Tech

Crypto politics are already reshaping the 2024 elections.

After the spectacular fall of FTX CEO Sam Bankman-Fried, you might have expected the embattled cryptocurrency sector, and its sophisticated lobbying operations, to have ground to a halt. But if anything, both are back with a vengeance—and the regulatory post-SBF crackdown that followed has spurred the sector to potentially become a major political force in 2024.

A new, unholy alliance has emerged on Capitol Hill, and it’s hoping not just to recraft governmental policy around digital funny money but to push its antiregulatory agenda across a whole host of elections. To do so, the crypto industry is teaming up with the people behind the latest megahyped, bubblicious tech trend: the artificial intelligence boom.

You may already have noticed crypto and tech money swishing around in the 2024 primaries. For the open California Senate seat, crypto-backed super PAC Fairshake splurged $10 million on ads against candidate Katie Porter, whose progressivism and crypto skepticism made her an enemy of the industry. She, of course, would lose. An affiliated PAC, Defend American Jobs, likewise dove into North Carolina’s GOP primaries, throwing half a million to the winning candidate for the 14th Congressional District. That PAC also contributed $3 million on behalf of West Virginia Gov. Jim Justice, who’s far and away the front-runner in his Senate primary and will inevitably succeed Sen. Joe Manchin come 2025.

Another Fairshake affiliate, Protect Progress, has put millions behind candidates who have explicitly expressed their support for the crypto industry. The group blew nearly $2 million to boost Shomari Figures in the Democratic primary for Alabama’s 2nd Congressional District; he ended up winning the April 16 runoff by 22 points. Protect Progress also spent nearly $1 million in support of Julie Johnson, who crushed her opponents in the Dem primary for Texas’ 32nd Congressional District. The competitive primaries of crypto-supporting Democratic Maryland Senate candidates David Trone and Angela Ashbrook have seen a large influx of money from obscurely named crypto PACs like Defend American Jobs.

It’s in not just the electoral sphere but also the messaging being sent directly to current officials. According to CNBC, a dark-money nonprofit called the Cedar Innovation Foundation “is being heavily funded by crypto industry players” and running ads encouraging crypto enthusiasts to request that Ohio Sen. Sherrod Brown loudly oppose Securities and Exchange Commission Chair Gary Gensler; both are considered villains in the crypto world, along with Sens. Elizabeth Warren and Roger Marshall, who’ve likewise been the target of Cedar Innovation ads thanks to their co-sponsorship of the hated Digital Asset Anti–Money Laundering Act. Warren has also been courted by individual blockchain workers hoping to dissuade her from that legislation, and received a letter co-signed by figures from big firms—Coinbase, Andreessen Horowitz, the Blockchain Association—asking the same. A Fairshake spokesperson told Bloomberg that crypto donors will likely be homing in next on the primaries in important states like Michigan and Montana.

To see how we got here, despite all of crypto’s recent travails, it’s worth looking back to the first significant surge in crypto lobbying that occurred throughout 2021, when all aspects of the industry (Bitcoin, alternative currencies, NFTs, the blockchain) gained mainstream exposure, political acceptance, and frenzied valuations as a result of lockdown-fueled interest in virtual economics and get-rich-quick schemes. The then-nascent Biden administration had already turned its attention to crypto regulation, with the SEC lodging its securities charges against Ripple in February of that year—while also approving crypto exchange Coinbase’s request to go public. One of that company’s biggest investors, famed venture capital firm Andreessen Horowitz, lavished its money on other crypto players and launched an aggressive lobbying operation to shield the industry from regulations around tax reporting and money laundering—and, most importantly, to exclude it from SEC oversight. Results came quickly: Prior to its November passage, Biden’s infrastructure bill contained expansive tax-reporting requirements for Bitcoin miners that were significantly weakened by aggressive lobbying (including by Coinbase itself).

