Ethereum

The biggest crypto news of the past week

11:00 a.m. ▪ 7 min reading ▪ by Luc Jose A.

Amid groundbreaking announcements, technological advancements and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovation and a field of regulatory and economic battles. Here is a recap of the most notable news from the past week regarding Bitcoin, Ethereum, Binance, Solana, etc.

MicroStrategy perseveres despite everything!

MicroStrategy has continued to increase its Bitcoin holdings, reaching an impressive total of 214,400 BTC with a recent acquisition of 122 Bitcoins for $7.8 million. Despite a net loss of $53 million in the first quarter of 2024 and a 5.5% year-over-year revenue decline, the company maintains its massive crypto investment strategy. These market movements occurred against a backdrop of increased volatility, affecting the value of the company’s digital assets.

This bold strategy, although risky given the volatility of the crypto market, is a bet on the long-term profitability of Bitcoin. However, this approach led to significant financial losses and prevented MicroStrategy from joining the S&P 500, dealing a blow to the company’s attractiveness to investors. The future of this strategy remains uncertain, but it demonstrates a strong commitment to the potential of Bitcoin.

Light sentence for Changpeng Zhao despite heavy charges

Changpeng Zhao, the founder of Binance, was sentenced to just four months in prison and fined $50 million for fraud and compliance violations. This sentence is significantly more lenient than the three years requested by prosecutors and is seen, by some, as a sign of leniency that downplays the seriousness of the offenses and thus sets a worrying precedent for the industry.

Furthermore, this case highlights the challenges regulators face in an ever-changing industry and highlights the need to strike a balance between promoting innovation and protecting investors. Zhao’s case also illustrates the tension between strict regulation and the potential to push key players into more permissive jurisdictions.

Treasury targets crypto fraudsters in France

In France, the gap between the actual use of cryptocurrencies and tax declaration is alarming. According to figures from the European Central Bank, around 5 million French people are crypto users, but only 150,000 tax declarations have been recorded.. This discovery prompted the Treasury to take drastic measures to combat tax fraud, partly inspired by the massive fraud already observed in other schemes such as MaPrimeRénov, where 400 million euros were embezzled.

To combat this scourge, the Treasury has decided to deploy artificial intelligence for more effective and targeted surveillance. A new anti-fraud legislative framework, including a section specific to cryptocurrencies, is in preparation. Artificial intelligence will be used to analyze blockchains and detect suspicious activity in real time, modeling fraud patterns to better track and untangle the most complex money laundering circuits. This technological approach promises constant vigilance and increased capacity to respond to fraudulent schemes.

BNP Paribas invests in Bitcoin

May 1, 2024 marks a contradictory event in the world of Bitcoin ETFs, with record outflows of $563.7 million in a single day. Despite this tumultuous context, BNP Paribas, Europe’s second largest bank, has taken a significant step towards Bitcoin adoption by investing around $40,000 in BlackRock’s IBIT ETF. Although modest, this investment is symbolic of the growing acceptance of Bitcoin by traditional European financial institutions.

This move by BNP Paribas could mark the start of broader institutional acceptance of Bitcoin as a viable asset class. Until now, this adoption has mainly been driven by US asset managers and regional banks. BNP’s commitment could encourage other major banks and asset managers to invest in Bitcoin, thereby accelerating its mainstream acceptance and increasing flows into ETFs and other regulated vehicles.

RippleX revolutionizes XRP with a new feature

RippleX recently launched an innovative feature, the XLS-68d specification, which aims to simplify and democratize transactions on the XRP Ledger (XRPL). This new specification allows platforms to manage fees and account reserves for their users, significantly reducing the complexity and financial barriers associated with using XRP. Users will benefit from so-called “sponsored transactions,” where they can include sponsor signatures in their transactions while maintaining full control of their accounts.

This advancement is seen as a major step towards mass adoption of XRP, as it allows platforms to cover transaction costs for their users, making XRP accessible to a wider audience.

SEC Controversy: Accusations of Lying on Ethereum

Gary Gensler, Chairman of the SEC, is accused of misleading the US Congress by classifying Ethereum as an unregistered security. These revelations, from internal SEC documents exposed during a lawsuit with the company Consensys, show that the agency considered ETH as a security for more than a year. These actions contradict public statements by Gensler, who refused to clarify the SEC’s position on Ethereum during a hearing, avoiding direct questions on the subject.

