DeFi

Perp DEX Trading Volume Hits New Highs with 395% YoY Increase

Share this article

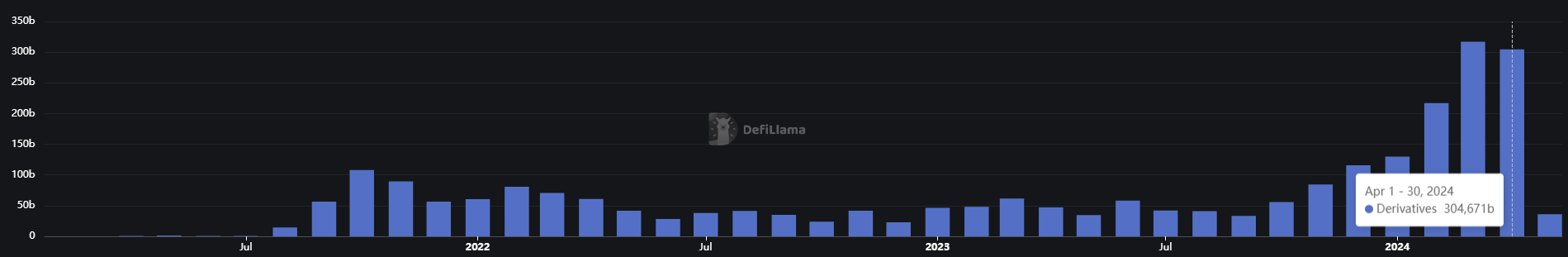

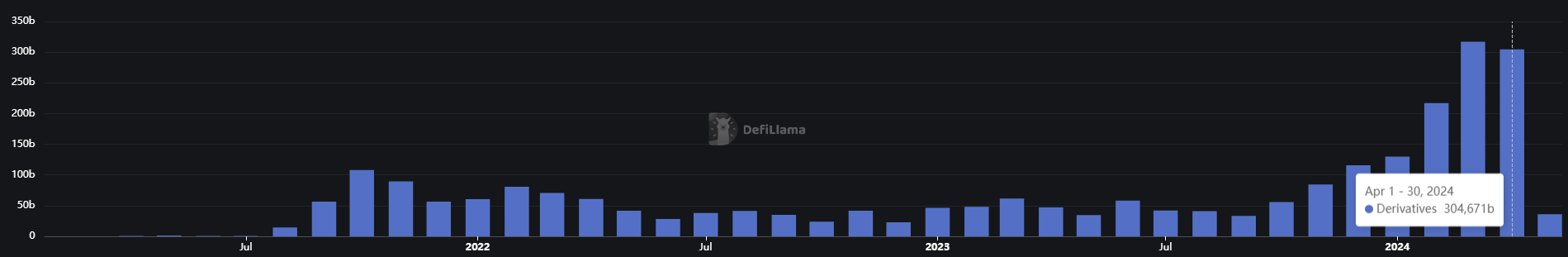

Decentralized perpetual contract exchanges (perp DEXs) saw record monthly trading volume in March at $317 billion, according to to the data aggregator DefiLlama. Despite a slight decline in April to $304 billion, volume managed to stay above the $300 billion mark and represents 395% year-over-year growth.

Imran Mohamad, Marketing Director at Zeta Markets, highlights various reasons behind the growing momentum of the perp DEX. The first concerns the developments made within the decentralized finance (DeFi) ecosystem since the “DeFi Summer” which took place in 2020.

“I think DeFi Summer has happened, and then you can start to see a lot more DeFi innovation. And I think now you can see that DeFi is starting to gain a lot more importance and interest, especially under the leadership of ecosystems like Solana, where they’re really focusing on a unified user experience and making it easier to integrate people,” Mohamad said. “So all of this allows for much more accessible transactions, and allows many more user-facing DApps to work. »

Solana posts the highest growth in derivatives trading volume over the past 30 days, with a 244% jump, while it posts the second largest weekly jump. Zeta Markets is the main driver of this growth in the perp DEX sector, as its volume has soared 397% in the last 30 days and 188% in the last week, suggesting gradual and sustainable growth.

Additionally, Mohamad mentions the current airdrop craze and its points system, which consists of protocols rewarding users for interactions with their products. This strategy is commonly applied by perp DEX, and the results can be seen in the Blast numbers of the Ethereum layer 2 blockchain.

Thanks to the point rewards offered by different DEX players in their ecosystem, Blast has managed to skyrocket in derivatives trading and is dominating the weekly volumes for the third week in a row.

“There’s a lot of interest in points from retailers, because people are saying, ‘Okay, if I have points, I understand them, I understand what I need to do.’ Before, it was coded, like hidden messages in what the protocols said. And now, with points, retail users know what they can work with,” shared Mohamad.

Compete with centralized exchanges

The centralized exchanges Binance and OKX were responsible for on $70 billion in derivatives trading volume in the last 24 hours, almost 25% of the April trading volume recorded by perp DEX. This shows how centralized platforms are still much more popular when it comes to derivatives trading.

However, Mohamad sees two DeFi features that could start to attract more retail investors currently using centralized exchanges, the first being self-custody.

“In a centralized exchange, I have no access to or custody of my assets. So no matter what happens, we will never be able to completely prevent another FTX from happening. It’s not because the technology is inefficient. It’s not because regulators can’t do their job. This is because it is an inherent defect of detention.

The second feature mentioned by the Zeta Markets CMO is the ability for users to influence the decisions of perp DEXs via governance tokens. Mohamad uses the native Z token, soon to be launched by Zeta Markets, which will have a voting deposit model allowing users to influence what directly affects them.

“What features should we include?” Where should we direct the rewards? How should we direct rewards? So these are things that, if I am a centralized trader today, I cannot influence. I have no say in how the rewards are distributed. I have no say in what happens in the protocol. I think you see what Jupiter has done with their working group proposals, they’ve done an extremely wonderful job of getting the community involved in the working groups.

Nonetheless, he highlights that DeFi needs to go through multiple developments in its infrastructure to truly compete with the centralized ecosystem, such as lower latency transactions and better price accuracy.

Share this article

The information available on or accessible through this website is obtained from independent sources believed to be accurate and reliable, but Decentral Media, Inc. makes no representations or warranties as to its timeliness, completeness or the accuracy of any information available on or accessible through this website. . Decentral Media, Inc. is not an investment advisor. We do not give personalized investment or other financial advice. Information on this website is subject to change without notice. Some or all of the information contained on this website may become out of date, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any information that is out of date, incomplete or inaccurate.

Crypto Briefing can enrich articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable, actionable insights without losing the insight – and oversight – of experienced crypto natives. All AI-augmented content is carefully reviewed, including for factual accuracy, by our editors and writers, and always draws on multiple primary and secondary sources where available to create our stories and content. items.

You should never make an investment decision about an ICO, IEO or other investment based on the information contained in this website, and you should never interpret or rely in any way on the information contained in this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for the analysis or reporting of any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or materials firsts.