The point was to persuade both Biden administration members and members of Congress—from either party—to embrace crypto monkeymakers’ relevant legislative agenda. The clearest examples of this success manifested with Sens. Kirsten Gillibrand and Cynthia Lummis, who were wined and dined by several crypto bigwigs—Grayscale, the Blockchain Association, the Chamber of Digital Commerce, BTC Inc.—and introduced a bill, in the midst of the summer 2022 crypto crashes, that would have achieved lobbyists’ goals of shifting governance away from the SEC and exempting digital assets from certain tax requirements, like capital gains. Other senators who earned cash from SBF put forth a more constrictive bill that likewise placed crypto under the oversight of the Commodity Futures Trading Commission. Congressional representatives who earned the benefits of crypto-lobby largesse, like Republican Patrick McHenry, also gravitated thus.

Then, after FTX’s late-2022 collapse drew additional scrutiny to all the pols who glad-handed with SBF, the enthusiasm for crypto-industry handouts duly subsided. The entire industry, already smarting from the impact of interest rate hikes and the misdeeds of companies (and eager lobbyists) like Terraform Labs and Celsius, seemed ready to back off for a bit, as was made apparent by the 2023 Super Bowl’s conspicuous dearth of crypto ads.

Since the collapse of the FTX empire, the Biden administration has gone after every major crypto firm in existence, notching some significant legal victories along the way—for example, Binance, once the world’s largest crypto exchange, has had its business absolutely crushed by U.S. and international prosecution. (Its former CEO, Changpeng Zhao, was forced to step away from both the company and crypto altogether and just earned a four-month prison sentence.) Just one day after it lodged its own Binance suit, the SEC also sued Coinbase, the largest crypto exchange based in the U.S., for allegedly acting as an unregistered securities institution—a suit that, if successful, could tank Coinbase’s business model for good.

That’s a key sticking point in this fight: the government’s attempt to define many non-Bitcoin currencies, such as Solana, as securities that should be governed as such—not commodities, as Bitcoin is considered thanks to its collective use as a store of value, rather than a proper investment contract and vehicle (which is how securities function).

As the government lawsuits around these classifications began flying in, companies like Coinbase and orgs like the Blockchain Association escalated their lobbying game, playing nice by sweet-talking all manner of lawmakers into re-upping support for their preferred legislation (i.e., stripping the SEC of crypto-governance authority and granting states oversight over dollar-pegged tokens). Coinbase even launched a grassroots advocacy nonprofit called the Stand With Crypto Alliance, which partnered with prominent companies like Gemini and Blockchain.com, organized retail crypto traders to show their support, and produced a bunch of advocacy ads.

In December, three long-shot presidential candidates—Republicans Vivek Ramaswamy and Asa Hutchinson, plus Democrat Dean Phillips—gathered for an event hosted by Stand With Crypto, during which they expressed their support for the industry and promised to reduce aggressive government oversight. None of those guys got too far, of course, but their shared stance was telling as to what crypto lobbyists did expect from other politicians: Potential spoiler Robert F. Kennedy Jr., who has been backed by prominent crypto advocates like former Overstock.com CEO Patrick Byrne, spoke at the 2023 Bitcoin Conference in Miami, and recently proclaimed at a Michigan rally that he would “put the entire U.S. budget on blockchain.” (For whatever it’s worth, even city-level efforts to put certain municipal functions on the blockchain haven’t turned out so great.) Naturally, RFK Jr. has a high candidate rating from Stand With Crypto.

After the Republican-led House Financial Services Committee approved the preferred bills, Stand With Crypto kept bugging Congress to pass the legislation in full and advocated strongly for the crypto-friendly Republican Tom Emmer to replace Kevin McCarthy as House speaker. But that push failed, and the bills fell by the wayside, not least because they faced doubts from skeptical Democrats—including and especially Brown, who has been heading the Senate Banking Committee since 2021. Even an attempt at passing crypto provisions within the defense budget was scuttled. The crypto lobby ended 2023 with a record-breaking spend and little to show for it.

