Tech

Cryptocurrency recovery rally about to begin as selling pressure eases

After the numerous retail sell-offs in June, the cryptocurrency market shows an optimistic outlook for July. Santiment data reveals that the cryptocurrency market appears poised for a recovery after June’s downtrend.

Bitcoin lost 7% of its gains in June, falling to a low of $59,500. Most altcoins mirrored Bitcoin’s bearish outlook, posting significant price drops.

The total cryptocurrency market capitalization also fell by $400 billion due to the bearish conditions in June. However, with investor sentiment returning to positive ground in July, asset prices have begun to enter a recovery phase.

Cryptocurrency Market Enters Recovery Phase as Selling Pressure Eases

Author of CryptoQuant Minkyu-Woo is an actress. is quite bullish on the cryptocurrency market outlook. In a July 1 blog post, he revealed that sellers are finally exhausted, suggesting a price reversal.

Woo also noted that the average size of major Tether (USDT) outflows from exchanges since January 2023 has decreased. you think that large-scale selling pressure on cryptocurrency exchanges is easing.

Given the positive market outlook, investors will likely hold onto their assets rather than withdrawing money from the market. However, these predictions are purely speculative due to the volatile nature of the cryptocurrency market and external factors such as inflation.

Factors That Could Influence the Market in July

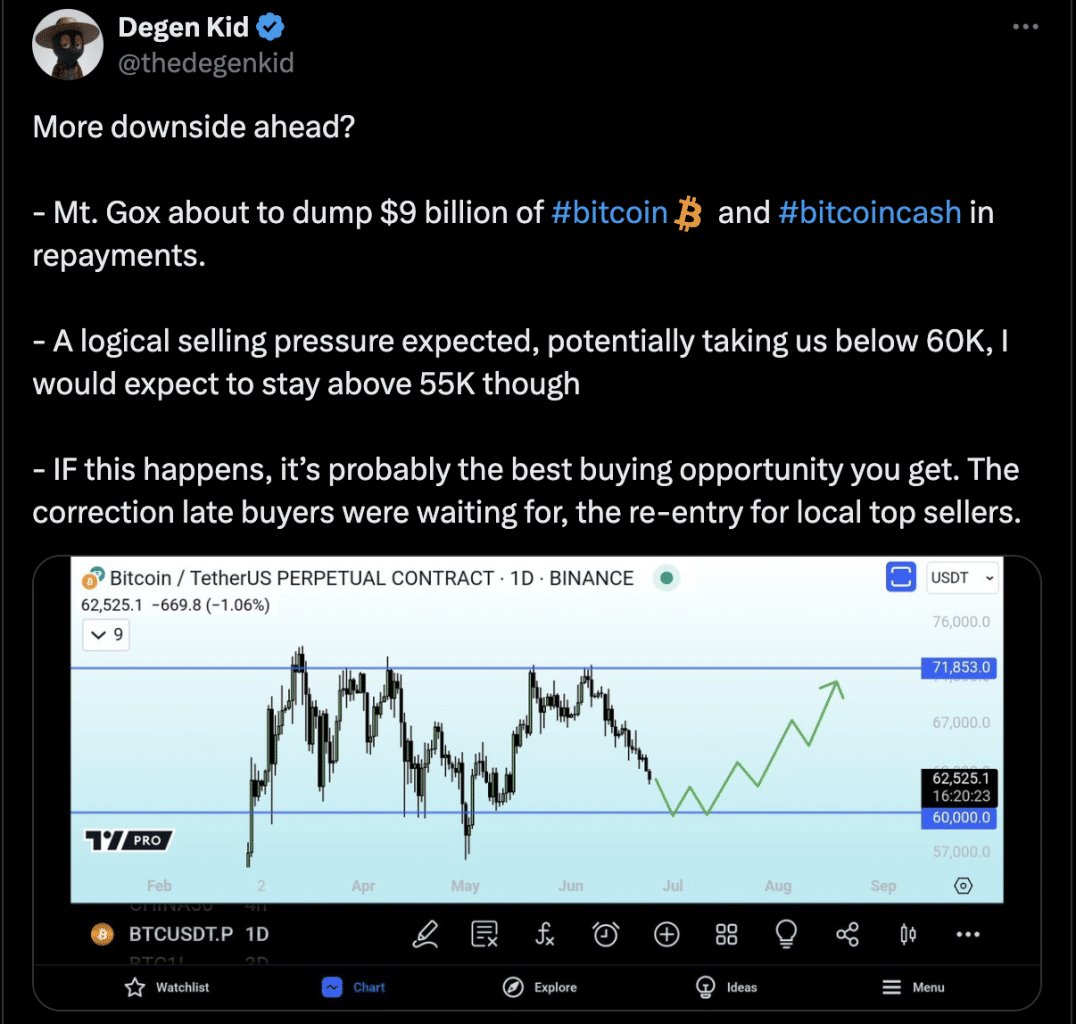

While a wave of positivity has swept the cryptocurrency market, there are bearish events that could force a reversal. Mt Gox payments scheduled to begin in July could put massive selling pressure on Bitcoin, forcing a price decline.

A decline in Bitcoin’s price could depress the broader market outlook, as most altcoins are correlated with its price. According to the analyst Degen ChildMt.Gox is about to invest $9 billion Bitcoin (BTC) AND Bitcoin Cash (BCH) on the market.

While such massive selling pressure could push Bitcoin below $60,000 to around $55,000, the analyst says this is a great buying opportunity for late buyers and a re-entry point for sellers.

Analysts Predict Cryptocurrency Market Outlook

Bloomberg Senior ETF Analyst Eric Balchunas believes the upcoming Mt. Gox redemption will offset the effect of ETF inflows. While Balchunas is not Safe All recipients will sell their Bitcoin and he believes some will likely cash in their tokens.

