new transactions are added in “blocks” that are cryptographically secured, permanent and linked to previous blocks in a “chain.” Examples of DLTs include Ethereum and Solana, the latter being designed for payment use cases by focusing on speed, cost and throughput.

By facilitating direct transactions without the need for intermediary banks and authorities, blockchain-based payments cut through the complexities that inflate costs and prolong times along traditional payment rails. Consequently, payments can zip across borders in seconds rather than days, and fees plummet. In addition, blockchain features such as automated recordkeeping and self-executing smart contracts that handle currency conversions and regulatory compliance guarantee payments’ transparency and seamlessness. These features are poised to alter the fundamental fabric of cross-border commerce.

Stablecoins could become the go-to currency for cross-border payments.

In the popular conception, blockchain technology is often conflated with cryptocurrencies, such as Bitcoin and Ethereum — digital currencies that are subject to notorious fluctuations in value. In reality, however, blockchain is a storage technology for data on decentralized networks, whereas cryptocurrency is a medium of exchange that uses blockchain as its transaction ledger. One of the obstacles to blockchain’s adoption for cross-border payments has been the volatility of well-known digital currencies, which has instilled misgivings in business stakeholders who otherwise have much to gain from a blockchain-based cross-border payments system.

Blockchain, however, is not wedded to any single digital currency. Stablecoins, for example, represent a digital asset that is as stable as the U.S. dollar. By having their value pegged to fiat currencies, stablecoins reduce the risk of volatility for both senders and receivers in cross-border transactions. This makes them a strong candidate for this use case. The adoption of stablecoins is significant, with Visa reporting the transfer of several trillion dollars’ worth of the currency every month. Moreover, tokenization, the conversion of traditional financial assets into digital tokens on a blockchain, is another payment strategy being pursued. Blockchain’s capacity to serve as the transactional infrastructure for any number of digital assets on the back end — whether stablecoins, digital tokens or others — means that users ultimately may need never see anything other than fiat currency in their transactions.

Permissioned DeFi raises the bar for cross-border payments security.

Some blockchain-based models offer greater advantages for cross-border payments than others. One key difference between distributed ledgers is whether they are “permissioned” or “unpermissioned.” Unpermissioned ledgers are generally public, allowing any participant to conduct transactions and thus possibly placing them at greater risk for fraud — another argument that has deterred adoption of blockchain at scale for these payments.

Permissioned ledgers, on the other hand, admit only trusted users to transact, still instantly or in near real time. Fusing know your customer (KYC) protocols with the efficiencies of blockchain raises the cost-effectiveness of cross-border payments to a level that legacy payment rails cannot rival. The Boston Consulting Group recently estimated that permissioned decentralized finance (DeFi), as this model is called, could reduce cross-border transaction costs by up to 80% compared to those on traditional rails.

There are new hybrid solutions that offer all the controls of a permissioned network on an unpermissioned ledger. As a specific example, the Solana blockchain allows asset issuers to create digital assets or tokens using a standard called “token extensions” that have built-in controls over transfers, reversibility and accessibility. This standard allows regulated entities to issue and transact with digital assets with full control over how those assets move and are used.

On the Vanguard of Blockchain-Based Cross-Border Payments

Top-tier FIs, FinTechs and central banks are all leading bold initiatives to harness blockchain’s potential to electrify cross-border payments and commerce.

Visa, Shopify and PayPal are trialing stablecoin rails for cross-border payments.

With a market capitalization topping $150 billion and an annualized transfer value soaring to $7 trillion in Q1 2024, stablecoins are experiencing explosive adoption for cross-border payments — and big players are getting on board. Both Visa and Shopify have teamed up with blockchain platform Solana to pilot the use of stablecoins for cross-border payments, marking significant strides toward mainstream acceptance.

Similarly, PayPal’s cross-border money service Xoom recently began allowing users to make transactions with PayPal’s USD stablecoin, indicating the broadening appeal of this usage beyond blockchain enthusiasts. The Solana network processed $1.4 trillion in stablecoin cross-border payments in March alone — a testament to the technology’s scalability.