But a pair of court rulings last summer helped crypto companies successfully beat certain charges brought by the SEC. First, the SEC’s suit against Ripple, on which a federal judge ruled that the trading protocol’s sale of its XRP token straight to investors met the definition of a securities transaction—but trades of XRP between investors on a secondary market did not constitute trading in securities. The SEC’s appeal was rejected, although the judge did note that her ruling should not weigh on all digital assets swapped on secondary markets; rather, her legal definition was limited to XRP and XRP alone, leaving a hazy space for the overall altcoins-are-securities argument. The SEC also lost one against the company Grayscale, after an appellate judgment established that the crypto firm could incorporate Bitcoin into a spot exchange-traded fund, essentially allowing investors to trade a security whose financial health has a stake in Bitcoin’s price. The court-mandated SEC approval of several spot Bitcoin ETFs in January is credited with fueling the remarkable comeback (and record heights) Bitcoin’s value has achieved since its 2022 nadir, even as that surge has fallen just a touch.

Another seed of the crypto lobby’s comeback was planted just weeks after SBF’s downfall: the launch of ChatGPT. As the impressive chatbot became one of the fastest-growing apps ever, crypto bros and their financiers noticed the rapid consumer and professional adoption of the technology and realized they had a shot at a natural alliance. The CEO of ChatGPT’s parent company, OpenAI, was also a crypto enthusiast with a stake in the Andreessen Horowitz–backed biometric-crypto project WorldCoin.

Burgeoning A.I. startups and companies also needed massive amounts of infrastructure to handle their resource-intensive tech—and stranded crypto miners had a lot of that lying around, including data centers and cooling systems and energy hookups that companies needed if they wanted to catch up to OpenAI’s progress. Financially hurting digital-asset specialists figured out they could ride investment hype around A.I. by incorporating the tech into crypto processes, and these so-called A.I. tokens have certainly skyrocketed in value, much like every other company having anything to do with A.I. these days. And, hey, SBF’s A.I. investments had turned out to be his single smartest decisions.

But beyond material interests, crypto die-hards and A.I. bulls share something even more essential: a hunger for uninhibited growth and an allergy to regulatory burdens.

You may recall that late last year, OpenAI CEO Sam Altman was briefly ousted from his company after the board expressed its displeasure with Altman’s decisionmaking. This provoked a revolt within OpenAI and among the broader tech world, which perceived Altman’s firing as an unforgivable trespass from A.I. insiders who wished to be more careful, rather than hasty, in developing their tools.

Such “doomers” typically adhered to the philosophies of effective altruism and longtermism, whose followers (including SBF) dedicated themselves to minimizing any risks to human flourishing—including that of runaway, superintelligent A.I. But a rival faction, carrying the mocking banner of effective accelerationism, viewed any and all slowdown in A.I. development as existentially dangerous to the mission of furthering life-changing A.I. that could bring humanity toward new frontiers (and could make its practitioners a lotta money).

Such accelerationists viewed SBF’s criminality as a discredit to effective altruism and marched to the tune of Marc Andreessen’s “Techno-Optimist Manifesto,” which cheered on unimpeded development of all technology—no government interference or regulation, no “doomers” with doubts about efficacy or considerations of social justice, no guardrails around safety. Just let ’em cook, as the kids say. (Andreessen Horowitz has, of course, poured millions upon millions into A.I. as its investments into other ventures have flopped.)

The boldest Bitcoin and crypto advocates, including Coinbase’s Brian Armstrong, have glommed on to this philosophy. And it has changed the way they lobby too.

For one, there’s been a sharp turn to the right. Previous crypto-lobby efforts may have heavily courted both sides of the aisle, but the outrage at the Biden administration’s crypto crackdowns and meekest attempts at crafting A.I. guidelines make it clear that techies desire a wholesale change—one more libertarian and generally hands-off, and one less apt to work with non-centrist Democrats than the effective-altruist A.I. advisers currently dominating (and still lobbying) Washington.

Nitish Pahwa

I Was There When Sam Bankman-Fried Was Found Guilty. I Think I Know Why He Did It.

Read More

Around the same time Coinbase started Stand With Crypto, Armstrong announced that he and his business would be donating to the super PAC Fairshake, which would subsequently launch ads supporting the Republican co-sponsors of Armstrong’s dream House bills (including McHenry, even though he is not seeking reelection).

