News

Zombie blockchain: what to do about it

A PR expert recently told me that they had almost stopped accepting crypto clients. The person I’ve worked with for years told me that she was tired of taking money from clearly failed projects but that she wanted to pay someone to help her pretend otherwise. Fair enough. At some point, money isn’t everything and there comes a point where meaningful work is more important. But it’s also worth taking a hard look at why so many crypto flops are out there behaving like concerns in the first place.

This does not happen in other areas, such as Schumpeter’s creative destruction It’s definitely the order of the day. This is especially true in Silicon Valley, where startups must struggle to survive and most fail for the simple reason that not enough people want to spend time or money on the startup’s product. In the case of cryptocurrencies, however, many projects can challenge these fundamental forces of the economy.

A recent Forbes characteristic highlighted the problem well. History compiled a list of 20 “cryptozombies” — I call them dead blockchains — and published key metrics to show that they had nearly stayed flat. One of these metrics is revenue (Coinbase CEO Brian Armstrong likes to call it “truth serum”) and the other is developer activity, which shows how many people are actually working on a given blockchain. The Forbes list showed how some of the largest and most famous blockchains, including Cardano and XRP, have long had little of it. Yet they move forward.

The reason is that many zombies in the cryptocurrency world are sitting on billions of dollars. This is because blockchain can upend the conventional startup funding model. Thanks to token sales, many projects have raised large amounts of money upfront, instead of receiving a seed round and scrambling like crazy to build something viable so they can stay alive.

Even when it’s been clear for years that a particular blockchain isn’t going anywhere, project promoters can still whip up hype and false hopes on social media to give their tokens a boost. One could argue that there is nothing wrong with any of this. After all, if someone wants to spend their money on Stellar or whatever, let them. It’s a free country and all.

The problem isn’t just that this makes the crypto industry in general seem unstable, it’s also that dead blockchains are taking resources and attention away from crypto ventures that are getting some traction or building something worthwhile. The question is whether anything can be done about it. The best option may be for respected players in the cryptocurrency industry, including those in the VC industry and analysts, to follow Forbes’ lead and publish lists showing which blockchains are truly dead in the water.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Once lively crypto project Amico.tech, which allows people to trade influencer-linked tokens on the Base blockchain, plunged 98% on its first day of trading. (Bloomberg)

The Russian citizen who handled the wildcat BTC-e exchange from 2011 to 2017 he pleaded guilty to money laundering in the United States (CoinDesk)

THE New York Police they are looking for three men who beat and robbed a 40-year-old man who had come to a hotel to exchange cash for cryptocurrencies. (New York Daily News)

VC have poured money into crypto startups via valuation-boosting “open-ended mobile funds” and agree with decentralization, but skeptics say this is a recipe for overpaying. (Bloomberg)

Bitcoin, which went live more than 15 years ago, processed its billionth transaction this weekend. (The block)

MEME OF THE MOMENT

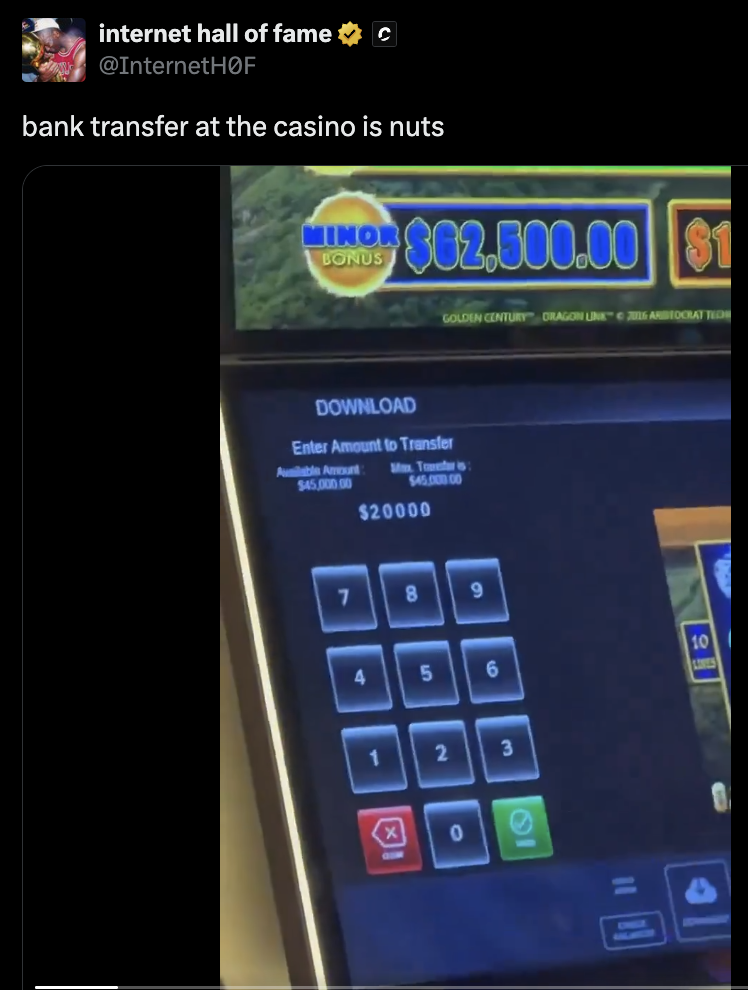

Do you think cryptocurrencies are reckless? Here’s a $20,000 wire transfer to the slot machine:

This is the web version of Fortune Crypto, a daily newsletter about the coins, companies and people shaping the world of cryptocurrencies. Registration free.