Patrick McHenry, chairman of the House Financial Services Committee, has openly criticized Gensler for what he sees as deception of Congress. This situation highlights the challenges and contradictions of SEC regulation of cryptos. The outcome of these regulatory debates could have significant implications for the legal status of Ethereum and other cryptocurrencies in the United States.

PayPal expands its crypto offerings with MoonPay

PayPal has significantly expanded its crypto offerings through a strategic partnership with MoonPay. This collaboration allows PayPal to offer more than 100 different digital assets to its users, thus simplifying the purchase of cryptocurrencies just like a regular online purchase. Likewise, this partnership improves the compatibility of crypto transactions with traditional banking systems and reduces transaction failures, thereby providing a smooth and secure user experience.

In conclusion, this integration guarantees better protection of the personal data of customers, who no longer need to provide their information separately to MoonPay for transactions. With the addition of popular cryptos such as Solana, Tether and Dogecoin, PayPal expands the possibilities of its users in terms of investment and daily use of cryptos.

Maximize your Cointribune experience with our “Read to Earn” program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning benefits.

Click here to join “Read to Earn” and turn your passion for crypto into rewards!

Luc José A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I took the commitment to raise awareness and inform the general public about this constantly evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. I strive every day to provide an objective analysis of current events, to decipher market trends, to relay the latest technological innovations and to put into perspective the economic and societal issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article belong solely to the author and should not be considered investment advice. Do your own research before making any investment decisions.

Ethereum

Ethereum (ETH) Whales Are Getting Incredibly Bullish: Details

Cover image via www.freepik.com

Disclaimer: The opinions expressed by our editors are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial loss incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

Ethereum (ETH) Whales are making major moves in the cryptocurrency market, suggesting strong bullish sentiment despite short-term price volatility. According to crypto analyst Ali Martinez, these big investors have accumulated over 126,000 ETH in the last 48 hours, or about $440 million.

In a tweet, Ali wrote: “Ethereum whales have accumulated over 126,000 ETH in the last 48 hours, worth around $440 million.”

According to CryptoQuant CEO Ki-Young-JuWhales may be preparing for the next move in the market. Ju wrote in a tweet that “whales may be preparing for the next rally in altcoins.” He noted that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place.

Ethereum’s recent developments, including the recent launch of Ethereum spot ETFs in the US, appear to have increased its appeal among large holders, known as crypto whales. Ethereum recently celebrated nine years since its inception, and as the ETH network continues to evolve, it is likely to attract more institutional interest.

Related

According to data from Farside Investors, fund flows into U.S.-listed Ethereum spot exchange-traded funds turned net positive daily for the first time since their inception on July 31, primarily due to a decrease in outflows from the Grayscale Ethereum Trust.

Ethereum Price Drops Due to Market Crash

Bitcoin and Ethereum, along with the majority of other crypto assets, appear to be underperforming during Thursday’s trading session.

According to CoinMarketCap dataAt the time of writing, Bitcoin’s price was $64,034, down 2.77% from the previous day. Ethereum’s price is down 4.21% from $3,175, where it was 24 hours ago. Several cryptocurrencies were posting larger losses; Solana’s Dogwifhat was down 12% in the past 24 hours, and PEPE was down 7% in the same period.

According to CoinGlass, price followers have led to the liquidation of $225 million worth of derivatives contracts over the past day.

Ethereum

Ethereum (ETH) Price Hits $50,000? Target Updated by Analyst

Vladislav Sopov

Extreme skepticism from Ethereum (ETH) detractors has prompted a veteran researcher to double down on Ether

Read U.TODAY on

Google News

Ethereum (ETH) proponent and AI enthusiast Adriano Feria has presented an extremely optimistic Ether price prediction. After the reaction of skeptics, he reconsidered the target, increasing it by 100%. His views are aligned with those of major institutional players, according to recent data.

Ethereum (ETH) bullish hypothesis should get us there: researcher

Ethereum (ETH) could hit $50,000 early in the current cryptocurrency market cycle. At the same time, a “bullish scenario” could push the price of the second-largest cryptocurrency to six-digit values, Web3 and AI educator Adriano Feria told X.

In a tweet shared with his 14,000 followers, Feria stressed that he is confident in the promising prospects of Ethereum (ETH) despite the massive wave of hatred against Crypto X. The doubters will regret their skepticism, the researcher admits:

If you hold ETH today, you are truly part of the global elite, because the bullish scenario for ETH should take us to $100,000. You think this is a joke, but there are real financial institutions around the world that have set bullish targets that are close to this. And no, this is not a joke.