Fairshake also launched the PACs Protect Progress and Defend American Jobs, and the three share common donors, including Coinbase, Andreessen Horowitz, and Ripple. Notably, per CNBC, rumors have it that Coinbase will also donate to the Cedar Innovation Foundation, the dark-money nonprofit spending against Sens. Brown and Warren (the latter of whom is also facing a long-shot challenge from Republican John Deaton, a former crypto lawyer enjoying a lot of backing from that industry as well as arguing on Coinbase’s behalf before the SEC). Coinbase has also notched some powerful political allies, including former Los Angeles Mayor Antonio Villaraigosa, who recently came on to help advise the firm.

It’s also worth noting that Cedar Innovation has hired a longtime lobbying firm, Mindset Advocacy, whose staffer Charlie Schreiber will be tasked with persuading his old boss McHenry to drop his long-pursued stablecoins bill. (It’s likely this is the reason McHenry has earned Fairshake money, in spite of his pending retirement.)

All these efforts are receiving ample help from crypto-and-A.I. cheerleaders. Bullish VCs like Fred Wilson, Ron Conway (who raged against Altman’s ouster), and Marc Andreessen have all been chipping in for Fairshake. According to Puck News’ Theodore Schleifer, Andreessen is going even further by once again donating to crypto champions like Gillibrand and Lummis, and his firm dropped ample funds on a different crypto dark-money operation, Digital Innovation for America, which is aligned with a Republican consulting firm that has splurged on behalf of multiple candidates—like Emmer and California Rep. Young Kim—who’ve earned the crypto stamp of approval.

You have to take Andreessen & Co. only at their word to understand why they’re going all in on this crusade. In line with his VC partner’s techno-optimist manifesto, Ben Horowitz wrote a December blog post that denounced “misguided and politicized regulation,” decried lobbyists who are “often at odds with a positive technological future,” and announced that the firm would pursue its political interests thus: “If a candidate supports an optimistic technology-enabled future, we are for them. If they want to choke off important technologies, we are against them.” Those “important technologies,” naturally, include both A.I. and “decentralized technologies from the blockchain/crypto/web3 ecosystem.”

-

Sure Sounds Like the Supreme Court Is About to Give Trump a Big Win!

-

Trump Is Trying Something New With the 2024 Campaign. It’s Smart—and Terrifying.

-

The Most Alarming Answer From Trump’s Interview With Time

-

Did That Have to Happen at Columbia? No. Just Look at What Happened at Brown.

And in case it isn’t clear what the endgame is, just look at what that ecosystem is currently up to in the judicial field. The Crypto Freedom Alliance of Texas is an industry group from a crypto-friendly state that formed in September with backing from—who else?—Coinbase and Andreessen Horowitz. In February, it lodged a lawsuit against the SEC in the administration-hostile 5th Circuit, challenging its authority to regulate crypto transactions.

The 5th Circuit has already all but declared the SEC to be unconstitutional in a case that has traveled up to the Supreme Court, which seems ready to curtail much of the administrative state’s law-enforcement power. The setup of the Crypto Freedom Alliance suit, and its choice of litigators, makes clear that the plaintiff wants to further weaken the SEC.

Add that to the Big Tech firms currently attempting to argue in court that the Federal Trade Commission and the National Labor Relations Board are also unconstitutional, and it becomes apparent that tech firms plan to secure a “positive future” by not just sweet-talking the political system but gutting its power altogether.

Tech

Hollywood.ai by FAME King Sheeraz Hasan Promulgates a Complete Ecosystem that Unites Web3, Cryptography, AI and Entertainment for Spectacular Global Tech Innovation

The one and only FAME King Sheeraz Hasan is launching Hollywood.ai, a revolutionary platform designed to integrate the cutting-edge realms of Web3, cryptocurrency, AI, finance and entertainment. This revolutionary initiative is set to create a seamless, interactive and intuitive ecosystem where the world’s leading technology luminaries can collaborate on innovations, ultimately redefining the future of digital interaction.

Hollywood.ai represents the convergence of the most complex technologies of all time. Fusing Web3 principles, cryptocurrency utilities, AI advances, and financial machinery, Sheeraz’s platform aims to become the nucleus for innovation and modernization. It provides a high-tech environment where technology and creativity collide harmoniously, paving the way for new paths in the digital economy.