Banking giants helped break ground on blockchain’s use for the industry.

J.P. Morgan has been at the forefront of the movement to leverage blockchain to improve banking processes and was the first major U.S. bank to introduce its own digital token, JPM Coin, for use back in 2019.

Most recently, J.P. Morgan joined with Thailand’s Kasikornbank to launch Project Carina. This blockchain-based payments initiative utilizes JPM Coin and Q-money — Thai Baht eMoney on blockchain — to reduce transaction settlement times from 72 hours to just five minutes 24/7 year-round. The project is slated to begin piloting cross-border transactions in May 2024.

Central banks are orchestrating a blockchain-based revolution of their own.

With a spotlight on progress, central banks — including the Federal Reserve Bank of New York and the Bank of England — are spearheading initiatives to streamline cross-border payments through the use of blockchain technologies. The Bank for International Settlements (BIS) has partnered with seven central banks on Project Agorá — a collaborative push to test the pairing of tokenized commercial bank deposits with tokenized wholesale central bank money on a public-private programmable financial platform.

They are not alone. Forty-one percent of central banks globally are eyeing the launch of a central bank digital currency (CBDC) by 2028, with 31% naming CBDCs the most promising means for improving cross-border payments.

A 3,500-mile blockchain handshake made history.

Earlier this year, the United Arab Emirates sent its first cross-border payment via the country’s CBDC, the Digital Dirham. The historic 3,500-mile payment to China via the mBridge platform was a major endorsement of blockchain’s potential for institutional cross-border payments, shaving costs by 50% and trimming transaction time to seven seconds.

Leveraging the Power of Blockchain for International Commerce

For too long, cross-border payments have been shackled by high costs, slow settlement times and the lack of transparency inherent to the traditional payment rails over which they run. This friction imposes a punitive burden on businesses operating in multiple markets.

The recent blockchain initiatives across the institutional spectrum illustrate growing public and private confidence in the technology, suggesting that blockchain-based cross-border payments are transitioning from experimental to essential. The broader integration of these technologies into financial ecosystems has profound implications for competitive dynamics.

PYMNTS Intelligence offers the following actionable roadmap for businesses engaged in cross-border commerce:

- Partner with a FinTech to leverage blockchain-based payments. Integrate an advanced blockchain payment platform for businesses that simplifies cross-border payment processing and facilitates seamless digital-to-fiat currency conversion, ensuring a streamlined cross-border payments experience.

- Offer stablecoin payment options. Utilize payment platforms to incorporate stablecoins into your business’s payment system. Doing so offers cross-border customers a fast, dependable and cost-effective alternative to traditional payment rails that boosts transaction speed and lowers currency-exchange risks.

- Adopt permissioned DeFi platforms for cross-border B2B payments. Implement business-friendly permissioned DeFi solutions that automate and secure B2B transactions through smart contracts. These solutions diminish reliance on traditional payment rails, accelerate payment cycles and significantly bolster transaction security and transparency.

- Educate customers. Develop comprehensive informational resources, such as guides, FAQs and tutorials, to inform customers about the benefits of blockchain-based cross-border payments and empower them to use these innovative payment solutions with confidence when conducting business with you.

- Advocate for blockchain-based solutions with banks and FIs. Proactively communicate with banks and FIs about your interest in blockchain-based cross-border payment solutions. Highlight the advantages these solutions would bring to your business. Advocacy can accelerate industry change and encourage more banks and FIs to adopt and support this next-generation cross-border payments technology.

The inefficiencies of traditional payment rails are no longer the inevitable cost of international commerce. Blockchain-based alternatives promise businesses a new chapter of secure, fast and inexpensive cross-border payments.

News

Terra Can’t Catch a Break as Blockchain Gets $6 Million Exploited

The attack, which exploited a vulnerability disclosed in April, drained around 60 million ASTRO tokens, sending the price plummeting.

The Terra blockchain has been exploited for over $6 million, forcing developers to take a momentary break the chain.

