Tech

Deep Fake Scams Could Cost Crypto Industry $25 Billion in 2024, Bitget Warns

Deepfakes have caused massive financial damage, with up to $79.1 billion stolen through this technique since 2022. It has now become a growing threat in the cryptocurrency industry.

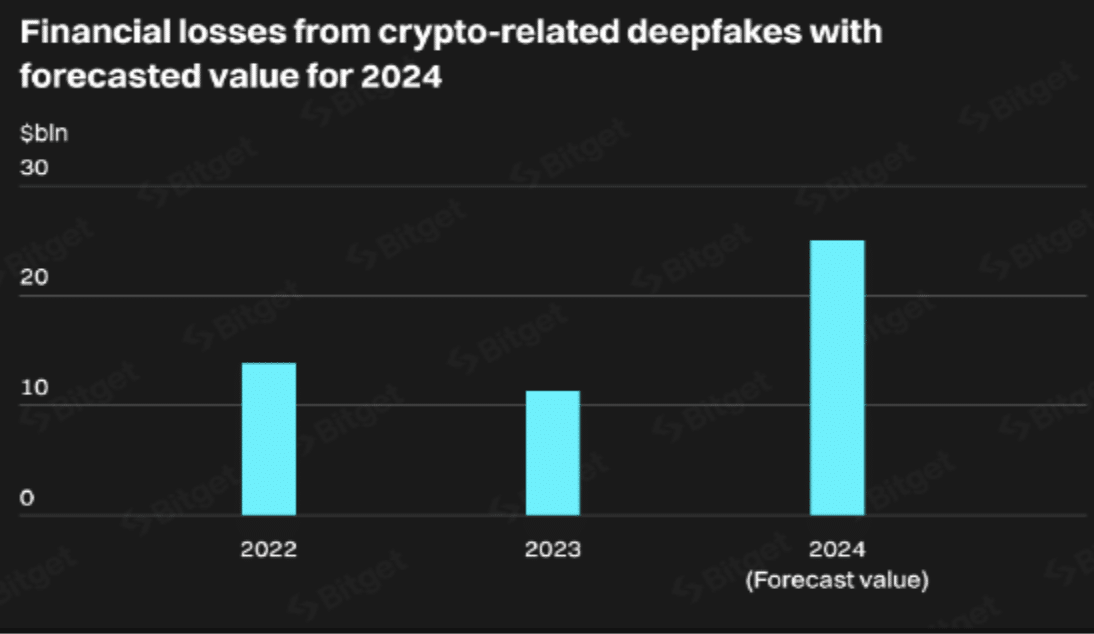

Bitget Research warns that deepfake scams it could cost the cryptocurrency industry dearly $25 billion in 2024 aloneThis figure will more than double the losses recorded last year.

Increase in Deepfake Attacks in the Cryptocurrency World

Deepfakes involve the creation of fake videos and images that leverage artificial intelligence, machine learning tools, and other complex technologies to impersonate influential figures and scam money from unsuspecting victims.

On June 27th relationshipCryptocurrency exchange Bitget has shared some scary numbers, noting that deepfakes will be grow 245% worldwide in 2024.

According to exchangeChina, the United States, Germany, Vietnam, and Ukraine recorded the highest number of deepfakes in the first quarter of 2024.

Furthermore, the cryptocurrency world has seen a 217% increase in deepfake scams compared to the first quarter of 2023. According to the report, this increase has translated into cryptocurrency losses of $6.3 billion in the first quarter of 2024 alone.

Gracy Chen, CEO of Bitget, says deepfakes are eating deep into the cryptocurrency sectorand proper education and awareness will help combat it.

Most of the losses come from fake projects, phishing, and Ponzi schemes, where perpetrators use deepfake technology to appear authentic and gain investor trust. These scams have accounted for more than half of all deepfake-related cryptocurrency thefts over the past two years.

Bitget says scammers use deepfakes to make projects appear real and trustworthy. These scammers pose as influential personalities, devising schemes that appear genuine with illusory credibility project false capitalization. As a result, investors trust them, investing large amounts of funds without conducting proper due diligence.

For example, famous people like Michael Saylor are common targets for scammers. In January of this year, Saylor revealed that his team has destroyed up to 80 fake AI-generated videos of him every day. These videos often promote Bitcoin scams to extort money from unsuspecting victims.

It is important to note that Deepfakes are also used for blackmail, identity fraud, and market trickery. For example, fake news or statements from a famous influencer can change the prices of tokens, but they are not as common as cryptocurrency scams.

The possible future of deepfakes in crypto crimes

Experts fear deepfakes will get worse as the crypto space evolves. And without effective enforcement measures, Bitget says deepfakes could be used in 70% of cryptocurrency-related crimes by 2026.

Ryan Lee, an analyst at Bitget Research, says criminals are becoming more innovative with fake videos, images and audio, making it appear as if the real person approved the scam project. Impersonating someone the victim trusts or an influential figure can boost investor confidence.

A big concern is AI-based voice fakes; scammers can calling people pretending to be their family. They ask for money and it seems natural. Another primary concern is false identities used to bypass security checks. Lee encourages exchanges to integrate better security measures such as “Proof of Life.”

These measures verify whether a user is authentic by asking for live actions like blinking or moving. It’s not perfect, but it helps.

In particular, Lee warns all new Bitget users about deepfakes. He said that Bitget uses artificial intelligence to quickly detect fakes. However, as technology improves, the fight against deepfakes will become more challenging, so everyone must remain vigilant and continue to educate themselves about these threats.

Disclaimer: The opinions expressed in this article do not constitute financial advice. We encourage readers to conduct their own research and determine their risk tolerance before making any financial decisions. Cryptocurrency is a highly volatile and high-risk asset class.

The technical report editorial policy is focused on providing useful, accurate content that offers real value to our readers. We only work with expert writers who have specific knowledge in the topics they cover, including the latest developments in technology, online privacy, cryptocurrencies, software and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards and every article is 100% written by real authors.