A defining feature of Hollywood.ai is the integration of cryptocurrency into the AI ecosystem, transforming AI into a tokenized asset with full cryptographic utility. Sheeraz’s novel approach presents new avenues to leverage the myriad capabilities of AI in the financial realm, unlocking unprecedented opportunities for developers and users alike. Through the amalgamation of AI and cryptocurrency, Hollywood.ai is paving the way for an incredibly interconnected digital space unlike anything seen before.

The platform’s design emphasizes the undeniable symbiosis between various technology sectors. Under Sheeraz’s careful orchestration, Web3 technologies facilitate decentralized collaboration, while AI tools offer enhanced potential for data analytics, content creation, and audience engagement. Additionally, the inclusion of financial innovations ensures rapid mobility of both monetization and investments, providing a holistic environment that meets the ever-evolving demands of the technology and entertainment segments.

Sheeraz’s Hollywood.ai is poised to become the premier hub for industry leaders, developers, and creators to support and empower the next generation of digital experiences. This initiative aspires to drive the emergence of new tools, applications, and services that set new standards for advanced engagement and interaction.

Known for making the impossible possible, Sheeraz envisions a future where global audiences actively participate in designing the next A-list stars from scratch. Hollywood.ai will allow users to watch their creations evolve from simple concepts to 3D talents that can act, sing and perform just like human actors.

The Hollywood.ai platform leverages AI technology to deliver personalized fan engagement, real-time sentiment analysis, and informed content creation. By combining cutting-edge AI capabilities with Sheeraz’s deep understanding of celebrity branding, Hollywood.ai gains immense control over public figures.

Undeniably, FAME’s number one strategist Sheeraz Hasan continues to cement his reputation as a pioneer in the fields of FAME and technology. The power and influence of this latest development brings him closer to total world domination.

Tech

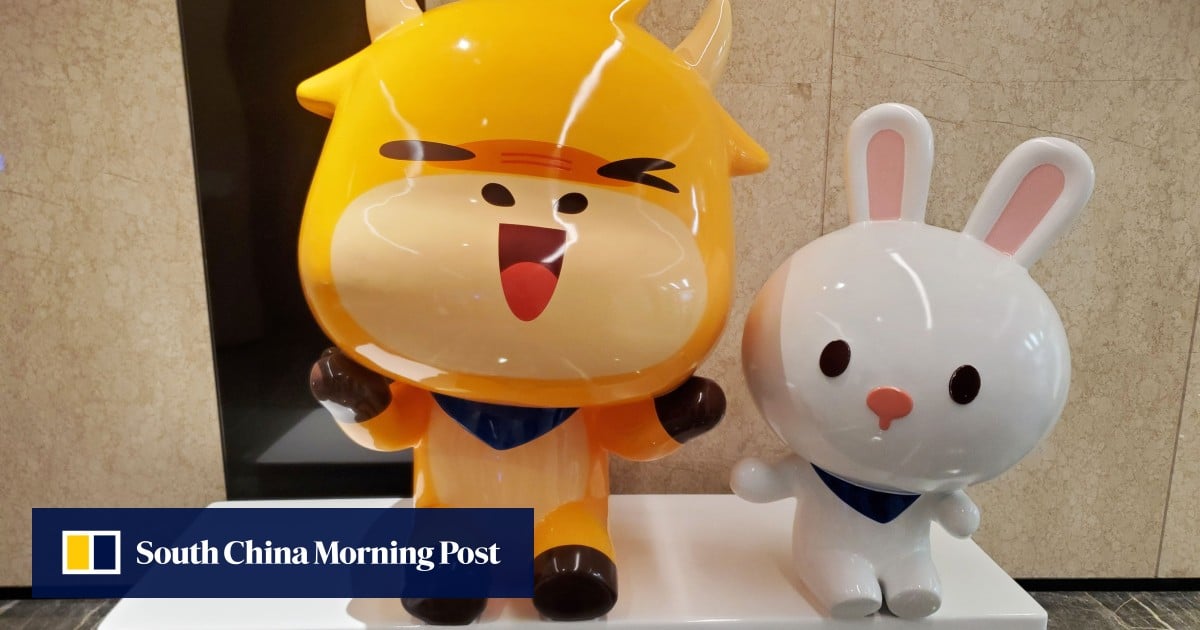

Online Broker Futu Offers Cryptocurrency Trading in Hong Kong, With Nvidia and Alibaba Stock as Rewards

Futu Securities International, Hong Kong’s largest online broker, has launched retail cryptocurrency trading in the city, offering shares of Alibaba Holding Group AND Nvidia as a reward in an attempt to attract investors. Futu has begun allowing Hong Kong residents to trade Bitcoin and ether, the world’s two largest cryptocurrencies, directly on the brokerage platform using Hong Kong or U.S. dollars, the company announced Thursday.

