Bitcoin

Crypto Catches M&A Frenzy as Bitcoin Miners Chase AI Boom

Whinstone CEO Chad Harris takes CNBC on a tour of North America’s largest bitcoin mine.

Meanwhile, mining companies need to diversify. Following the bitcoin halving In April, an event that happens roughly once every four years, the business of generating new tokens became much less profitable. JPMorgan Chase analysts wrote in a report earlier this month that “some traders are feeling the financial pinch from the recent block reward halving, which cut industry revenues in half, and are actively exploring exit strategies.”

With the burgeoning AI industry in need of capacity and bitcoin miners looking for new ways to generate returns on their hefty capital investments, mergers, financings and partnerships are coming together quickly.

On Tuesday, US bitcoin miner Scientific Center announced an expanded agreement with CoreWeaveone NvidiaThe backed startup is one of the chipmaker’s main suppliers of technology for running AI models. Core Scientific will provide 70 megawatts of computing infrastructure to support CoreWeave’s operations.

Scientific Center said the agreement The deal will generate an additional $1.2 billion in revenue over 12 years, in addition to an existing deal expected to generate $3.5 billion. In total, the company plans to deliver approximately 270 megawatts of infrastructure to CoreWeave by the second half of 2025, with the possibility of adding an additional 230 megawatts to other Core Scientific facilities.

Earlier this month, CoreWeave offered to buy Core Scientific for $1.02 billion, not long after the initial deal. Core Scientific rejected the offer. The company, which returned to the public market in January, after going through bankruptcy, it is currently worth about $1.8 billion.

“The world is changing, and many data centers built in the last 20 years are not well-suited to support future computing requirements,” Core Scientific CEO Adam Sullivan said in Tuesday’s press release.

A day before this announcement, bitcoin mining group Hut 8 said this raised $150 million in debt from private equity firm Coatue to help develop your data center portfolio for AI.

Cabin 8based in Miami, is one of many cryptocurrency mining companies that are moving towards AI. The company said in its first quarter earnings report last month that it had purchased its first batch of 1,000 graphics processing units (GPUs) from Nvidia and secured a customer deal with a venture capital-backed AI cloud platform. Hut 8 generates 6% of sales with AI, according to CoinShares.

“The broader market is beginning to appreciate the scarcity of high-quality energy assets, and Hut 8 has built a deep pipeline of highly attractive expansion assets,” Coatue partner Robert Yin said in the funding announcement.

Cabana 8 CEO Asher Genoot recently told CNBC that his company has “finalized commercial agreements for our new AI segment under a GPU-as-a-service model, including a customer agreement that provides for fixed infrastructure payments in addition to revenue sharing.”

Bit Digital, a bitcoin mining company that now derives about 27% of its revenue from AI, he said on Monday that it had reached a deal with a customer to supply 2,048 Nvidia GPUs over three years, doubling the number of processors it supplies to the unspecified customer.

To fulfill the contract, Bit Digital ordered 256 servers from Dell Technologies, and will soon deploy them in a data center in Iceland. The company said the contract is expected to generate $92 million in annual revenue. It’s paying for the GPUs, in part, by dumping some cryptocurrencies.

“The company intends to fund the deal with a mix of cash and on-balance sheet digital assets,” Bit Digital said.

Bit Digital has also entered into a so-called sale-leaseback agreement for half of the new GPUs, “which will proportionally reduce the company’s capital outlay.” With the lease, another company owns those GPUs and Bit Digital leases them back, generating revenue by providing the technology to customers.

People wait in line for T-shirts at a pop-up kiosk for online brokerage Robinhood on Wall Street after the company went public with an IPO early July 29, 2021 in New York City.

Spencer Platt | Getty Images

The combined market capitalization of the top 14 U.S.-listed bitcoin miners tracked by JPMorgan hit a record $22.8 billion on June 15 — adding $4.4 billion in just two weeks, according to a June 17 research note from the bank.

The mining space, more broadly, has been going through a period of consolidation. On Thursday, bitcoin miner CleanSpark reached a deal to acquire a rival company GRID for $155 million in an all-stock deal.

GRIID shares plunged more than 50% on news of the deal, after soaring more than 400% ahead of the news amid speculation of a takeover.

And while most recent crypto deals involve miners, there has been at least one major notable exception.

Earlier this month, trading platform Robinhood agreed with a agreement to buy Bitstampa Luxembourg-based cryptocurrency exchange, for around $200 million in cash.

Bitstamp holds 50 active licenses and registrations worldwide and is popular in Europe and Asia. Buying helps Robinhooda retail-focused trading app, bolsters its crypto operation to better take on Binance and Coin base.

The deal, which is expected to close next year, comes as Robinhood faces regulatory challenges in the US over its crypto trading. In May, the company said he received a warning from Wells for their crypto operations. The Securities and Exchange Commission has also sued Coinbase and Binance.

Robinhood had $4.7 billion in cash and cash equivalents at the end of the first quarter. Its shares are up 75% this year.

Don’t miss these insights from CNBC PRO

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

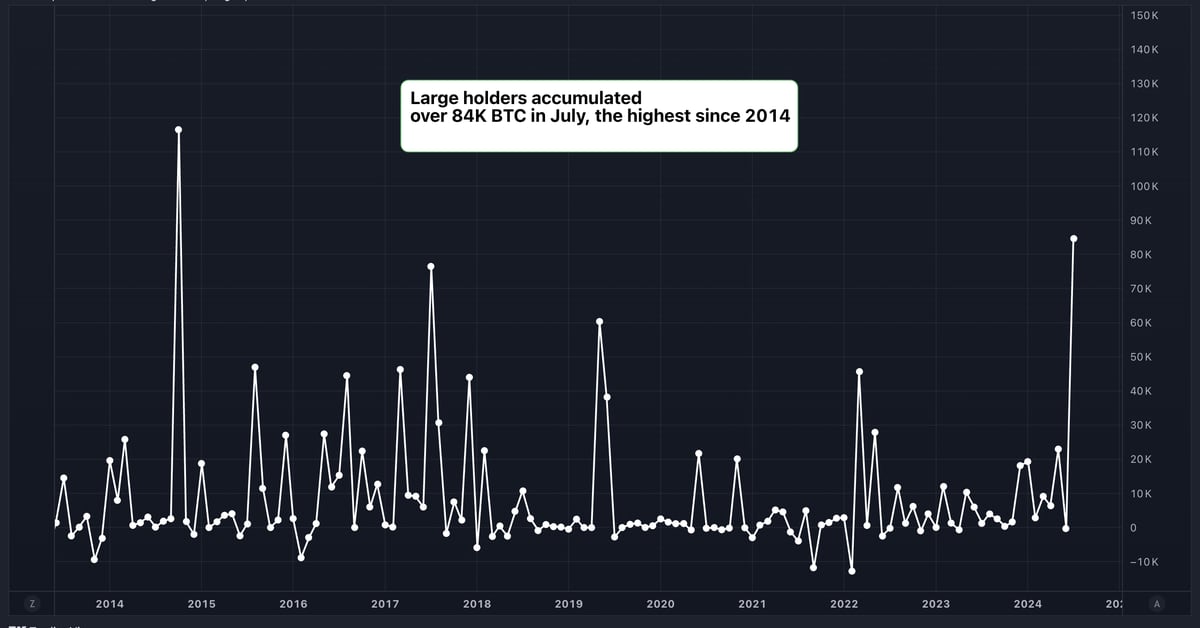

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!