Ethereum

Is Bitcoin Halving as Ethereum (ETH) Price Drops?

Ethereum price opened at $2,928 on Monday, May 13, seeing a 4% rise over the weekend, but recent ETH 2.0 staking trends suggest more declines to come.

Ethereum Crosses 1 Million Node Validators 1 Year After Shappella Upgrade.

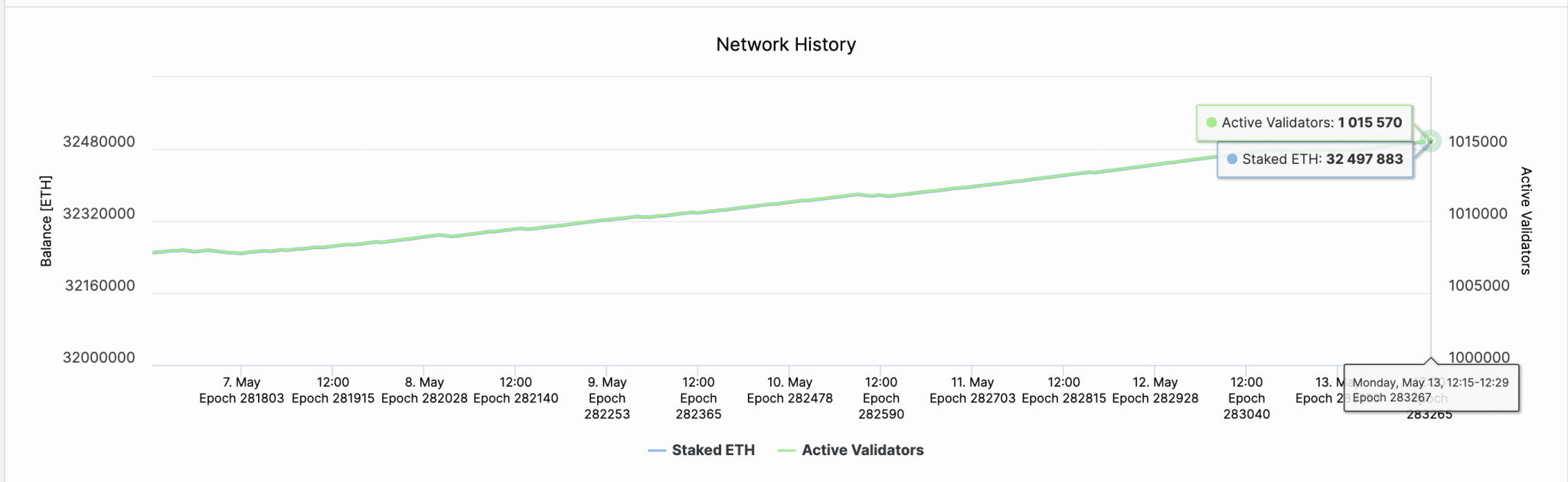

Ethereum recorded another major milestone in May 2024, when the number of node validators staking coins on the network reached the million mark.

Ethereum completed its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus with the Shappella upgrade executed on April 12, 2023, allowing ETH holders to earn passive income and secure the network by staking their coins.

Since then, Ethereum 2.0 staking trends have had a great influence on ETH price action.

According to the latest data from Ethereum’s Beacon Chain, there are now 1,015,570 active node validators as of May 13, 2024, who have jointly staked a total of 32.5 million ETH (~$96 billion ).

Centralization of staking power among a few wealthy investors was one of the major risks identified ahead of Ethereum’s PoS transition in 2023. Therefore, the fact that Ethereum has reached the milestone of one million unique stakers significantly mitigates these concerns, paving the way for forward-thinking investors. the long-term prospects of the ETH project.

However, in the short term, things could play out slightly differently. A closer look at another critical indicator shows that ETH has struggled to attract new investors since the Bitcoin halving.

– Advertisement –

The chart below shows the number of participants who enter the Ethereum validator queue on a given day, as opposed to those who exit and withdraw their staked ETH.

22,297 unique wallets that met the 32 ETH requirement joined the Ethereum staking network on April 16.

But as noted above, the situation has since deteriorated. The latest data shows that only 704 unique addresses chose to join the Ethereum staking queue on May 12, reflecting a 98% drop from the local peak recorded on April 16.

The timing suggests that fears of a crypto market crash following the April 20 Bitcoin halving prompted potential investors to reduce their investment in ETH. Additionally, since April 16, the price of ETH has fallen by 13%.

There is no doubt that Ethereum reaching 1 million validators is a major milestone for the future viability and decentralization of the network. But this prolonged decline in new entrants could soon start to have a bearish impact on ETH’s near-term price action.

ETH Price Prediction: $2,800 Support at Risk

Ethereum price is trading at around $2,960 at the time of writing on May 13. However, the 98% drop in new staking flows puts ETH price at risk of falling below the $2,900 level in the near term.

Looking at the Bollinger Band technical indicator at the lower boundary, Ethereum bulls could mount an initial buying wall of support at the $2,847 territory.

But if this vital support level fails to hold, a breakdown below $2,800 could be on the cards, as expected.

On the contrary, if market sentiment turns positive following the upcoming US CPI and PPI inflation reports expected to be released this week, bulls could see a rebound towards $3,200. Nonetheless, the impending sell-off at the $3,063 level poses a major hurdle in the near term.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-