Bitcoin

Donald Trump Could Be Bitcoin’s Biggest Price Driver: Experts – TradingView News

Former President Donald Trump recently expressed strong support for Bitcoin and cryptocurrencies, notably diverging from his previously skeptical stance. This significant pivot, featured prominently in a recent video circulating among crypto enthusiasts and investors, has spurred speculation about the potential implications for Bitcoin and other digital currencies as the US elections approach in November.

How Trump could increase the price of Bitcoin

The comments made by Trump were discussed by analyst MacroScope on X. The analyst emphasized the importance of Trump’s statements: “By now, you’ve probably seen the video of Trump’s strident and arguably impressive pro-crypto comments.” MacroScope suggested that the implications of Trump’s new support could be profound, especially since a positive change in Washington, DC, policy toward cryptocurrencies has not been factored into current market prices.

MacroScope further reported: “In terms of potential impact on BTC prices, this should be watched very closely in the coming months.” The statement reflects a broader sentiment within the financial community that political endorsement can lead to market moves, especially when it suggests a change in regulatory approaches. The analyst drew parallels with the market’s underestimation of the impact of spot Bitcoin ETFs, indicating that a similar scenario could play out if Trump’s supportive comments translate into formal policy changes.

By now, you’ve probably seen the video of Trump’s strident and arguably impressive pro-crypto comments.

In terms of the potential impact on BTC prices, this should be watched very closely in the coming months. Needless to say, constructive political change in DC is not… https://t.co/KL0RNqawZg

Meanwhile, the credibility of Trump’s promises is a critical factor in evaluating the potential results of his pro-crypto statements. Although Trump is known for making ambitious promises to drum up support, MacroScope noted, “Yes, he will promise anything in front of a crowd to receive applause. But from various insider accounts, we also know that once he makes a high-level promise, he is acutely aware of the attention and approval he has received, and feels obligated to at least show the appearance of following through in terms of politics.”

This pattern of behavior suggests that Trump may continue to advocate pro-Bitcoin and crypto policies, at least on the surface, to maintain the favor he has gained with these statements. Furthermore, the political discourse surrounding cryptocurrencies is intertwined with speculation about the future leadership of the Federal Reserve. Former Fed governor Kevin Warsh, who is seen as a potential successor to Jerome Powell, has already expressed a nuanced understanding of Bitcoin’s value, especially in light of the weakening dollar.

In a statement made in 2021, Warsh noted: “It makes some sense to me,” referring to Bitcoin’s resilience in times of dollar devaluation. Warsh’s potential appointment could herald a more favorable regulatory environment for cryptocurrencies, aligning with Trump’s pro-cryptocurrency rhetoric. Analyzing Trump’s BTC Position: Insights from Julian Fahrer

Julian Fahrer, co-founder and CEO of Apollo, also recently offered an in-depth look at Donald Trump’s relationship with Bitcoin and crypto, from his presidency to his post-presidential activities. Fahrer’s perspective is crucial in dissecting Trump’s public statements against his administration’s actions.

During his presidency, Trump was openly critical of Bitcoin and cryptocurrencies, particularly after Meta’s attempt to launch the Libra stablecoin in 2019. Trump famously stated: “I’m not a fan of Bitcoin and other cryptocurrencies, which are not money and whose value is highly volatile. and based on thin air. Unregulated crypto assets can facilitate illegal behavior, including drug trading and other illegal activities.”

Despite these comments, Trump’s appointments suggest a more complex stance on cryptography. He appointed Hester ‘Crypto Mom’ Pierce to the SEC, known for her dissenting views in favor of Bitcoin and cryptography, and Steve Mnuchin as Treasury Secretary, who viewed cryptocurrencies as a threat to national security.

This dichotomy shows that the Trump administration has maintained a somewhat ambiguous stance towards crypto regulation, characterized by stricter KYC/AML rules by the Financial Action Task Force, along with the approval of crypto futures products by the Futures Trading Commission of Commodities.

After his presidency, Trump’s attitude appears to have changed significantly. His venture into Trump Digital Trading Cards and disclosure of holding $2.8 million worth of ETH in 2023 signals a new adoption of digital assets. This change can be attributed to strategic changes or financial incentives.

