Ethereum

Whale invests in Ethereum: why PEPE, LINK and UNI are in the spotlight

- Whales have accumulated over $9 million in ERC-20 tokens.

- Pepe and LINK saw a more positive price trend than UNI.

Recently, Pepe [PEPE], Uniswap [UNI]And Chain link [LINK] witnessed significant accumulations of whales. While UNI stood out with its distinct price trend, PEPE and LINK showed similar price movements.

Another commonality between these assets is that they are all ERC-20 tokens. Ongoing accumulation and price trends are considered a bullish signal, which could impact the market. Ethereum [ETH] network.

Whales bring together Pepe, Chainlink and Uniswap

According to data from Lookonchainwhales engaged in significant accumulation activity on May 4, acquiring millions of dollars worth of various ERC-20 tokens.

One notable transaction involved a whale withdrawing 322.48 billion Pepe tokens from the Binance exchange, valued at approximately $2.78 million.

Another whale took out 500,000 United tokens worth approximately $3.75 million and 183,799 LINK tokens worth approximately $2.62 million from the Binance [BNB] exchange.

Pepe and Chainlink see upward trends

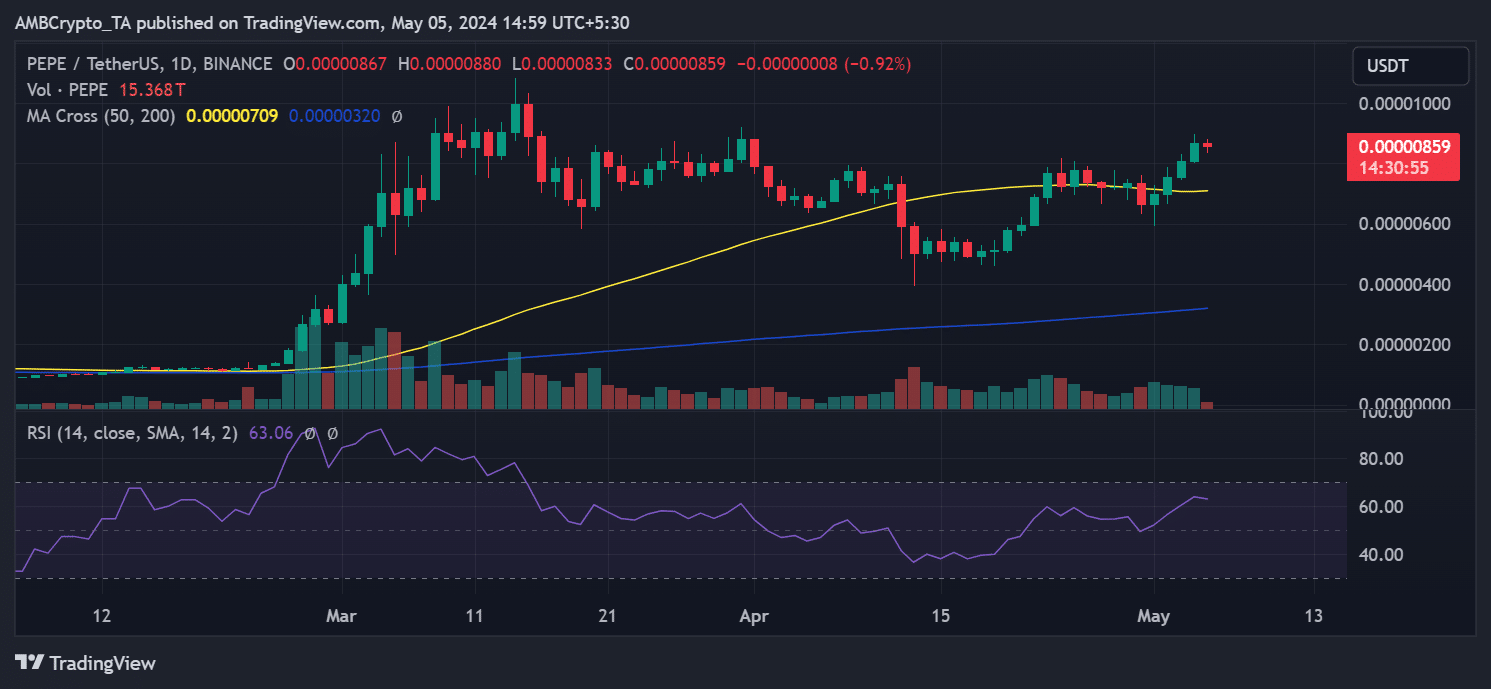

Analysis of AMBCrypto on that of Pepe Price action on a daily chart revealed consecutive bullish trends from May 1 to May 4. On May 4, its value jumped 7.30%.

Notably, the price trend was now positioned above its short moving average (yellow line), which had transitioned to provide support, indicating a positive price trend.

However, Pepe was experiencing a decline of more than 1% in his trade value at the time of writing.

Source: TradingView

AMBCrypto found that Chainlink also exhibited consecutive uptrends starting May 1.

Its price rose from around $13 to over $14, closing at around $14.3 on May 4, a price increase of over 1%.

Despite the positive movement, Chainlink’s overall trend remained less positive than Pepe’s, with its price trading below its short and long averages (yellow and blue lines).

At the time of writing, it was trading at around $14.2, reflecting a decline of less than 1%.

Source: TradingView

Among the standard Ethereum tokens accumulated by whales, Uniswap displayed the worst performance in terms of price.

Although prices increased from May 1, it was not until May 4 that the rise exceeded 1%, increasing by 6.66% to trade at around $7.5.

However, despite the increase, its blue and yellow lines acted as resistance levels. It was trading at around $7.4, indicating a decline of more than 1% in value.

Additionally, its relative strength index (RSI) was hovering near 40, suggesting a downtrend.

Source: TradingView

Will Ethereum be affected?

The accumulation of Pepe, Chain link, and Uniswap is a positive signal for these Ethereum-based assets. This suggests an anticipation of further price appreciation, which is inherently bullish.

Is your wallet green? Check LINK Profit calculator

In the event of a possible surge in the prices of these tokens, the sales of these accumulating whales could trigger additional accumulation from other traders.

This resulting increase in trading volume could have a significant impact on the overall trading volume of the Ethereum network. Additionally, a slight increase in volume would likely affect network fees.