Beosin Cyber Security Company reported that the protocol lost 60 million ASTRO tokens, 3.5 million USDC, 500,000 USDT, and 2.7 BTC or $180,000.

Terra developers paused the chain on Wednesday morning to apply an emergency patch that would address the attack. Moments later, a 67% majority of validators upgraded their nodes and resumed block production.

The ASTRO token has plunged as much as 75%. It is now trading at $0.03, a 25% decline on the day. Traders who took advantage of the drop are now on 195%.

The vulnerability that took down the Cosmos-based blockchain was disclosed in April and involved the deployment of a malicious CosmWasm contract. It opened the door to attacks via what is called an “ibc-hooks callback timeout reentrancy vulnerability,” which is used to invoke contracts and enable cross-chain swaps.

Terra 2.0 also suffered a massive drop in total value locked (TVL) in April, shortly after the vulnerability was discovered. It plunged 80% to $6 million from $30 million in TVL and has since lost nearly half of that value, currently sitting at $3.9 million.

The current Earth chain emerged from the rubble as a hard fork after the original blockchain, now called Terra Classic, collapsed in 2022. Terra collapsed after its algorithmic stablecoin (UST) lost its peg, causing a run on deposits. More than $50 billion of UST’s market cap was wiped out in a matter of days.

Terraform Labs, the company behind the blockchain, has been slowly unravelling its legal woes since its mid-2022 crash. Founder Do Kwon awaits sentencing in Montenegro after he and his company were found liable for $40 billion in customer funds in early April.

On June 12, Terraform Labs settled with the SEC for $4.4 billion, for which the company will pay about $3.59 billion plus interest and a $420 million penalty. Meanwhile, Kwon will pay $204.3 million, including $110 million in restitution, interest and an $80 million penalty, a court filing showed.

