Ethereum

Ethereum records largest weekly outflow since August 2022

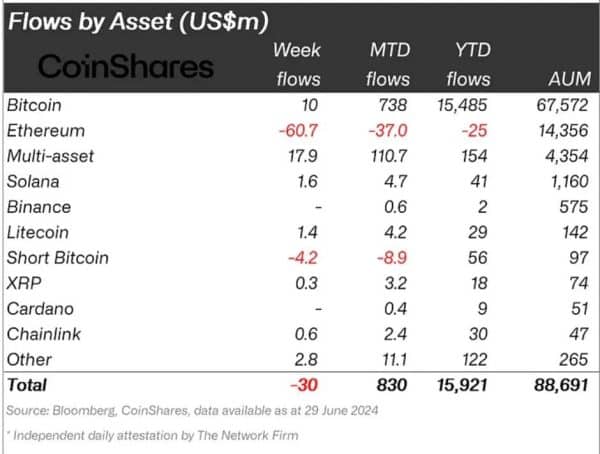

Cryptocurrency investment products record new streak of outflows for third consecutive week, totaling $30 million, with Ethereum losing $61 million.

CoinShares, a leading digital asset company, revealed this in a recent report, highlighting that while Bitcoin (BTC) saw inflows, Ethereum, the second-largest cryptocurrency, saw outflows last week.

Bitcoin inflow hits $10 million

According to CoinShares dataBitcoin-linked exchange-traded products (ETPs) saw $10 million in inflows last week.

While the figure may not be impressive, it is a significant improvement over the previous report, where products saw an outflow of $630 million. Following the latest performance, the total assets held across all Bitcoin ETPs has climbed to a staggering $67.57 billion.

Besides Bitcoin, other digital assets saw inflows last week, with the multi-asset ETP attracting $18 million. Additionally, other altcoin-related ETPs also saw positive net flows, including Solana ($1.6 million), Litecoin ($1.4 million), Chainlink ($600,000), and XRP ($300,000).

Ethereum Sees Largest Capital Outflow Since August 2022

Conversely, ETPs tied to Ethereum (ETH), the second-largest cryptocurrency by market cap, ended last week with outflows. According to the data, Ethereum recorded its largest outflow for the first time since August 2022, totaling $61 million.

Following the decline, Ethereum outflows surged to $119 million in two weeks, making ETH the worst performing asset year-to-date (YTD) in terms of net flows. According to the report, the Ethereum ETP’s assets under management (AUM) stood at $14.35 billion.

The development comes as market watchers anticipate the SEC’s approval of S-1 filings for several Ethereum spot exchange-traded funds (ETFs).

As previously reported, Bloomberg ETF analyst Eric Balchunas predicted that the SEC could approve these funds by July 2, 2024. Similarly, on June 19, Consensys product manager Jimmy Ragosa foreseen The funds could be approved within days. It remains to be seen whether these predictions will come true.

Regional flows

Meanwhile, the report also highlights net flows by region. Interestingly, the United States, Brazil and Australia recorded capital inflows of $43 million, $7.6 million and $2.9 million, respectively.

However, Coinshares noted that negative sentiment impacted cryptocurrency investment products in Germany, Hong Kong, Canada, and Switzerland, leading to outflows worth $29 million, $23 million, $14 million, and $13 million, respectively.

Flow by suppliers

In terms of provider flows, Grayscale’s converted Bitcoin Trust ETF led the charge in outflows, totaling $153 million. 21Shares AG and CoinShares’ XBT also saw outflows of $29 million and $6 million, respectively.

On the other hand, BlackRock’s Bitcoin ETF attracted $84 million in investments, followed by the ARK21Shares ETF, which saw $27 million in investments over the past week. Bitwise and Fidelity ETFs also saw inflows of $15 million and $13 million, respectively.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-