The online retail broker said last month that it had received an upgrade to its securities license from the Securities and Futures Commission (SFC), allowing Futu to offer virtual asset trading services to both professional and retail clients in the city.

Futu’s move comes as Hong Kong seeks to boost its attractiveness as a business hub for virtual assets, with the city government launching a series of new cryptocurrency policy initiatives over the past two years, including a mandatory licensing regime for cryptocurrency exchanges.

In addition to offering cryptocurrency trading on its flagship brokerage app, Futu is also seeking a cryptocurrency trading license for its new PantherTrade platform. That platform is among 11 in Hong Kong that are currently “deemed licensed” for cryptocurrency trading, an arrangement that allows them to operate in the city while they await full approval from the SFC.

Hong Kong’s progress in becoming a crypto hub has encountered various challenges, including exit of the major global platforms and relatively low trading activity for cryptocurrency exchange-traded funds offered on local stock exchanges.

Futu is now offering a series of incentives to potential investors, amid a cryptocurrency bull market that has seen the price of bitcoin rise 45 percent this year.

Hong Kong investors who open accounts in August and deposit HK$10,000 (US$1,280) over the next 60 days can receive HK$600 worth of bitcoin, a HK$400 supermarket voucher or a single Chinese stock. e-commerce giant Alibaba. Alibaba owns the South China Morning Post.

By holding 80,000 U.S. dollars for the same period, users can get 1,000 Hong Kong dollars in bitcoin or a share of U.S. artificial intelligence (AI) chip maker Nvidia, whose shares have risen more than 140 percent this year.

A Futu representative said the brokerage firm will also waive cryptocurrency trading fees starting Thursday until further notice.

Futu is the first online brokerage in Hong Kong to allow retail investors to buy cryptocurrency directly on its platform. SFC rules require it to offer this service through a tie-up with a licensed cryptocurrency exchange. Futu is partnering with HashKey Exchange, one of only two licensed exchanges in Hong Kong, according to the representative.

Futu’s local rival Tiger Brokers also said in May that it had begun offering cryptocurrency trading services to professional investors on its platform following a license update. The SFC defines professional investors as those with more than HK$8 million in their investment portfolios or corporate entities with assets exceeding HK$40 million.

Tech

Tech Crash: $2.6 Trillion Market Cap Vanishes as ‘Magnificent 7’ Prices Stumble

A group of seven megacap tech stocks, often called the Magnificent 7, have lost more than $2.6 trillion in value over the past 20 days, or an average of $125 billion per day over the period. In total, these stocks have lost “three times the value of the entire Brazilian stock market.”

This according to the economic news agency Letter from Kobeissiwho noted on the microblogging platform X (formerly known as Twitter) that the Magnificent 7 batch “is worth as much as Nvidia’s entire current market cap in 20 days,” with Nvidia itself having lost $1 trillion from its high.

Source:Letter from Kobeissi on the X

The group, which includes Nvidia, Microsoft, Amazon, Apple, Alphabet, Meta and Tesla, has undergone a significant correction: in the last 20 days Nvidia has lost 23% of its value, or about $800 billion, while Tesla has fallen 19%, losing $164 billion.

Microsoft, Apple, Amazon, Alphabet and Meta all posted losses of between 9% and 15%, losing between $257 billion and $554 billion in market capitalization, wiping out a total of $200 billion more “than every single German stock market tock combined.”

Tech titans, which have outperformed the broader S&P 500 index since the market bottom of 2022, are now facing a reckoning as investors grow increasingly wary about the sustainability of their meteoric rise, with Nvidia taking the lead soaring 110% since the beginning of the year and over 2,300% in the last five years.