News

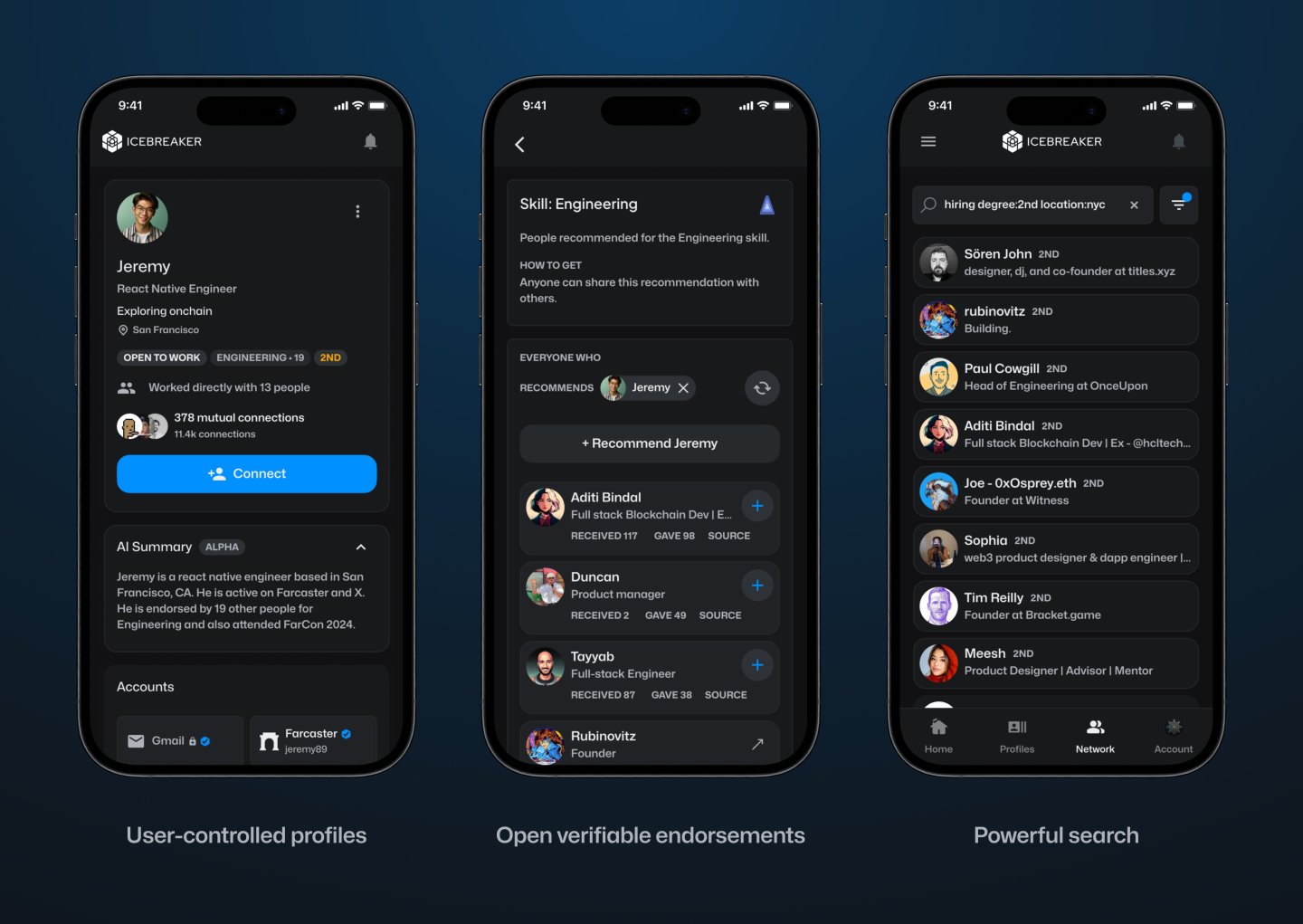

Google and Coinbase Veterans Raise $5M to Build Icebreaker, Blockchain’s Answer to LinkedIn

Icebreaker: Think LinkedIn but on a Blockchain—announced Wednesday that it has secured $5 million in seed funding. CoinFund led the round, with participation from Accomplice, Anagram, and Legion Capital, among others.

The company, which is valued at $21 million, aims to become the world’s first open-source network for professional connections. Its co-founders, Dan Stone and Jack Dillé, come from Google AND Monetary base; Stone was a product manager at the cryptocurrency giant and also the co-creator of Google’s largest multi-identity measurement and marketing platform, while Dillé was a design manager for Google Working area.

The pair founded Icebreaker on the shared belief that the imprint of one’s digital identity (and reputation) should not be owned by a single entity, but rather publicly owned and accessible to all. Frustrated that platforms like LinkedIn To limit how we leverage our connections, Dillé told Fortune he hopes to remove paywalls and credits, which “force us to pay just to browse our network.” Using blockchain technology, Icebreaker lets users transfer their existing professional profile and network into a single, verified channel.

“Imagine clicking the login button and then seeing your entire network on LinkedIn, ChirpingFarcaster and email? Imagine how many introductions could be routed more effectively if you could see the full picture of how you’re connected to someone,” Stone told Fortune.

Users can instantly prove their credentials and provide verifiable endorsements for people in their network. The idea is to create an “open graph of reputation and identity,” according to the founders. They hope to challenge LinkedIn’s closed network that “secures data,” freeing users to search for candidates and opportunities wherever they are online. By building on-chain, the founders note, they will create a public ledger of shared context and trust.

Verified channels are now launched for

Chirping

Online Guide

Wallet

Discord

Telephone

TeleporterYou can find them in Account -> Linked Accounts Italian: https://t.co/mRDyuWW8O2

— Icebreaker (@icebreaker_xyz) April 3, 2024

“Digital networking is increasingly saturated with noise and AI-driven fake personas,” the founders said in a statement. For example: Dillé’s LinkedIn headline reads “CEO of Google,” a small piece of digital performance art to draw attention to unverifiable information on Web2 social networks that can leave both candidates and recruiters vulnerable to false claims.

“Icebreaker was created to enable professionals to seamlessly tap into their existing profiles and networks to surface exceptional people and opportunities, using recent advances in cryptographically verifiable identity,” the company said, adding that the new funding will go towards expanding its team and developing products.