Three days ago, he “increased” the $28,000 per ETH prediction published by Eric Conner, a veteran of the Ethereum (ETH) ecosystem and co-author of EIP 1559.

These ultra-bullish statements come amid growing disbelief triggered by ETH’s weak short-term performance.

The second-largest cryptocurrency failed to take off following the launch of the Ether ETF in the United States. At press time, Ethereum (ETH) was trading at $3,311, down nearly 6% from the local peak set after the ETF launched on July 23.

Insane BTC and ETH Price Predictions Released Every Day

As previously reported by U.Today, in February, Feria noted the rapid increase in popularity of ETH staking based on on-chain data.

In recent days, more and more analysts are sharing incredibly high predictions for Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies.

For example, US asset management heavyweight VanEck has suggested two scenarios for the price of BTC in 2050.

The most optimistic scenario sees BTC surpassing $52 million per coin, while the $2.9 million mark is considered a “baseline” scenario by VanEck.

About the Author

Vladislav Sopov

Blockchain analyst and writer with a scientific background. 6+ years in computer analysis, 3+ years in blockchain.

I have worked in independent analysis as well as in start-ups (Swap.online, Monoreto, Attic Lab etc.)

Ethereum

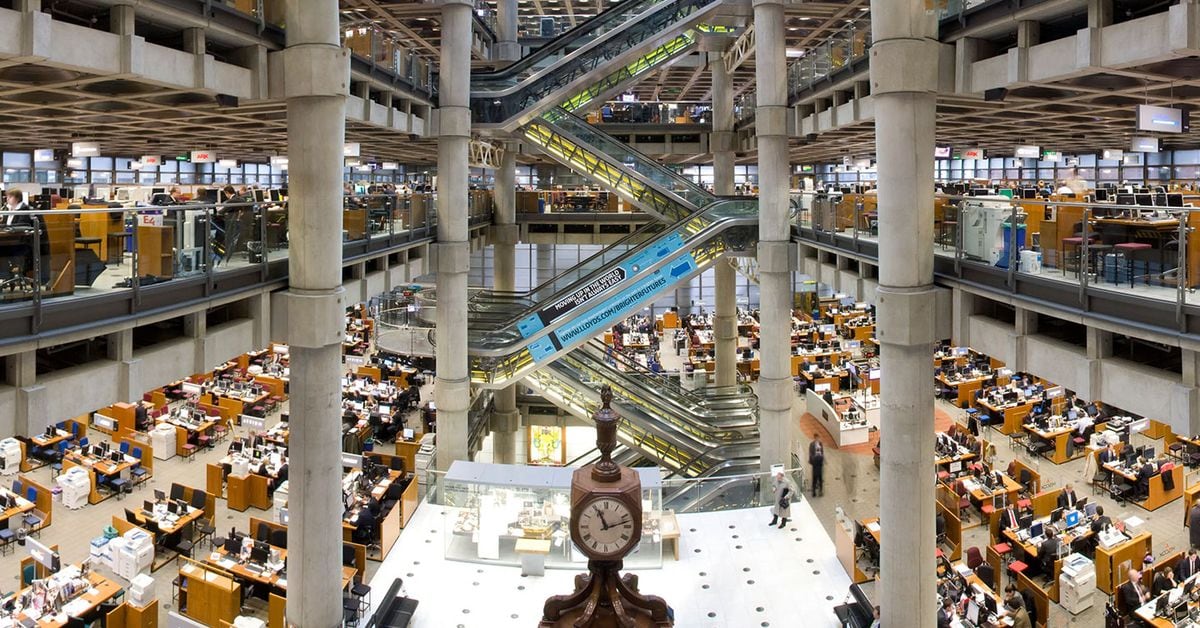

Lloyd’s of London-backed insurance policies can now be paid in crypto on Ethereum

Lloyd’s of London, the three-century-old insurance marketplace, is supporting digital asset protection policies curated on the Ethereum public blockchain that can be paid for natively, on-chain, using cryptocurrency, through Lloyd’s Coverholder Evertas and smart contract insurance provider Nayms.

Not so long ago, any kind of cryptocurrency insurance coverage Finding solutions was difficult. Aside from the efficiency benefits of paying for insurance policies in cryptocurrency and using blockchain to streamline the burdensome paperwork of intermediaries, a consortium of Lloyd’s of London syndicates backing cryptocurrency-native, on-chain insurance shows how far the industry has come in the last two years.