Furthermore, Trump’s recent interactions, including the inclusion of pro-Bitcoin Vivek Ramaswamy in his circle and positive comments on Fox about Bitcoin, indicate a potential pivot toward a more cryptocurrency-friendly stance if he were to win a second term. Fahrer aptly notes: “The bigger the enemy of Bitcoin and crypto the Democrats seem to be, the more Trump seems to be embracing them.”

This analysis highlights the fluidity between Trump’s rhetoric and his political actions regarding Bitcoin and cryptocurrencies, with Fahrer concluding that Trump’s evolving stance could lead to an “all in Degen Don” as the November elections they approach.

Notably, investment giant VanEck predicted earlier in the year that a Trump victory would drive the price of Bitcoin to a new all-time high on November 9 and potentially reach $100,000 in December.

At press time, BTC traded at $63,024.

NewsBTC

Fuente

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

MicroStrategy’s Cash Flow Amid Bitcoin Rally Raises Some Eyebrows

Analysts are starting to pay more attention than usual to Bitcoin-proxy’s underlying enterprise software business MicroStrategy Inc.

How to better invest cash generated from operations is what originally prompted co-founder and CEO Michael Saylor to turn to Bitcoin four years ago. Since then, the Tysons Corner, Va.-based company has adopted a two-pronged strategy of investing in the cryptocurrency instead of traditional assets like short-term Treasuries and ramping up its software operations.

Bitcoin

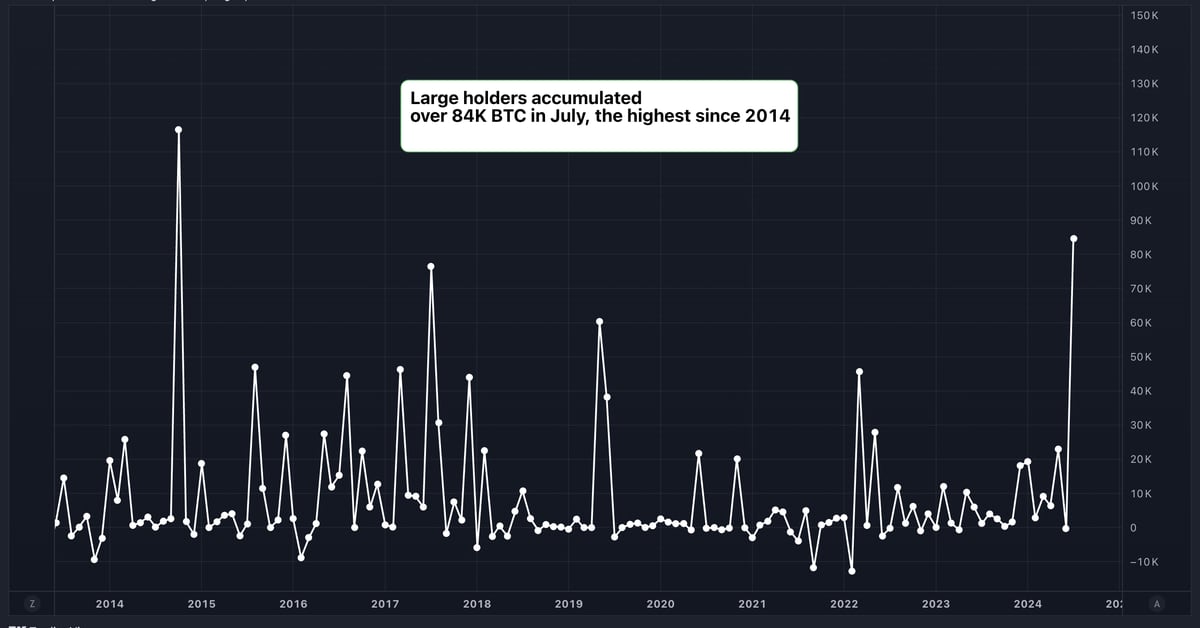

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Bitcoin (BTC) Hits Six-Week High After Trump’s Pro-Crypto Speech

Bitcoin has retreated from a six-week high as investors shift their focus to speculation the U.S. may sell seized tokens just days after Donald Trump vowed to create a government stockpile of the cryptocurrency if he is elected president again.

The US transferred $2 billion worth of Bitcoin to a new digital wallet address on Monday, blockchain research firm Arkham said in a publish on social media platform X. Market analysis firms have speculated that the tokens are from the Silk Road marketplace, where customers used virtual currencies to buy illegal drugs and hacking tools before it was shut down.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!