“One of the next significant use cases for cryptocurrency is the development of fundamental social graphs for applications to leverage… We are proud to support Dan, Jack and their team in their mission to bring true professional identity ownership to everyone online,” said CoinFund CIO Alex Felix in a statement.

Learn more about all things cryptocurrency with short, easy-to-read flashcards. Click here to Fortune’s Crash Course in Cryptocurrency.

Fuente

News

Luxembourg proposes updates to blockchain laws | Insights and resources

On July 24, 2024, the Ministry of Finance proposed Blockchain Bill IVwhich will provide greater flexibility and legal certainty for issuers using Distributed Ledger Technology (DLT). The bill will update three of Luxembourg’s financial laws, the Law of 6 April 2013 on dematerialised securitiesTHE Law of 5 April 1993 on the financial sector and the Law of 23 December 1998 establishing a financial sector supervisory commissionThis bill includes the additional option of a supervisory agent role and the inclusion of equity securities in dematerialized form.

DLT and Luxembourg

DLT is increasingly used in the financial and fund management sector in Luxembourg, offering numerous benefits and transforming various aspects of the industry.

Here are some examples:

- Digital Bonds: Luxembourg has seen multiple digital bond issuances via DLT. For example, the European Investment Bank has issued bonds that are registered, transferred and stored via DLT processes. These bonds are governed by Luxembourg law and registered on proprietary DLT platforms.

- Fund Administration: DLT can streamline fund administration processes, offering new opportunities and efficiencies for intermediaries, and can do the following:

- Automate capital calls and distributions using smart contracts,

- Simplify audits and ensure reporting accuracy through transparent and immutable transaction records.

- Warranty Management: Luxembourg-based DLT platforms allow clients to swap ownership of baskets of securities between different collateral pools at precise times.

- Tokenization: DLT is used to tokenize various assets, including real estate and luxury goods, by representing them in a tokenized and fractionalized format on the blockchain. This process can improve the liquidity and accessibility of traditionally illiquid assets.

- Tokenization of investment funds: DLT is being explored for the tokenization of investment funds, which can streamline the supply chain, reduce costs, and enable faster transactions. DLT can automate various elements of the supply chain, reducing the need for reconciliations between entities such as custodians, administrators, and investment managers.

- Issuance, settlement and payment platforms:Market participants are developing trusted networks using DLT technology to serve as a single source of shared truth among participants in financial instrument investment ecosystems.

- Legal framework: Luxembourg has adapted its legal framework to accommodate DLT, recognising the validity and enforceability of DLT-based financial instruments. This includes the following:

- Allow the use of DLT for the issuance of dematerialized securities,

- Recognize DLT for the circulation of securities,

- Enabling financial collateral arrangements on DLT financial instruments.

- Regulatory compliance: DLT can improve transparency in fund share ownership and regulatory compliance, providing fund managers with new opportunities for liquidity management and operational efficiency.

- Financial inclusion: By leveraging DLT, Luxembourg aims to promote greater financial inclusion and participation, potentially creating a more diverse and resilient financial system.

- Governance and ethics:The implementation of DLT can promote higher standards of governance and ethics, contributing to a more sustainable and responsible financial sector.

Luxembourg’s approach to DLT in finance and fund management is characterised by a principle of technology neutrality, recognising that innovative processes and technologies can contribute to improving financial services. This is exemplified by its commitment to creating a compatible legal and regulatory framework.

Short story

Luxembourg has already enacted three major blockchain-related laws, often referred to as Blockchain I, II and III.

Blockchain Law I (2019): This law, passed on March 1, 2019, was one of the first in the EU to recognize blockchain as equivalent to traditional transactions. It allowed the use of DLT for account registration, transfer, and materialization of securities.

Blockchain Law II (2021): Enacted on 22 January 2021, this law strengthened the Luxembourg legal framework on dematerialised securities. It recognised the possibility of using secure electronic registration mechanisms to issue such securities and expanded access for all credit institutions and investment firms.