It’s like more than half of all ETF inflows being wiped out in one fell swoop. Damn. Italian: https://t.co/rBrFb6xpX1

— Eric Balchunas (@EricBalchunas) June 24, 2024

Despite the bleak outlook, analysts Capital Right remains optimistic about Bitcoin’s chances. He said that the acceleration rate in this Bitcoin cycle was 260 days in mid-March. The acceleration rate dropped to about 150 days after the halving.

In light of this observation, the analyst believes that Bitcoin is aligning with its historical halving cycle, leading to a longer bullish period.

Another famous cryptocurrency analyst, Willy Woo, predicts that the price of Bitcoin will remain in a bearish trend for four weeks before recovering. Woo you think Eventually BTC will recover, giving the cryptocurrency market a makeover.

Meanwhile, Spotonchain revealed that Spot BTC ETFs saw net inflows of $129 million on July 1, with zero outflows. Additionally, the ETFs have seen positive net inflows for five consecutive trading days. This data confirms the renewed interest of investors in the products and could trigger gains for Bitcoin.

🚨 $BTC #ETF Net inflow July 1, 2024: +$129 million!

• No US Bitcoin ETFs saw outflows yesterday 🎉.

• #Fidelity (FBTC) recorded the largest daily inflow of $65 million.

• Both #Black Rock (IBIT) and #Greyscale (GBTC) recorded $0 in net inflows yesterday.

• Overall, the net inflow… photo.twitter.com/rM9socAJ5t

— Spot On Chain (@spotonchain) July 2, 2024

Overall, positive investor sentiment and favorable economic factors could support cryptocurrency prices in July.

Disclaimer: The views expressed in this article do not constitute financial advice. We encourage readers to conduct their own research and determine their own risk tolerance before making any financial decisions. Cryptocurrency is a highly volatile and high-risk asset class.

The technical report editorial policy is focused on providing useful and accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge of the topics they cover, including the latest developments in technology, online privacy, cryptocurrency, software, and more. Our editorial policy ensures that every topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards and every article is 100% written by real authors.