“We’re enabling people using public blockchain infrastructure to interact with traditional, highly regulated, fiat-backed institutions in a transparent way,” Evertas CEO J. Gdanski said in an interview. “Whether it’s paying in USDC or native cryptocurrency, or placing policies entirely on-chain with blockchain helping coordinate between a broker, the policyholder, and insurers, we believe this is a foundational infrastructure.”

Nayms, a digital marketplace where brokers and underwriters connect with crypto capital investment, is a play on Lloyd’s “names,” the collection of individuals and companies that underwrite risks in the historic insurance market.

“The native cryptocurrency expertise we bring to the underwriting process gives us a deep understanding of the risks we insure,” Nick Selby, the company’s head of European underwriting, said in an interview. “It means we’re very explicit about what we do and don’t cover, and we can pay insured claims faster than anyone else.”

Ethereum

10 Years of Crypto Innovations! Here’s How Buterin Sees the Future of Ethereum!

2h45 ▪ 3 min read ▪ by Eddy S.

At the EDCON2024 conference, Vitalik Buterin unveiled the future directions of Ethereum, with a focus on innovative application development and wallet security. He presented promising projects and innovative ideas to improve privacy and accessibility for cryptocurrency users.

Ethereum’s new innovations by Vitalik Buterin!

Vitalik Buterin delivered a key speech on the future of Ethereum in the next ten years. He stressed that the priority of the crypto blockchain will now be to develop applications. Some of the already successful applications include decentralized finance (DeFi), decentralized identities (DID) with the Ethereum Name Service (ENS), DAOs and NFTs.

Vitalik also highlighted several promising projects. These include the prediction market Polymarket, the social media aggregator Firefly, the wallet Daimo, and the voting tool Rarimo. These applications illustrate the diversity and potential of Ethereum-based technologies to transform various sectors of crypto.

Vitalik also proposed several innovative ideas to improve the security and accessibility of Ethereum wallets. One of his proposals is to encrypt the private key directly into the cell phone’s chip! Thus turning the phone into a secure crypto wallet. Another idea is to place part of the private key in a regulatory-compliant custodial institution, thus providing an additional layer of security.

Vitalik also mentioned the use of zero-knowledge (ZK) proof technology to link KYC information to the wallet. This approach would ensure the privacy of cryptocurrency users while meeting regulatory requirements.

Security and Privacy: Two Requirements for Cryptocurrency Users

These proposals aim to improve the security and privacy of cryptocurrency users while facilitating the adoption of the technology by a wider audience. By combining technological innovations with practical applications, Ethereum continues to position itself as a leader in the cryptocurrency and blockchain ecosystem.

Vitalik Buterin’s speech highlighted Ethereum’s many advancements and future prospects. With a focus on application development and innovative proposals for crypto wallet security, Ethereum is well-positioned to continue to grow and innovate in the years to come.

Optimize your Cointribune experience with our “Read to Earn” program! Earn points for each article read and access exclusive rewards. Sign up now and start earning benefits.

Click here to join “Read to Earn” and turn your passion for crypto into rewards!

Eddy S.

The world is changing and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in everything that is closely or remotely related to blockchain and its derivatives. To share my experience and promote a field that fascinates me, there is nothing better than writing informative and relaxed articles.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be considered investment advice. Do your own research before making any investment decision.

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin, ETH Price, CPI Print, PYTH, WIF & MORE!!

-

Videos9 months ago

Videos9 months agoCrypto News: Bitcoin Price, ETF, ETH, WIF, HNT & MORE!!

-

DeFi9 months ago

DeFi9 months agoMetasphere Labs announces follow-up event regarding

-

Videos9 months ago

Videos9 months agoSolana price potential?! Check out THIS update if you own SOL!!

-

Videos8 months ago

Videos8 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

DeFi6 months ago

DeFi6 months agoPump.Fun Overtakes Ethereum in Daily Revenue: A New Leader in DeFi

-

DeFi6 months ago

DeFi6 months agoDegens Can Now Create Memecoins From Tweets

-

News6 months ago

News6 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

News6 months ago

News6 months agoLawmakers, regulators to study impact of blockchain and cryptocurrency in Alabama • Alabama Reflector

-

Bitcoin6 months ago

Bitcoin6 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Ethereum8 months ago

Ethereum8 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos8 months ago

Videos8 months agoCryptocurrency News: BTC Rally, ETH, SOL, FTM, USDT Recover & MORE!