Blockchain Act III (2023): Also known as Bill 8055, this is the most recent law in the blockchain field and was passed on March 14, 2023. This law has integrated the Luxembourg DLT framework in the following way:

- Update of the Act of 5 August 2005 on provisions relating to financial collateral to enable the use of electronic DLT as collateral on financial instruments registered in securities accounts,

- Implementation of EU Regulation 2022/858 on a pilot scheme for DLT-based market infrastructures (DLT Pilot Regulation),

- Redefining the notion of financial instruments in Law of 5 April 1993 on the financial sector and the Law of 30 May 2018 on financial instruments markets to align with the corresponding European regulations, including MiFID.

The Blockchain III Act strengthened the collateral rules for digital assets and aimed to increase legal certainty by allowing securities accounts on DLT to be pledged, while maintaining the efficient system of the 2005 Act on Financial Collateral Arrangements.

With the Blockchain IV bill, Luxembourg will build on the foundations laid by previous Blockchain laws and aims to consolidate Luxembourg’s position as a leading hub for financial innovation in Europe.

Blockchain Bill IV

The key provisions of the Blockchain IV bill include the following:

- Expanded scope: The bill expands the Luxembourg DLT legal framework to include equity securities in addition to debt securities. This expansion will allow the fund industry and transfer agents to use DLT to manage registers of shares and units, as well as to process fund shares.

- New role of the control agent: The bill introduces the role of a control agent as an alternative to the central account custodian for the issuance of dematerialised securities via DLT. This control agent can be an EU investment firm or a credit institution chosen by the issuer. This new role does not replace the current central account custodian, but, like all other roles, it must be notified to the Commission de Surveillance du Secteur Financier (CSSF), which is designated as the competent supervisory authority. The notification must be submitted two months after the control agent starts its activities.

- Responsibilities of the control agent: The control agent will manage the securities issuance account, verify the consistency between the securities issued and those registered on the DLT network, and supervise the chain of custody of the securities at the account holder and investor level.

- Simplified payment processesThe bill allows issuers to meet payment obligations under securities (such as interest, dividends or repayments) as soon as they have paid the relevant amounts to the paying agent, settlement agent or central account custodian.

- Simplified issuance and reconciliationThe bill simplifies the process of issuing, holding and reconciling dematerialized securities through DLT, eliminating the need for a central custodian to have a second level of custody and allowing securities to be credited directly to the accounts of investors or their delegates.

- Smart Contract Integration:The new processes can be executed using smart contracts with the assistance of the control agent, potentially increasing efficiency and reducing intermediation.

These changes are expected to bring several benefits to the Luxembourg financial sector, including:

- Fund Operations: Greater efficiency and reduced costs by leveraging DLT for the issuance and transfer of fund shares.

- Financial transactions: Greater transparency and security.

- Transparency of the regulatory environment: Increased attractiveness and competitiveness of the Luxembourg financial centre through greater legal clarity and flexibility for issuers and investors using DLT.

- Smart Contracts: Potential for automation of contractual terms, reduction of intermediaries and improvement of transaction traceability through smart contracts.

Blockchain Bill IV is part of Luxembourg’s ongoing strategy to develop a strong digital ecosystem as part of its economy and maintain its status as a leading hub for financial innovation. Luxembourg is positioning itself at the forefront of Europe’s growing digital financial landscape by constantly updating its regulatory framework.

Local regulations, such as Luxembourg law, complement European regulations by providing a more specific legal framework, adapted to local specificities. These local laws, together with European initiatives, aim to improve both the use and the security of projects involving new technologies. They help establish clear standards and promote consumer trust, while promoting innovation and ensuring better protection against potential risks associated with these emerging technologies. Check out our latest posts on these topics and, for more information on this law, blockchain technology and the tokenization mechanism, do not hesitate to contact us.

We are available to discuss any project related to digital finance, cryptocurrencies and disruptive technologies.

This informational piece, which may be considered advertising under the ethics rules of some jurisdictions, is provided with the understanding that it does not constitute the rendering of legal or other professional advice by Goodwin or its attorneys. Past results do not guarantee a similar outcome.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!

ASTRO Price

ASTRO Price