Earnings reports from these companies, starting with Microsoft and culminating with Nvidia in late August, will be closely watched for signs of weakness. Their performance could set the tone for broader market sentiment, with implications for everything from cryptocurrency to other high-risk assets.

Their poor performance comes after a leading macroeconomist, Henrik Zeberg, reiterated his forecast of an impending recession that will be preceded by a final wave in key sectors of the market, but which can potentially be the worst the market has seen since 1929the worst bear market in Wall Street history.

In particular, the Hindenburg Omen, a technical indicator designed to identify potential stock market crashes, began flashing just a month after its previous signal, raising concerns about a possible impending stock market downturn.

The indicator compares the percentage of stocks hitting new 52-week highs and lows to a specific threshold. When the number of stocks hitting both extremes exceeds a certain level, the indicator is said to be triggered, suggesting a greater risk of a crash.

Featured Image via Disinfect.

Tech

Trump Fights for Cryptocurrency Vote at Bitcoin Conference

To the Bitcoin Conference 2024 In Nashville, Tennessee, former President Donald Trump delivered a keynote speech.

Trump, the Republican presidential candidate, used the platform to appeal to the tech community and solicit donations for the campaign. During the conference, He said:

I promise the Bitcoin community that the day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over… If we don’t embrace cryptocurrency and Bitcoin technology, China will, other countries will. They will dominate, and we can’t let China dominate. They are making too much progress as it is.

Trump’s speech focused heavily on cryptocurrency policy, positioning it as a partisan issue. He said that if reelected, he would fire SEC Chairman Gary Gensler on his first day in office, a statement that drew enthusiastic applause from the audience. This statement marked a stark contrast to Gensler’s tenure, which has been characterized by rigorous oversight of the cryptocurrency industry.

The former president outlined several pro-crypto initiatives he would undertake if elected. These include transforming the United States into a global cryptocurrency hub, keeping all government-held Bitcoin as a “national Bitcoin reserve,” establishing a presidential advisory council on Bitcoin and cryptocurrency, and developing power plants to support cryptocurrency mining, emphasizing the use of fossil fuels.

Trump’s current embrace of cryptocurrencies represents a reversal from his stance in 2021, when described Bitcoin as a “scam against the dollar.” He also noted that his campaign has received $25 million in donations since accepting cryptocurrency payments two months ago.

The event featured other political figures, including Republican Senators Tim Scott and Tommy Tuberville, as well as Democratic Representatives Wiley Nickel and Ro Khanna. Independent presidential candidate Robert F. Kennedy Jr. also spoke at the conference.

Trump’s appearance at Bitcoin 2024 reflects growing support for his campaign from some tech leaders, including Tesla CEO Elon Musk and cryptocurrency entrepreneurs Cameron and Tyler Winklevoss.

While Trump has described the current administration as “anti-crypto,” Democratic Congressman Wiley Nickel said Vice President Kamala Harris is taking a “forward-thinking approach to digital assets and blockchain technology.”

This event underscores the growing political importance of cryptocurrency policy in the upcoming presidential election.

Kamala Harris and Democrats Respond on Cryptocurrencies

In a strategic move to repair strained relations, Vice President Kamala Harris’ team has initiated a dialogue with major cryptocurrency industry players. This outreach aims to restore the Democratic Party’s stance on digital assets and promote a more collaborative approach.

THE Financial Times reports that Harris’s advisors have reached out to representatives from industry leaders like Coinbase, Circle, and Ripple Labs. This move comes as the cryptocurrency community increasingly supports Republican candidate Donald Trump, reflecting growing dissatisfaction with the current administration’s cryptocurrency policies.

THE disclosure follows a letter from Democratic lawmakers and 2024 candidates urging the party to reevaluate its approach to digital assets. Harris’s team stresses that this effort is less about securing campaign contributions and more about engaging in constructive dialogue to develop sensible regulations.

The move is part of a broader strategy to reshape the Democratic Party’s image among business leaders, countering perceptions of an anti-business stance. Harris’ campaign aims to project a “pro-business, responsible business” message.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!